The Importance of Trial Balance in Financial Accounting

In financial accounting, the trial balance serves as a crucial step in the preparation of financial statements. It plays a vital role in ensuring that the total debits and credits in the ledger accounts are equal. This balance verifies the arithmetic correctness of the accounts before preparing the final accounts. A trial balance is generated after closing the books of accounts at the end of each accounting period. If the trial balance does not balance, it signals errors, which need to be identified and corrected. Common errors might include mispostings or unrecorded transactions. Managers or accountants often use the trial balance to scrutinize accounting records. Accurate financial reporting relies on a well-prepared trial balance. Any discrepancies could lead to serious inaccuracies in financial statements, affecting stakeholder relationships. Investing time in reconciling the trial balance can yield long-term benefits by mitigating risks. It assures stakeholders of the financial integrity of the organization, directly affecting decision-making processes. Thus, the trial balance is foundational for producing reliable financial statements. An effective trial balance simplifies the auditing process and promotes transparency.

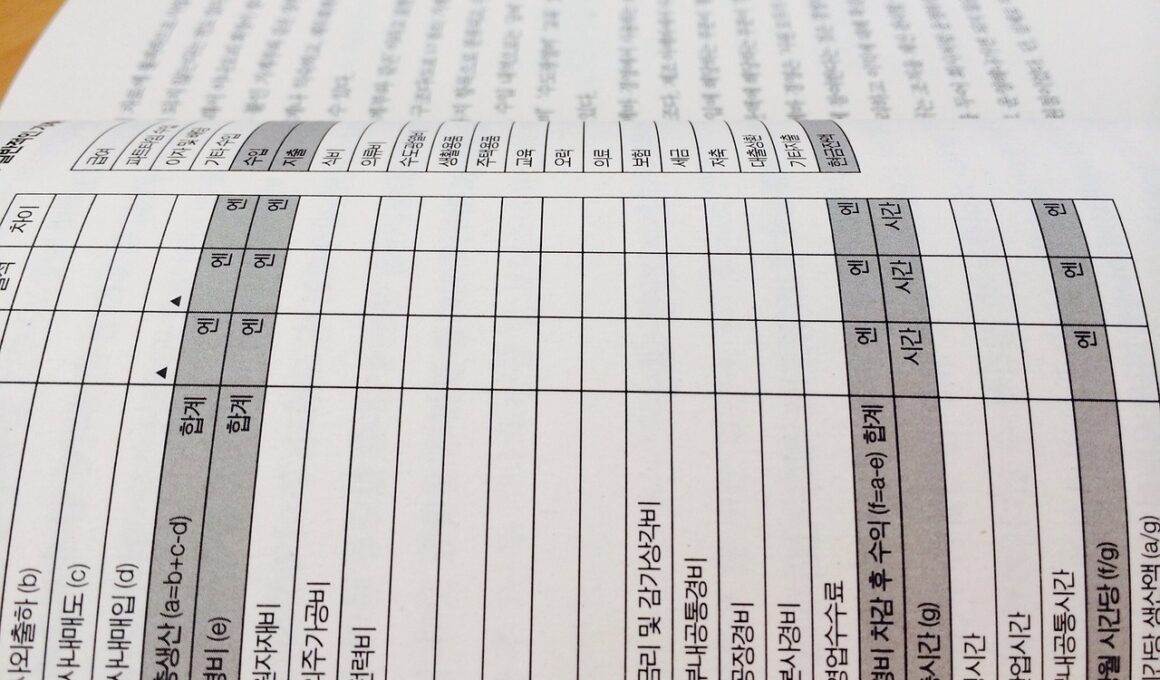

Components of a Trial Balance

A trial balance consists mainly of two sections, one for debits and another for credits. Each account from the general ledger is listed in one of these two sections based on its nature. Common accounts include assets, liabilities, equity, revenues, and expenses. Within the trial balance, the debit balances typically consist of assets and expenses, while the credit balances encompass liabilities, equity, and revenue. While preparing the trial balance, each account’s final balance is stated to confirm the totals align. Totals of both the debit and credit sides should be equal; if they are not, it indicates an error in the recording process. Errors in accounts can stem from various sources. For example, simple transcription errors can skew the results, along with misclassifying accounts. Furthermore, ensuring the proper application of accounting principles is essential for accurate balance. Understanding this process helps accountants quickly identify discrepancies, enabling them to rectify any errors efficiently. Thus, the components of a trial balance are interconnected and critical for the accounting cycle. They simplify financial validation, making them indispensable for any financial accounting operation.

The trial balance also significantly aids stakeholders in analyzing the financial well-being of an organization. Investors often look at trial balances to assess potential risks and returns before making investment decisions. It offers a snapshot of the company’s financial status. Additionally, creditors utilize it to decide the creditworthiness of the business. An unbalanced trial balance might deter potential investors or creditors, indicating mismanagement or errors in financial reporting. Furthermore, a clean trial balance is invaluable during audits. Auditors depend on trial balances to confirm that the accounting records are accurate and comply with accounting standards. A well-structured trial balance streamlines the audit process, thereby saving time and resources. Moreover, it establishes a foundation for preparing key financial statements such as the income statement and balance sheet. Therefore, the trial balance should not be neglected; it should be regarded as an essential instrument for maintaining healthy financial practices. An accurate trial balance boosts confidence among stakeholders and enhances overall organizational credibility. Hence, understanding its importance extends beyond basic accounting procedures.

Common Errors in Preparing Trial Balance

Errors may occur during the preparation of a trial balance, some of which can significantly impact the accuracy of financial records. Common mistakes might include omissions, where transactions are completely unrecorded, or mispostings, where amounts are recorded in the wrong accounts. Additionally, mathematical errors can occur in totaling debits and credits, leading to discrepancies. It is also plausible to misclassify accounts, placing debits as credits or vice versa. Understanding these common pitfalls is vital for accountants who strive for precision. Human errors are typical in accounting, highlighting the necessity for thorough review processes. Implementing systematic checks can minimize such inaccuracies. Moreover, utilizing accounting software can further help automate calculations, thus reducing the risk of manual errors. Accountants should ensure that they regularly review their work for any inconsistencies. The importance of addressing these errors cannot be overstated, as they can affect stakeholders’ trust and financial integrity. In this regard, organizations must invest in training for their accounting staff on efficient practices. Therefore, awareness and education surrounding trial balance errors can help foster professional growth and operational improvement.

Utilizing the trial balance can also enhance managerial decision-making. A balanced trial balance offers management clear insights into the organization’s financial health. It provides essential data, facilitating strategic planning and budgeting. Managers can pinpoint areas needing improvement through consistent analysis of trial balances over time. This information can guide resource allocation and investment strategies. Furthermore, the trial balance can be instrumental in performance evaluations. By comparing trial balances across periods, management can gauge progress toward financial goals. This comparison can identify trends, strengths, and weaknesses within the organization. A comprehensive review enables proactive approaches to any emerging issues. Knowing the financial position allows for better forecasting and risk assessment. Therefore, reliance on a well-prepared trial balance boosts organizational effectiveness. It strengthens the financial processes and ultimately contributes to sustainable growth. It nurtures a culture of accountability and transparency. Managers who recognize the value of accurate financial data can make informed decisions that drive success. Thus, embracing the trial balance can lead to long-term benefits for both management and the organization’s overall health.

Preparing for Audits with Trial Balance

Audits are integral to maintaining financial integrity, and preparing a trial balance can simplify this process. A meticulously prepared trial balance acts as a critical audit tool, ensuring that financial data is ready for evaluation. During audits, auditors review the trial balance first, verifying its accuracy to ascertain the organization’s financial accuracy. This stage is crucial for internal controls, helping identify discrepancies or fraud. Additionally, a well-organized trial balance aligns with auditing standards, showcasing an organization’s commitment to compliance and ethical practices. By presenting a balanced trial balance, businesses can foster auditors’ confidence, potentially reducing the duration and complexity of audits. This proactive approach can translate into lower audit fees, as auditors spend less time investigating inconsistencies. Furthermore, maintaining a consistent trial balance throughout the year enhances audit efficiency. It ensures clarity for auditors who require a clear understanding of financial transactions. Therefore, organizations should consider their approach to the trial balance strategically, knowing that it is more than just a compliance tool. A focus on a thorough trial balance process supports not only audit preparedness but also the overall transparency and reliability of financial practices.

The impact of the trial balance extends beyond auditing; it is critical in enhancing communication among departments within an organization. Clear financial reporting facilitated by a well-crafted trial balance fosters collaboration among teams. Financial insights generated by the trial balance can be vital for departments needing budgetary guidance. It offers teams context, enhancing their understanding of financial performance. In turn, this empowers departments to make informed decisions that align with organizational objectives. Financial transparency forged through a balanced trial balance promotes accountability across departments. Each team becomes cognizant of its financial responsibilities, which can lead to improved overall performance. For effective communication, organizations should integrate the trial balance into regular financial discussions, ensuring that it is accessible to relevant departments. Training personnel on interpreting trial balances can further increase engagement and understanding. Consequently, knowledge sharing via the trial balance can facilitate better decision-making, driving collective success. This collaborative approach helps cultivate a financially aware culture, ensuring that decisions made are congruent with financial realities. Hence, viewing the trial balance as a communication tool can unlock untapped potential in organizational effectiveness.

Conclusion

In conclusion, the trial balance holds a significant place in financial accounting. This document not only serves as a checkpoint for verifying account accuracy but also as a cornerstone in preparing financial statements. Its importance transcends basic accounting functions, extending into managerial decision-making and internal controls. Businesses need to recognize the value of maintaining accurate trial balances, which can increase financial transparency and foster stakeholder confidence. Moreover, the trial balance aids in identifying areas requiring greater attention, thereby driving continuous improvement. Addressing errors in trial balances should be a priority, as accurate financial reporting underpins the health of an organization. Through comprehensive training and enhanced understanding of the trial balance process, accounting staff can drive efficiency and accuracy in their work. Ultimately, the trial balance represents a vital tool that supports both compliance and operational efficacy. Organizations invested in solid financial practices must prioritize the trial balance to maintain their credibility. By cultivating a robust financial framework centered around accurate trial balances, organizations can achieve long-term success. Thus, the trial balance emerges as an essential element in the broader scope of financial accounting.