Due Diligence in Private Equity Transactions: A Legal Perspective

In the arena of private equity transactions, legal due diligence is a critical process involving a detailed examination of potential investment targets. This process aims to identify any and all risks that could affect the value of the acquisition. Understanding the legal standing and financial health of a target company is paramount to assess the feasibility of an investment. A thorough due diligence process provides investors with a clearer picture of what they are getting into, including outstanding liabilities, compliance issues, or potential litigations. Different laws can impact transactions and require investors to navigate various regulatory environments. Therefore, strategic legal counsel is necessary for reviewing contracts, regulations, and other significant documents. Moreover, due diligence helps in determining if the corporate governance structure meets the standards and regulations. By focusing on the target’s compliance and risks, investors can make informed decisions and negotiate terms effectively. The insight gained during due diligence can significantly influence the transaction’s price and terms. Investors should engage legal experts who specialize in due diligence to ensure that their investments are secure and comply with existing laws and regulations.

The Role of Legal Advisors

Legal advisors play a pivotal role in the due diligence process for private equity transactions. Their expertise is essential for identifying any red flags that might jeopardize the transaction. Advisors examine a plethora of documents such as corporate records, financial statements, and previous legal cases. The analysis provided by legal experts guides investors in making prudent decisions that safeguard their interests. With a thorough review of contract obligations, intellectual property rights, and compliance matters, they highlight potential liabilities that may surface after the acquisition. Furthermore, advisors can communicate the implications of jurisdictional differences that affect legal compliance, which is often complex in private equity deals. Effective communication about these risks is crucial for the negotiation process. Legal advisors also assist in negotiating transaction terms based on thorough findings. They ensure that conditions in the contract adequately reflect the potential risks identified. Ultimately, engaging experienced legal advisors can lead to a more favorable outcome and minimize the risk associated with investment decisions. Their involvement is not just beneficial; it is essential to navigate the myriad of intricacies involved in private equity transactions.

Preparing for a legal due diligence process entails a systematic and organized approach. Investors must outline a comprehensive checklist of documents and information needed for the review. This checklist should encompass financial records, corporate charters, and material contracts that could impact the valuation. A well-defined process facilitates a smoother due diligence experience and minimizes potential oversights. Additionally, the preparation stage should include assembling a competent team to undertake the review. Team members often come from various backgrounds such as legal, financial, and operational sectors, making the review process both efficient and effective. It’s beneficial to establish clear internal communication channels to ensure all team members are aligned. A centralized repository for documents aids in simplifying data access and management. Regular meetings among team members can also help address any challenges encountered during the due diligence process. Engaging an external legal expert early allows the team to gain insights on pertinent areas that require more focus. This prior preparation not only saves time but also helps in thorough navigation through complex legal landscapes.

Risks and Liabilities

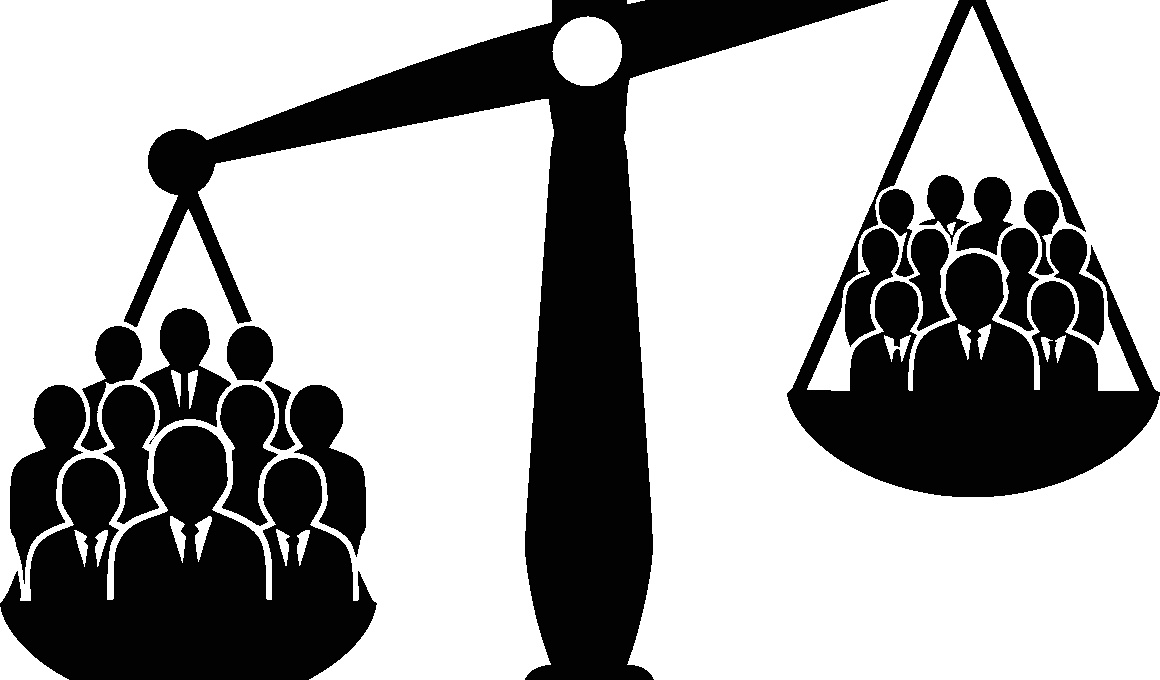

Investors must be well aware of potential risks and liabilities that could arise from the due diligence findings in private equity transactions. Identifying these risks early is crucial for informed decision-making. Possible liabilities can include unresolved legal disputes, tax issues, or regulatory non-compliance that may result in financial penalties. Risks associated with inaccurate financial statements or loss of critical contracts can significantly impact the value of a target investment. Furthermore, operational issues such as labor disputes or environmental liabilities can lead to unforeseen costs. Conducting a thorough legal review helps illuminate these risks allowing investors to make calculated judgments. In some cases, the discovered issues can serve as leverage in negotiations, potentially reducing the acquisition price. Moreover, understanding the implications of discovered liabilities is essential in reshaping deal structures to protect investments. Often, buyers can negotiate indemnities or escrow arrangements to buffer against potential future claims. Thus, having a robust understanding of risks and liabilities is fundamental to successfully executing private equity transactions.

The Importance of Compliance in due diligence cannot be overstated. Compliance issues can severely hinder a transaction, leading to significant fines or even liquidation of a company if unaddressed. Legal due diligence focuses on ensuring that the target company adheres to local, federal, and international regulations. This aspect involves a thorough review of environmental laws, employment practices, and industry-specific regulations. A target’s compliance history can also reveal vital information regarding operational integrity. Non-compliance records may indicate deeper systemic issues within the organization, presenting potential red flags. Conducting comprehensive background checks allows investors to assess not just current compliance but also the potential evolution of compliance over time. This examination can affect future performance as well as company reputation. Thus, potential acquirers must prioritize compliance issues in their due diligence efforts. Moreover, legal advisors should systematically evaluate how the compliance risks might affect the overall valuation and deal structure. Ultimately, ensuring compliance not only mitigates risks but also enhances the transaction value by confirming a sound and ethical operational framework.

Post-Due Diligence Integration

After concluding the due diligence phase, the integration of findings plays an integral role in successful transaction execution. Investors must develop a comprehensive plan to address the identified risks and issues effectively. This plan should include specific remediation steps to resolve compliance gaps or legal disputes. Facilitating communication between stakeholders during this stage promotes transparency and collaboration. Legal teams should work closely with operational teams to align on the implementation of the due diligence findings into everyday business practices. This integration not only ensures that the newly acquired company operates smoothly but also maintains compliance with legal standards. Furthermore, adhering to a structured post-due diligence plan can help prevent future liabilities from emerging. Review mechanisms should also be instituted to monitor compliance continuously and to assess whether the anticipated benefits of the transaction are being realized. Implementing a robust governance framework helps set expectations for performance post-acquisition. Overall, proper integration based on thorough due diligence can contribute substantially to the long-term success and sustainability of the investment.

In conclusion, legal due diligence in private equity transactions serves as a critical pathway towards informed investment decisions. The complexity of such transactions necessitates a keen understanding of both legal and financial landscapes. Engaging skilled legal advisors proves invaluable during the due diligence phase, as their expertise significantly mitigates associated risks. Felicitously navigating potential liabilities, compliance issues, and operational integrity ensures a more favorable transaction outcome. The preparatory stages and a structured approach to risk assessment are essential in identifying potential issues before they escalate. Furthermore, post-due diligence integration of findings is instrumental for aligning a newly acquired company with investment goals. Ultimately, a thorough and well-executed due diligence process sets a solid foundation for successful private equity investments and long-term growth. By understanding and prioritizing legal due diligence, investors can actively enhance their decision-making process while securing their investments against unforeseen challenges.