Best Practices for Organizing and Maintaining Journal Entries

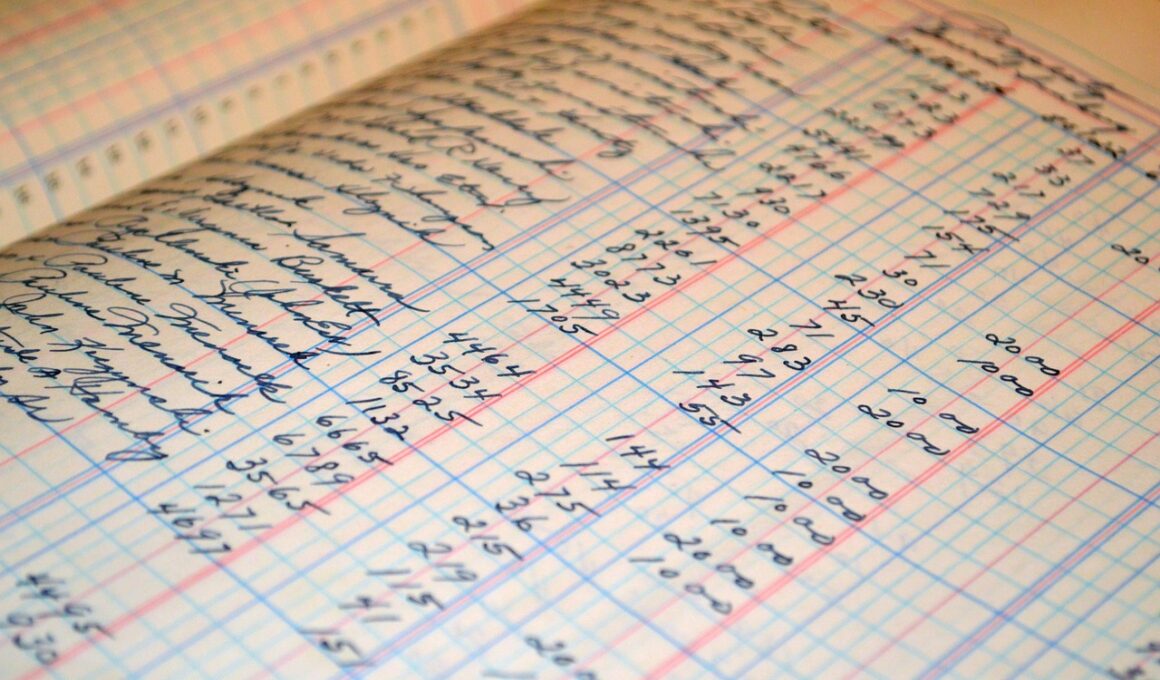

Journal entries serve as a fundamental aspect of financial accounting, tracking all financial transactions. To ensure accuracy and clarity, it’s essential to maintain organized records. Begin by establishing a standardized format for journal entries, which should include key components such as the date, account names, amounts, and a brief description of the transaction. A consistent structure allows for easier review and auditing. Furthermore, it is advisable to date all entries immediately upon transaction occurrence, which helps maintain chronological order. This practice reduces the chances of errors and omissions. Additionally, using software or spreadsheets can enhance the organization and accessibility of journal entries. Always lock these documents to prevent unauthorized changes, ensuring data integrity. Regularly back up digital records to avoid data loss. Establishing a routine for reviewing journal entries is also beneficial, allowing you to catch inconsistencies sooner rather than later. Identify discrepancies and address them promptly. By implementing these best practices, you can enhance the reliability of financial reporting and compliance with accounting standards.

Enhancing audit trails is another crucial aspect of maintaining journal entries effectively. An audit trail provides a step-by-step record of all transactions and modifications, ensuring transparency in the financial process. To establish a robust audit trail, assign unique identifiers to each entry. This practice not only simplifies tracking individual transactions but also aids auditors during reviews. All journal entries should be accompanied by supporting documents, such as invoices or receipts. This practice reinforces the legitimacy of each recorded transaction. Additionally, it is beneficial to create a detailed coding system that categorizes expenditures and revenues. This organizational method streamlines reporting tasks and helps an organization conduct financial analyses efficiently. Implementing monthly or quarterly reconciliations can minimize discrepancies and confirm the accuracy of accounts. In the reconciliation process, compare journal entries with bank statements and subsidiary ledgers to identify differences. Timely reconciliations help ensure that any errors are quickly corrected, maintaining the integrity of financial records. By adhering to these audit trail enhancements, accountants can significantly improve their journal entry management and strengthen overall financial health.

Utilizing Technology for Efficiency

Leveraging technology can greatly improve the way journal entries are organized and maintained. Modern accounting software offers numerous features that simplify the recording of transactions. automation reduces the likelihood of human error and ensures that records are consistently maintained. Cloud-based solutions allow multiple users to access and collaborate on financial data in real-time. This accessibility enhances communication within financial teams and expedites the decision-making process. Additionally, many accounting platforms offer integration with other financial tools that facilitate seamless data importation, reducing redundancy. Implementing digital workflows can help streamline the review and approval of journal entries. By creating specific approval routes within these systems, organizations can ensure that each entry receives the necessary oversight. Furthermore, utilizing analytics within accounting software can offer insights into financial patterns, assisting with budget forecasting and financial planning. Regularly updating software ensures that organizations benefit from the latest features and security measures. Overall, technology plays a pivotal role in enhancing the organization and maintenance of journal entries, aligning with best practices in financial accounting.

Training and development are critical components in ensuring that team members are adept at managing journal entries correctly. Regular training sessions can equip staff with the latest knowledge about accounting principles and software usage. This investment in employee development not only enhances their skill set but also promotes compliance with accounting standards. Practicing real-case scenarios can help employees understand the importance of bookkeeping and enhance their confidence in managing financial data. Additionally, maintaining open lines of communication within the finance team encourages knowledge sharing about challenges and solutions in journal entry management. Implementing mentorship programs can also foster growth by pairing experienced professionals with newer employees. This dynamic allows for practical, hands-on learning experiences that can reinforce best practices. Furthermore, establishing a resource hub with reference materials and best practice guides can provide staff with 24/7 access to supportive information. This ensures that employees have the tools they need to maintain journal entries accurately and efficiently. A well-informed team is indispensable in achieving optimal accuracy and reliability in financial reporting.

Implementing Internal Controls

Another critical aspect of organizing and maintaining journal entries is the establishment of internal controls. Internal controls are processes designed to ensure the integrity of financial and accounting information. They help to safeguard assets and enhance the reliability of an organization’s financial statements. One essential control is the segregation of duties, where different individuals are responsible for various steps in the journal entry process. This reduces the risk of errors and fraud by ensuring that no single person has control over all aspects of a transaction. Regular audits or assessments of internal controls are vital to identifying weaknesses. Institutions should develop specific policies surrounding journal entries, detailing the procedures to be followed and the responsibilities of each person involved. Furthermore, creating a system of checks and balances whereby entries are reviewed and approved by a supervisor can enhance accountability. Identifying and documenting any variances between planned and actual figures in journal entries is vital for corrective actions. In doing so, organizations can minimize risk and maintain accurate financial records.

The role of consistent documentation cannot be overstated in organizing and maintaining journal entries effectively. Documentation includes not only the journal entries themselves but also the accompanying explanations and sources. Each journal entry should have an annotation clarifying the reason behind the transaction and its significance to the financial picture. Furthermore, categorizing entries by type allows for more straightforward reporting and analysis, aiding in decision-making. Establishing a filing system for both physical and digital documents ensures that supporting materials can be easily retrieved. Clear labeling and indexing improve the efficiency of this system significantly. Consider utilizing color-coded systems or tags for visual identification of categories, which will facilitate quicker reference. Regularly scheduled document audits can help identify missing or misplaced files, encouraging thoroughness in maintaining records. This process ensures that all details associated with journal entries are readily accessible. When documentation is well-organized, it simplifies audits and enhances compliance with regulatory standards. Overall, maintaining robust documentation practices is a cornerstone of effective journal entry organization and retention.

Conclusion

In conclusion, organizing and maintaining journal entries is essential for accurate financial accounting and reporting. By implementing the best practices discussed, organizations can enhance their financial management capabilities. Establishing standardized formats and utilizing technology are foundational steps in this process. Enhancing audit trails and implementing strong internal controls further solidify an organization’s commitment to maintaining integrity in financial reporting. Training staff and ensuring access to resources plays a crucial role in developing competence within the finance team. Documentation should be comprehensive and well-organized, supporting the transparency of financial data. Regular reviews and reconciliations help in identifying discrepancies promptly. All of these practices together lay the groundwork for effective journal entry management. Ultimately, a disciplined approach results in improved financial accuracy and supports stronger financial decision-making. Firms that prioritize these best practices will likely experience streamlined operations, better compliance with regulations, and enhanced credibility among stakeholders. Therefore, commitment to ongoing improvement in organizing journal entries is a vital aspect of effective financial management.