Using Historical Data for More Reliable Financial Forecasting

Financial forecasting is a vital process that organizations utilize to predict their future financial performance based on historical data. Historical data acts as a crucial foundation because it provides insights into trends, patterns, and fluctuations within the financial markets. By systematically analyzing historical trends, organizations can construct more accurate forecasts, allowing them to make informed decisions. It’s essential for businesses to collect, store, and revisit historical data regularly to ensure that the forecasts stay relevant. In addition, these organizations can identify non-recurring expenses or extraordinary items that may skew their projections. For instance, incorporating seasonality into the analysis can highlight periods of typical financial performance. Understanding these variations can lead to better planning and resource allocation. However, it’s also important to recognize limitations in the data. External factors can affect past performances, and when forecasting, it’s imperative to look beyond mere numerical data. Factors like economic conditions, industry changes, and unexpected events also play critical roles. Solid financial forecasting is based on a comprehensive understanding of these elements that impact revenue and expenses, enabling more strategic business planning.

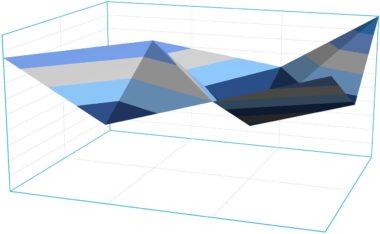

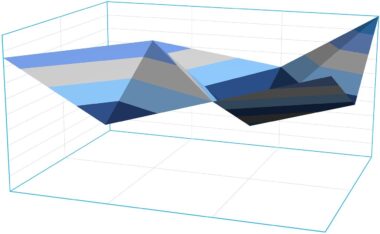

Evaluating the historical performances enhances the reliability of financial forecasting. For example, a company focusing on product sales might analyze sales data from recent years to pinpoint seasonal peaks and troughs. Recognizing these trends enables a company to refine its approach, effectively managing inventory and human resources in alignment with expected sales volumes. Moreover, organizations often must adjust these historical data points for inflation, ensuring forecasts remain realistic and not artificially inflated by past economic conditions. This approach requires a nuanced understanding of both financial metrics and economic indicators, such as interest rates and market demand. Incorporating economic models can supplement the historical data, adding depth to financial forecasting efforts. Additionally, companies can utilize technology and software that facilitate data analysis and visualization, revealing insights that might not be readily apparent in raw data. While historical data serves inevitably as a compass for future performance, the impact of rapidly changing markets must be factored in. Lastly, regular reviews of forecasting models based on actual performance can help businesses adapt and refine their approaches, ensuring the forecasts evolve in line with changing market landscapes.

Identifying Key Performance Indicators

Financial forecasting relies heavily on key performance indicators (KPIs) derived from historical data. KPIs are measurable values that help assess the effectiveness of various operational strategies and inform future forecasts. By establishing KPIs tailored to specific business objectives, organizations can quantify operational success. Common examples of KPIs include revenue growth rate, operating margin, customer acquisition cost, and monthly recurring revenue. Utilizing historical data to assess these KPIs helps businesses identify trends vital for planning. For instance, a company experiencing consistent growth in month-over-month revenue may leverage this data to estimate future sales accurately. It’s important to compare KPIs with industry benchmarks to understand relative performance. This comparative analysis can shed light on potential opportunities for improvement and risks in the forecast. However, it’s crucial to account for variations in data collection methods and market conditions. Furthermore, identifying leading indicators—those that can predict future outcomes—can be particularly beneficial. By focusing on these, organizations can be proactive rather than reactive. Successful financial forecasting is less about predicting numbers and more about understanding the underlying business and economic environment, underscoring the importance of using historical data.

Another aspect to consider is the granularity of data collection. Depending on the business model and the information available, forecasts can range from high-level summaries to detailed analyses. A granular approach may offer insights into specific product lines or customer segments. This level of detail enhances the accuracy of the forecasts, enabling organizations to develop strategies that are more tailored to different market segments. However, capturing this level of detail requires sophisticated data management practices and software solutions to analyze effectively. Data cleansing and accuracy also pose significant challenges in working with historical data. If the historical data is incorrect or incomplete, it can lead to forecast misalignments. Organizations must prioritize data integrity to ensure their forecasts remain accurate. Implementing robust data governance practices will cultivate trust in the forecasting process. Additionally, cross-functional collaboration can further enhance the data collection process, allowing different departments to contribute meaningfully. Collaboration can also encourage a culture of transparency, where employees understand that their input plays a role in shaping organizational strategies through informed financial forecasting.

The Role of Advanced Analytics

As organizations strive for greater accuracy in financial forecasting, using advanced analytics has become paramount. Historical data can be analyzed using machine learning algorithms and statistical models that improve forecasts and enable predictive analytics. This technology allows companies to model numerous potential future scenarios using historical patterns identified within the data. Advanced analytics presents a comprehensive view of potential risks and opportunities, in addition to enhancing various predictive capabilities for the business. By leveraging advanced analytics, organizations can simulate “what-if” scenarios, which reveal how different variables could influence financial performance. This strategic capability offers firms the ability to prepare for diverse outcomes, cultivating resilience. Additionally, automation in data gathering and analysis streamlines processes, reducing human error and increasing efficiency. However, investing in technology and training is critical for deploying these analytics effectively. Organizations need to ensure their staff is equipped with the knowledge necessary to interpret the data produced. Furthermore, ethical considerations should not be overlooked, as algorithms can sometimes perpetuate biases found in historical data. Striving for transparency in analytical approaches promotes a better understanding of and trust in the forecasting processes.

While historical data is vital in enhancing the accuracy of financial forecasts, organizations must remain ever vigilant of changing dynamics within their industries. Market environments can shift quickly, influenced by various external factors such as regulatory changes, technological advancements, and economic downturns. Therefore, in addition to using historical data, continuous monitoring of macroeconomic indicators is crucial. This ensures that forecasts remain relevant and adaptable to current situations. Incorporating sensitivity analysis into forecasting practices can draw attention to how dependent forecasts are on specific variables. Examining these dependencies helps organizations prepare for unexpected changes and create contingency plans. Recognizing potential discrepancies allows businesses to identify areas within their forecasts needing adjustments. Regularly updating forecasts based on new data can foster a culture of adaptability. Agile businesses can reposition strategies swiftly in response to forecast deviations. Alongside essential financial forecasting, organizations should emphasize a responsive action plan that adapts to shifting data trends. Ultimately, effective financial forecasting involves the careful and informed utilization of historical data, advanced analytics, and continuous monitoring of market dynamics.

The Future of Financial Forecasting

The landscape of financial forecasting is evolving rapidly. Emerging technologies and new methodologies are shaping how organizations interpret historical data and create forecasts. Innovations such as artificial intelligence and big data analytics are becoming integral tools for financial professionals aiming for precision in forecasting. These advancements facilitate the processing of vast amounts of historical information, revealing actionable insights and trends even faster than before. As forecasting becomes more data-driven, organizations are expected to create more dynamic and interactive financial models. Furthermore, data visualization techniques enhance the way financial data is communicated to stakeholders, promoting better understanding and informed decision-making. As industries undergo digital transformations, opportunities for collaborative forecasting will also increase. Cross-organizational efforts can foster more comprehensive financial plans, ensuring alignment in strategy across departments. However, organizations must also recognize and address the inherent risks tied to these emerging technologies, such as data privacy and security. Fostering a culture that values ethical data usage will be crucial. Investing in education and training is essential, preparing professionals for these future developments and ensuring they can harness the full potential of historical data analytics.

In conclusion, utilizing historical data effectively enhances the reliability of financial forecasting, empowering organizations to navigate uncertainties efficiently. A firm grasp of past performance coupled with advanced analytical tools can deliver deeper insights into potential future outcomes. The ongoing challenge will remain finding a balance between relying on established methodologies while embracing new technologies and innovations. As the landscape of financial forecasting continues to evolve, a proactive approach is essential. Businesses must maintain adaptability in their strategies and forecasts, leveraging their knowledge of historical data to inform future initiatives. An awareness of external factors that impact performance is essential in this forecasting landscape. Furthermore, by maintaining an agile mindset, organizations can quickly pivot strategies based on updated forecasts. Emphasizing collaboration among teams—alongside investing in training—will create a culture that values data-driven decision-making. Ultimately, the ability to forecast financial performance accurately will provide businesses with a competitive edge in a rapidly changing climate. The role of historical data will continue to be pivotal, ensuring organizations can anticipate changes and seize opportunities, ultimately leading to improved financial outcomes.