How to Report Business Expenses for Tax Purposes

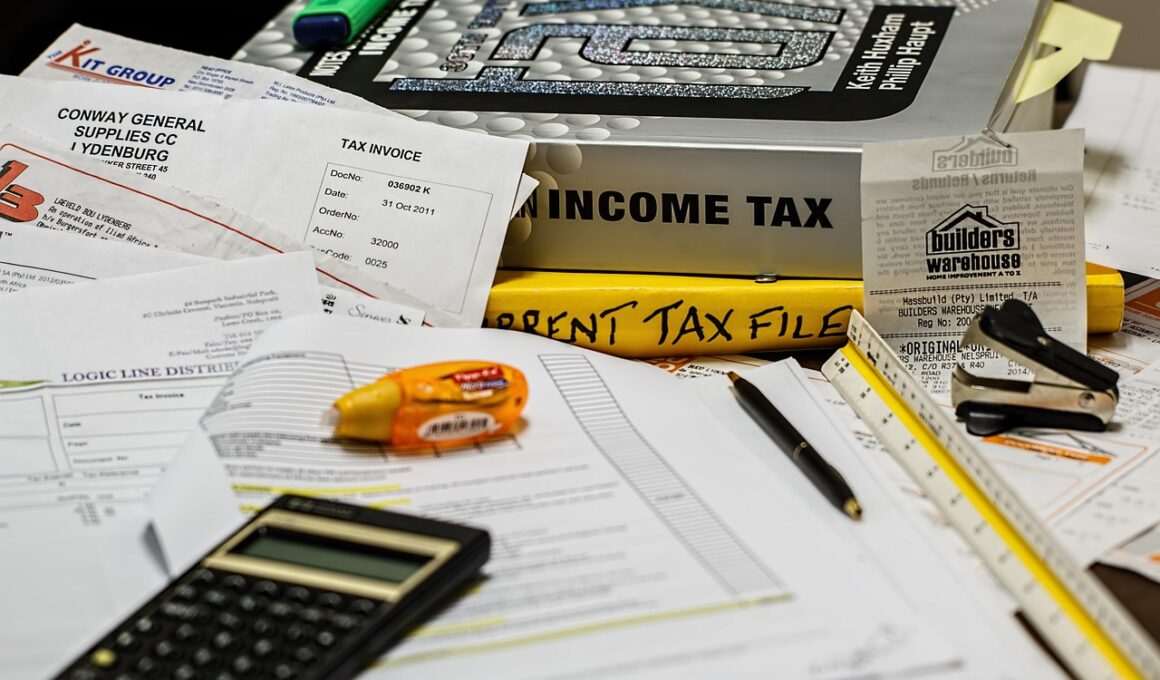

Accurately reporting business expenses is crucial for tax purposes and maintaining compliance with tax regulations. Business expenses are necessary expenditures needed to run your business effectively. Proper reporting helps to reduce taxable income, allowing for potential savings. One must first categorize expenses into different types. Categories may include operational costs, administrative expenses, and travel-related expenses. Segregation aids clarity in record-keeping and enhances the likelihood of deductions being approved. Essential documents and support receipts are vital for substantiating claims during tax assessments. Businesses should track every expense meticulously for reporting to be accurate. It is advisable to use bookkeeping software to simplify this tracking process while ensuring that every financial transaction is recorded. Familiarizing oneself with IRS guidelines will further ease the reporting process. When organizing expenses, include only those relevant to business operations. Avoid mixing personal and business expenses, as this complicates deductions. Professionals often recommend consulting a tax advisor for proper assistance. This ensures that all aspects of tax reporting are adhered to promptly. Ultimately, the accurate reporting of business expenses significantly impacts overall financial health.

When it comes to documenting business expenses, organization is key. Keep all receipts and relevant documentation for at least three years to comply with IRS requirements. This practice not only safeguards against audits but supports claims made on tax forms. Categorizing expenses facilitates the identification of potential deductions. Common categories may include travel, meals, supplies, and utilities. It is essential to include full descriptions and dates on your documentation. This level of detail helps clarify the purpose of each expense. For expenses that involve meals or entertainment, ensure to note the attendees and business purpose. This information is crucial for substantiating deductions during the review or audit process. Adopting a systematic approach to organizing receipts will save time and stress during tax season. Consider using digital expense management tools to streamline this process. Scanning receipts and maintaining electronic records can significantly reduce physical clutter. It makes retrieval much easier when compiling expense reports. In the case of vendor invoices or contracts, these too must be meticulously documented. Therefore, adopting good practices in recording can lead to accurate reports and prevent errors during tax filings.

Utilizing Bookkeeping Software

Leveraging bookkeeping software simplifies the process of recording and reporting business expenses. A reliable software program can automate functions, reducing the risk of human error while increasing efficiency. These platforms usually allow for easy categorization, tracking expenses in real time. By integrating bank accounts, the software can automatically import transactions, minimizing manual entry. This integration provides an accurate, up-to-date overview of expenses at your fingertips. Moreover, coding receipts with specific categories online ensures they can be easily tracked when reports are needed. Many programs come equipped with customizable reporting options, making it easier to view detailed expenses by category and timeframe. Users can also generate tax reports, significantly simplifying the preparation process when tax season arrives. These features allow for greater visibility into financial practices and support timely, organized filings. Adopting bookkeeping software can also assist in anticipating future expenses based on past behavior, making budgeting easier. Consider prioritizing platforms that offer mobile access as well; this functionality ensures that you can manage and report expenses even on-the-go.

Another important aspect of reporting business expenses involves knowing allowable deductions. The IRS has specific guidelines regarding which expenses can be deducted for tax purposes. Recording both ordinary and necessary expenses is essential. Ordinary expenses are those common in your line of business, while necessary expenses are appropriate and helpful for business operations. It is important to research and understand the current IRS definitions regarding allowable deductions to benefit the most during tax filings. Some commonly deductible expenses include office supplies, advertising costs, and rent. Additionally, expenses for home office space may also qualify for deductions when specific criteria are met. Delineating these expenses accurately is vital to ensure proper documentation. Failure to classify expenses correctly can lead to audits or penalties. Furthermore, take note of limitations imposed by the IRS on certain deductions, as understanding these can prevent potential financial repercussions. Ultimately, comprehensively understanding allowable deductions enhances your firm’s ability to optimize tax savings, securing a financially sound position during annual reporting periods.

Record-Keeping and Compliance

Maintaining accurate records is imperative for tax compliance, especially when it comes to business expenses. Consistent and organized record-keeping protects your business during internal audits and IRS examinations. Each recorded transaction should have a corresponding receipt or invoice documented clearly. Regularly updating these records ensures they are current and available when tax documents are required. Businesses should maintain a folder system, both digital and paper copies for ease of access. This organizational method helps when tax time approaches. Make sure to maintain records for every type of expense incurred while conducting business. Track business travel separately, categorizing according to transport and accommodation, and don’t forget related meals or entertainment. Each aspect is vital when claiming deductions on taxes. Consider establishing a schedule to review records periodically, ensuring accuracy and documentation remain aligned with transactions. Also, safeguarding electronic records with backups will prevent data loss. Utilize cloud-based storage services for additional security. Compliance extends to knowing important tax dates and submission deadlines to avoid penalties, ensuring timely filings.

Consulting a tax professional is invaluable in navigating the complexities of business expense reporting. A tax advisor provides current information relevant to tax codes and deduction strategies specific to your industry. Professional insight can uncover potential deductions that might have gone unnoticed without expert guidance. This proactive measure can lead to greater tax savings and help in structuring your expenses favorably. Regularly seeking professional advice will keep you informed regarding changes in tax laws, thus allowing timely adjustments. Furthermore, understanding local and state-specific tax regulations is critical as it can vary significantly from federal guidelines. Advisors often have access to resources that can simplify the identification of allowable deductions. Engage with your accountant regularly to ensure accurate record-keeping practices. Implementing recommendations made during consultations will enhance your firm’s financial management capabilities. Make a habit of reviewing tax strategies each planning cycle per year. This forward-thinking approach ensures readiness as filing deadlines approach. Incorporating professional expertise effectively streamlines the reporting process and establishes a thorough understanding of reporting and compliance requirements.

Final Thoughts on Business Expenses

Understanding how to report business expenses is paramount for maintaining compliance while maximizing potential deductions. Properly categorized, recorded, and documented expenses can greatly influence a business’s taxable income. Each detail matters; from the date, purpose, and amount to clear descriptions on receipts. Consistency in recording is essential and should be integrated into everyday business transactions. Equally important is a robust bookkeeping system that simplifies expense management while ensuring accuracy. By utilizing the right tools, such as bookkeeping software, businesses greatly reduce errors and improve reporting efficiency. Additionally, consulting with tax professionals provides valuable insight into tax regulations and allowable deductions. This strategic planning allows for informed financial decisions. Commitment to compliant record-keeping practices not only protects against audits but enhances the financial health of your business overall. Ultimately, understanding the nuances involved in reporting business expenses lays the foundation for improved financial standing. As tax deadlines approach, revisit these practices regularly and adjust as necessary to meet shifting requirements. Benefit from proactive engagement with tax advisory services to ensure thoroughness in your reporting.

For entrepreneurs and small business owners, comprehending tax reporting requirements is vital for business longevity. Even though it can seem daunting, with adequate information and a strategic approach, fulfilling these obligations becomes manageable. By staying organized and adopting best practices in expense tracking, you can expedite your tax filings while improving accuracy. Moreover, leveraging technology helps mitigate the complexities of tax reporting. As tax regulations evolve, continued education on pertinent updates equips you to navigate the dynamic landscape of business expenses efficiently. Remember, proper reporting can significantly impact your business finances, making this topic one of utmost importance for any business owner. Overall, with commitment and diligence, the process can transition from stress-inducing to manageable, ultimately benefiting long-term business health.