Whistleblowing and Financial Ethics: Detecting and Reporting Fraudulent Activities

Whistleblowing is a critical aspect of maintaining ethics within the business environment, especially concerning financial activities. Employees who witness unethical or fraudulent behavior are often faced with a dilemma: report the wrongdoings or remain silent. Whistleblowers play a vital role in uncovering fraud and protecting public interests. The motivation behind whistleblowing can stem from personal ethics, company culture, and fear of retaliation. Organizations must foster an ethical culture to support whistleblowers to create a safe environment, encouraging transparency and accountability. Various protections exist for whistleblowers through laws and regulations designed to shield them from retribution. Understanding the implications of financial misconduct and setting robust guidelines for reporting it are essential measures for any organization. Establishing clear policies outlining the procedures for reporting suspected fraud can empower individuals, leading to a healthier organizational culture.

Effective whistleblowing requires organizations to implement, promote, and enforce ethical standards rigorously. Employees should be educated about how to report unethical behavior properly, ensuring they understand their rights and options. Organizations can undertake various approaches to bolster whistleblowing, including the establishment of confidential reporting channels. Anonymity can significantly reduce fear and perceived risk, encouraging more people to come forward with their concerns. Furthermore, organizations ought to conduct regular training and awareness programs that reinforce the importance of ethics in the workplace. It’s crucial to communicate that whistleblowing is a commendable and protected action rather than an act of betrayal. By actively supporting whistleblowers, companies can enhance trust among employees. Recognizing and appreciating individuals who report unethical actions can further motivate others to do so. Small rewards or public acknowledgment can show that the organization values honesty and integrity.

The Importance of Reporting Fraud

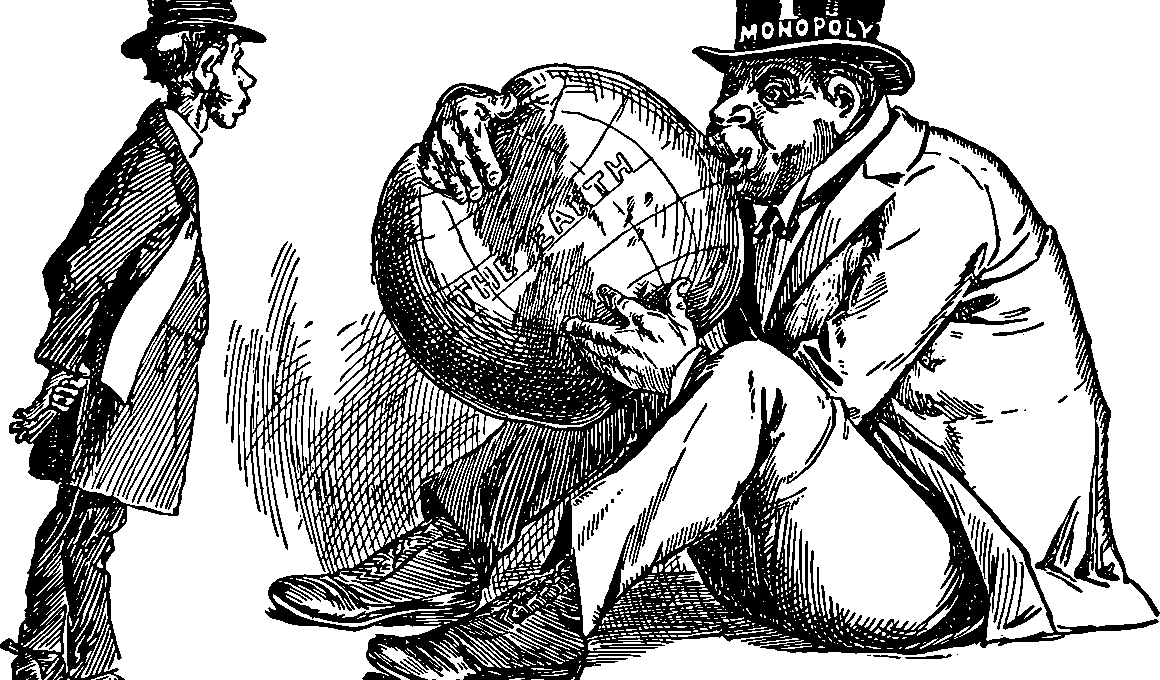

Reporting fraudulent activities is essential not only for the integrity of the organization but also for the broader financial ecosystem. When individuals report malpractices, they contribute significantly to the prevention of further misconduct. Fraudulent activities can lead to devastating consequences for companies, including financial loss, reputational damage, and legal repercussions. Therefore, protecting whistleblowers facilitates the uncovering of unethical practices before they escalate, benefiting stakeholders involved. Moreover, a proactive approach to fraud detection creates a sense of security for employees. Understanding that their efforts are valued can instill confidence among staff members. Additionally, organizations implementing a robust whistleblowing framework may also experience improved employee morale, loyalty, and transparency. A strong culture around ethical behavior can distinguish a company in a competitive market. As fraud becomes more sophisticated, the need for a transparent, accountable culture becomes increasingly critical.

Financial ethics play a significant role in shaping the decisions and accountability of organizations operating within various sectors. Businesses must recognize the importance of ethical implications in their operations and decision-making processes. Financial misconduct can occur at multiple levels, from executive decision-making to clerical errors. Hence, establishing a strong ethical foundation is crucial for preventing such incidents. It is essential for leaders to model ethical behavior, as their choices heavily influence company culture. Senior management should take the lead, exhibiting transparency and accountability for their actions. Encouraging discourse around financial ethics can foster a more conscientious mindset throughout the organization. Regular discussions and assessments of ethical dilemmas can reinforce the importance of reporting and addressing unethical behavior. This dialogue equips employees to have the knowledge and resources necessary to navigate potential ethical issues they may encounter in their roles.

Legal Protections for Whistleblowers

Legal protections are in place to encourage and protect whistleblowers, reducing the fear of retaliation in the workplace. Numerous laws across the globe establish safeguards for individuals reporting unethical behavior. In the United States, the Sarbanes-Oxley Act and Dodd-Frank Wall Street Reform extend considerable protections to whistleblowers. These laws ensure confidentiality, protect from job loss, and prohibit any discriminatory actions taken by employers against whistleblowers. Furthermore, many countries have instituted similar legislation, recognizing that whistleblowers play a crucial role in upholding corporate integrity. By familiarizing employees with these protections, organizations can empower them to speak out without fear of repercussions. Knowledgeable employees can also act as valuable resources in identifying irregularities and fraudulent activities early. Encouraging individuals to engage with these legal frameworks fosters a culture of accountability that can thwart serious financial misconduct.

Encouraging a culture of responsibility, accountability, and ethical awareness can ultimately reduce instances of fraud. When employees feel secure in reporting concerns, it leads to the early detection of unethical practices, enabling appropriate remedial actions before significant damage occurs. Organizations should establish protocols for investigating claims made by whistleblowers to ensure concerns are addressed seriously and promptly. Implementing a transparent process creates trust between employees and management. Regular audits and reviews can also help identify discrepancies and areas of concern to enhance organizational integrity. A thorough follow-up process on reported concerns assures employees that their voices are heard and valued. Consequently, a more ethical organizational culture discourages fraudulent behavior and encourages accountability. Strong communication between management and employees is crucial in nurturing a safer environment that promotes ethical excellence and organizational loyalty.

Investing in compliance programs allows organizations to establish effective frameworks for reporting unethical behavior while empowering employees to do the right thing. Training programs that focus on recognizing fraud, understanding the reporting process, and identifying ethical dilemmas will increase employee vigilance and awareness. Proactive measures help create an organization known for its integrity, which in turn strengthens stakeholder trust. Furthermore, such compliance structures come with several advantages beyond mere adherence to laws. They enhance brand reputation, improve employee morale, and reduce legal risks associated with unethical practices. By focusing on the interplay between whistleblowing and financial ethics, organizations can develop effective strategies to safeguard against fraud. Taking these steps can lead to a more transparent, accountable, and trustworthy organizational culture, preventing fraud before it happens.

Conclusion

Conclusively, whistleblowing is an essential mechanism for detecting and reporting fraudulent activities. It empowers employees and plays a crucial role in organizational integrity across various industries. Protecting whistleblowers through robust legal frameworks encourages them to come forward without fear of retaliation. With the right systems and resources, organizations can mitigate financial misconduct while fostering a culture of transparency and ethical excellence. Increased education, awareness, and encouragement to report unethical behavior can lead to positive change within organizations. Ultimately, it is in stakeholders’ best interests to promote these ethics within every business venture. Focusing on a proactive approach to ethics and whistleblowing is pivotal in combating fraud and maintaining a fair business environment for all.