Sustainable Risk Management in the Energy Sector

The energy sector faces numerous challenges related to sustainability, driven by climate change, resource depletion, and regulatory pressures. Sustainable risk management plays a vital role in addressing these challenges by integrating social, environmental, and economic factors into decision-making processes. This approach not only mitigates risks but also creates opportunities for innovation and growth. Companies must adopt sustainable practices to enhance their resilience against such risks. Key components include identifying potential risks, assessing their impacts, and developing strategies to manage them effectively. In the energy sector, investments in renewable energy sources and technologies are increasingly important. Additionally, engaging stakeholders and fostering transparency can improve community relations and project acceptance. Organizations must also consider the long-term implications of their operations on biodiversity and ecosystems. By doing so, they contribute to a more sustainable future and ensure their license to operate. Sustainable risk management sets the foundation for creating a competitive advantage, thus making it a priority for organizations in the energy sector.

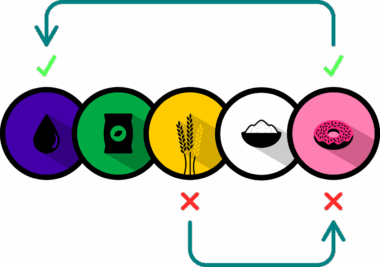

One of the primary aspects of sustainable risk management is aligning risk assessment with sustainability goals. This can be achieved by integrating environmental, social, and governance (ESG) criteria into risk models. By adopting ESG metrics, companies can better evaluate potential risks and opportunities in their operations. Training and educating employees about sustainable practices is essential to promote a culture of sustainability within the organization. Furthermore, collaboration with governments, NGOs, and local communities can enhance knowledge-sharing and improve the collective approach to sustainable risk management. The use of technology and data analytics is crucial for optimizing energy resources and reducing environmental impacts. Companies can employ predictive analytics to assess risks proactively and develop strategies that address them efficiently. Particularly in the energy sector, innovations like smart grids and energy storage can contribute to increased efficiency and lower emissions. The transition to renewable energy sources is not only beneficial for the environment but also offers significant economic opportunities. Investing in sustainable technologies enhances a company’s reputation and helps attract investors who prioritize social responsibility.

Integration of Technology

As the energy sector evolves, technological advancements are at the forefront of sustainable risk management strategies. Innovative solutions such as artificial intelligence, machine learning, and big data analytics are playing an essential role. These technologies can help organizations identify risk factors, forecast trends, and make data-driven decisions that align with sustainability efforts. For example, AI can optimize energy production and consumption patterns, reducing waste and advancing efficiency. Additionally, leveraging technology enables real-time monitoring of environmental impacts, empowering organizations to respond promptly to emerging risks. Drones, for instance, can facilitate inspections of infrastructure, ensuring compliance with environmental regulations. Furthermore, remote sensing technologies can track land-use changes that might affect ecosystems. As energy companies strive to meet sustainability targets, embracing these technologies becomes critical. By investing in research and development, organizations can innovate and enhance their competitive edge. The implementation of robust risk management systems powered by technology enhances adaptability to changing regulations and market dynamics. Ultimately, these efforts contribute to the long-term sustainability of energy sectors across the globe.

Engaging stakeholders remains a crucial aspect of sustainable risk management. Companies within the energy sector must communicate effectively with various stakeholders, including investors, customers, and communities. Proactively addressing concerns and expectations promotes trust and long-term collaboration. Conducting stakeholder assessments can help identify high-risk individuals and groups, allowing organizations to tailor their engagement strategies. Incorporating public input into decision-making processes enhances stakeholder relationships and supports the development of community-centric projects. Furthermore, organizations should prioritize transparency in their reporting and communication efforts. Sharing progress on sustainability initiatives and risk management strategies reinforces accountability and builds public confidence. The energy sector’s image can be significantly improved through engaging narratives about projects and initiatives that contribute to sustainability. Companies can leverage sustainable reports to stimulate investor interest and engage in constructive dialogue with stakeholders. Collaborating with universities, research institutions, and other organizations can facilitate knowledge sharing and innovation in sustainable practices. Overall, fostering positive stakeholder interactions is essential for successful sustainable risk management and achieving long-term sustainability goals.

Regulatory Compliance and Future Outlook

In the rapidly changing landscape of the energy sector, regulatory compliance is paramount. Organizations must navigate complex regulations that govern environmental protection and resource management. Non-compliance can lead to significant financial penalties, legal challenges, and reputational damage. Therefore, implementing robust sustainable risk management practices enables organizations to align with current regulations seamlessly. Companies should stay informed about upcoming regulatory changes and adapt their strategies accordingly. Engaging with policymakers and industry associations can aid in shaping effective regulations that promote sustainability. Sustainable risk management is not only about compliance; it also represents a proactive approach to enhancing organizational resilience and fostering innovation, promising a competitive edge. Looking ahead, the importance of sustainability in the energy sector will continue to grow, driven by public awareness, technological advancements, and shifts in consumer preferences. Companies that prioritize sustainable practices and comprehensive risk management will likely gain significant advantages. As expectations for corporate responsibility rise, embracing sustainability can position organizations favorably for future success. Ultimately, sustainable risk management will be instrumental in achieving a viable energy sector that meets both present and future demands.

Investment in employee training and development is vital for successful sustainable risk management. A knowledgeable workforce is essential for executing sustainable initiatives and making informed decisions. Organizations should prioritize training programs that focus on sustainability practices and risk management principles. Employees equipped with the right tools and knowledge can identify potential risks and contribute to mitigating them effectively. Increased awareness of sustainability challenges fosters a culture of accountability that goes beyond compliance. Furthermore, empowering employees to participate in decision-making processes can enhance motivation and creativity. Collaborative efforts can lead to innovative ideas and solutions that address sustainability challenges within the energy sector. As sustainability becomes a core organizational value, employee engagement is key in achieving goals. Companies should support initiatives that encourage volunteering and community involvement, enhancing their corporate social responsibility profile. By fostering a culture of sustainability, organizations can strengthen their brand and build partnerships with like-minded businesses. This enhances reputation while driving shareholder value and attracting sustainable investments. In summary, investing in employee development is not only a strategy for risk management but also a pathway to creating a sustainable organizational ethos.

Conclusion

In conclusion, sustainable risk management is crucial for the energy sector’s future. Organizations must integrate sustainability into their operational framework to mitigate risks and capitalize on opportunities. Embracing innovative technologies, engaging stakeholders, and ensuring regulatory compliance form the foundation of effective risk management practices. By prioritizing employee education and fostering a culture of sustainability, companies can enhance their resilience while promoting long-term growth. The transition to renewable energy sources and sustainable practices is not merely a response to external pressures but a strategic approach to ensuring survival in a competitive market. As the energy landscape continues to evolve, organizations that successfully implement sustainable risk management practices will be better equipped to navigate uncertainties and thrive in the future. The commitment to sustainability must be reflected in every aspect of business operations, guiding decisions and shaping organizational objectives. Ultimately, the persistent pursuit of sustainability can create a positive impact on society and the environment, benefiting not only the energy sector but the wider community. Adopting a comprehensive and proactive approach to risk management is essential for shaping a sustainable future.

In summary, as the energy industry grapples with the environmental challenges of today, sustainable risk management emerges as a key strategy. This is necessary for safeguarding the future of energy resources while promoting social and economic well-being. Therefore, companies that adopt rigorous sustainable risk management practices stand to benefit significantly. Harnessing innovation, collaboration, and a holistic approach will lead to superior outcomes for the environment, society, and shareholders alike.