Managing Cash Flow for Early-Stage Startups

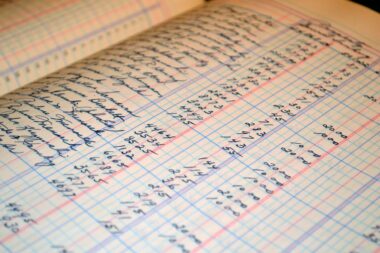

Cash flow management is crucial for early-stage startups as it ensures the availability of funds to meet operational expenses. For startups, maintaining a positive cash flow can be quite challenging due to fluctuating revenues and high initial costs. Entrepreneurs must develop a comprehensive cash flow strategy to navigate these financial waters effectively. Begin by meticulously tracking your income and expenditures. This will enable you to forecast your cash needs accurately. Utilize financial software to aid in management, making it easier to visualize and analyze cash inflow and outflow. Understand that maintaining liquidity is essential. Prepare for unexpected expenses, as they can arise at any moment, potentially damaging your financial stability. Consider establishing an emergency fund that can cover at least three to six months of operational costs. Developing strong relationships with suppliers can also provide flexibility in payment terms, which helps in managing cash flow. Moreover, keep a close eye on accounts receivable to ensure that your customers pay on time. By implementing these strategies, early-stage startups can enhance their ability to sustain operations, allowing them to focus on growth and development.

In developing cash flow projections, it is essential for startups to create both short-term and long-term forecasts. Short-term projections should focus on expected revenues and expenditures over the next few months. Conversely, long-term forecasts, often spanning one to three years, should consider growth opportunities and potential investments. To create accurate projections, gather historical data if available, or utilize industry benchmarks as a reference. Pay attention to seasonal fluctuations or economic trends that may influence your cash flow. Furthermore, adjusting your forecasts regularly is vital so that they reflect changes in your business landscape, customers’ buying patterns, and overall economic conditions. Developing a rolling forecast, which updates frequently, can provide a more agile response to changes. Engaging your team in this process can also promote internal transparency regarding financial expectations. Effective cash flow projections not only guide operational decisions but also enhance your credibility with potential investors and funding agencies. Proactively managing cash flow and incorporating these strategies can position your startup for long-term success and stability within their competitive industry.

Importance of Budgeting

Creating a budget is a critical step for early-stage startups seeking to manage their cash flow effectively. A well-structured budget provides both a roadmap and a valuable benchmarking tool to measure financial performance. It enables entrepreneurs to allocate resources wisely and identify potential cash flow issues before they escalate into significant problems. Start by analyzing all expected income sources and expenses to construct a realistic budget. Consider incorporating fixed and variable costs to frame your predictions accurately. Regularly reviewing and adjusting your budget ensures that it remains relevant and can adapt to any changes in your business approach or market conditions. Additionally, segment your budget into categories, such as operations, marketing, and development, allowing you to drill down into spending patterns. This level of detail can reveal opportunities for cost reduction and improved efficiency. Further, consider involving financial advisors to provide insight and guidance on your budget challenges. Ultimately, effective budgeting provides startups with both clarity and confidence as they navigate the unpredictable waters of entrepreneurship, ultimately contributing to achieving financial stability.

Managing receivables is another essential aspect of maintaining a healthy cash flow. Startups need to establish efficient invoicing processes to ensure that they remain on top of client payments. Make invoicing clear and professional, specifying payment terms and due dates to minimize confusion. Consider implementing electronic invoicing solutions to streamline the process and encourage faster payments. Follow up on overdue invoices promptly by sending reminders, which can improve cash flow significantly. It’s important to cultivate strong relationships with clients, as this can lead to improved payment dynamics and even referrals. Offering discounts for early payments can also incentivize timely transactions. In situations where clients are late in settling bills, developing a collections strategy can prove useful. Retain a level of professionalism during communications to maintain relationships. Strengthening your receivables process not only leads to better cash flow management but also reinforces your overall business creditworthiness. Focusing on collections and building a solid client payment culture is vital for your startup’s financial health and future success in the market.

Using Technology for Cash Flow Management

In today’s digital age, utilizing technology to manage cash flow is essential for startups. Numerous software applications can aid in tracking financial transactions, generating invoices, and managing budgets. Adopting cloud-based accounting platforms offers real-time visibility into your financial situation, enabling informed decision-making. Additionally, some platforms provide integrations with payment processors, automating payment collection and reconciliation processes. Explore tools that facilitate collaboration among team members regarding cash flow management. Make sure to research and select software that best suits the specific needs of your startup’s operations. Another tech trend in cash flow management involves the use of predictive analytics. This technology helps predict cash flow trends based on historical data, allowing entrepreneurs to anticipate shortfalls. Furthermore, employing dashboards that visualize financial data can simplify complex analyses, making it easier to share information with stakeholders and consultants. Investing in these technological solutions can elevate your startup’s financial management capabilities, ultimately promoting a culture of informed decision-making, which is vital for long-term sustainability.

Understanding your cash conversion cycle is another vital metric for startups. The cash conversion cycle measures the time it takes for a company to convert its investments in inventory and other resources into cash flows from sales. To calculate the cash conversion cycle, consider three components: Days Inventory Outstanding (DIO), Days Sales Outstanding (DSO), and Days Payable Outstanding (DPO). Each metric gives insight into how efficiently a startup utilizes its resources and manages working capital. Improving the cash conversion cycle can boost your cash flow significantly. For instance, reducing DIO by optimizing inventory levels ensures that products are sold quickly without overstocking. Likewise, collecting receivables faster minimizes the DSO, enhancing cash on hand. On the other hand, extending payment terms with suppliers can increase the DPO, providing more time to manage cash flow. Monitoring this cycle regularly allows entrepreneurs to identify areas of improvement and implement strategic changes, reinforcing overall financial management. Ultimately, understanding and improving the cash conversion cycle is crucial for a startup’s financial health and growth trajectory.

Facing Cash Flow Challenges with Confidence

Addressing cash flow challenges is a common experience for many early-stage startups. Entrepreneurs often face unexpected disruptions, accounting errors, or shifts in market demand that complicate cash flow management. Developing a proactive mindset is essential to addressing these challenges effectively. Stay informed on market trends and potential fluctuations that could impact your cash flow. Establishing contingency plans can provide a framework for navigating challenging scenarios, ensuring that your startup can quickly respond to crises. Additionally, maintain open lines of communication with stakeholders, including suppliers and investors, to foster transparency during lean periods. Establishing trust can lead to more favorable arrangements when necessary. Regularly assessing your startup’s financial health allows preemptive identification of potential issues. Consider involving experts or mentors who can offer guidance based on their experiences. Learning from past setbacks and adapting will enhance resilience in your business approach. Ultimately, by fostering a culture of adaptability and open communication, your startup will develop the confidence needed to tackle cash flow challenges and continue progressing toward long-term success.

Finally, understanding the significance of cash flow management cannot be understated for early-stage startups. A company’s cash flow directly impacts its viability and growth potential. When cash flow is mismanaged, it can lead to dire consequences, including inability to pay employees, suppliers, or even fund new projects. Therefore, adopting effective cash flow strategies is paramount to your startup’s success. It forms the backbone of decision-making processes, influencing whether to expand your product line or invest in marketing efforts. Immersed in the dynamic business environment, staying proactive with financial management sets the tone for building a successful and enduring enterprise. Make cash flow forecasts a staple part of your strategic planning to promote sustainability in operations. Additionally, surrounding yourself with trusted financial partners can enhance your startup’s capabilities and allow for better financial planning. Overall, prioritizing cash flow management proves beneficial for securing a stable foundation, enabling your startup to pursue innovations and plans for the future without hindrance or limitation. Therefore, commit to these practices as essential for navigating the complexities of startup financial environments.