Common Errors to Avoid During Consolidation of Financial Statements

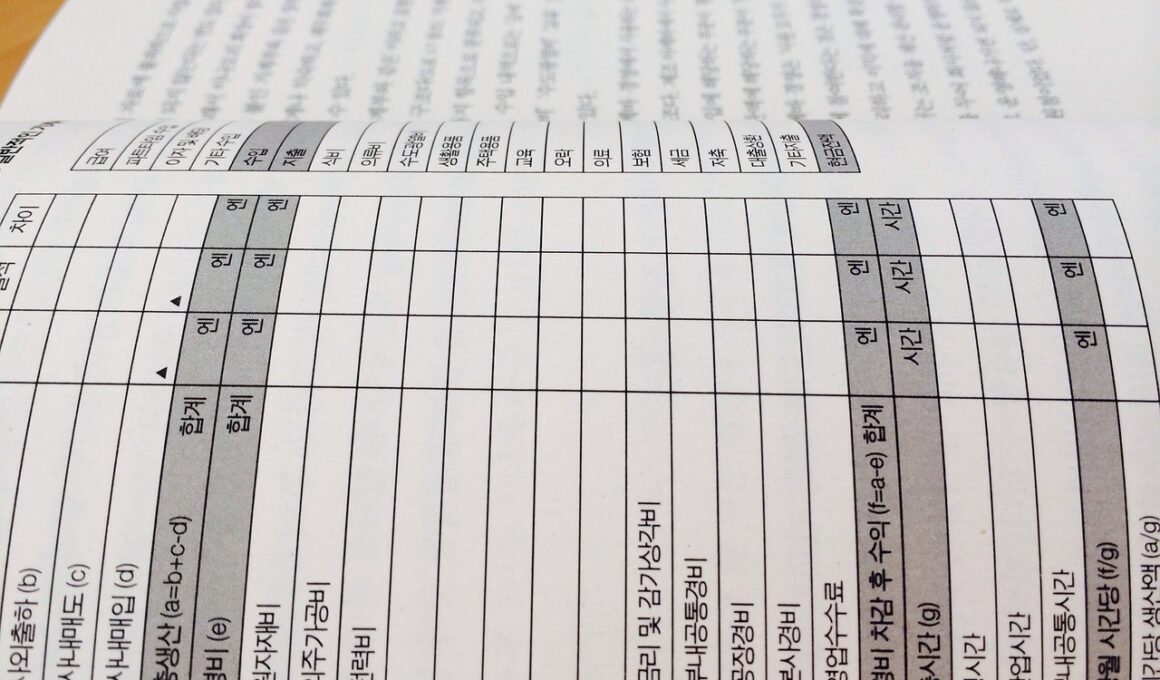

The consolidation of financial statements is a complex process that requires careful attention to detail. One common error that can occur is failing to identify intercompany transactions accurately. These transactions can significantly skew financial results and misguide stakeholders. It’s essential to have a comprehensive mapping of such transactions documented clearly. Without this, reporting can lead to inflated revenues or expenses. Moreover, applying inconsistent accounting policies across the entities can complicate the consolidation. Each entity might use different methods, resulting in misleading financial presentations. Rigorous consistency is crucial for transparent comparisons between financial years and periods. Inadequate or improper elimination of intercompany profits in inventories is another pitfall. It can lead to reported profits that do not reflect the true economic reality. Failure to address the ownership structures in the consolidated group, especially with joint ventures or subsidiaries, can result in incorrect equity or profit reporting. All parties involved in the consolidation process must be well-informed and trained in their roles to minimize such errors and ensure accuracy. Proper documentation and clear communications play a significant role in achieving accurate financial depreciation.

Another significant error commonly encountered in the consolidation of financial statements is neglecting to account for non-controlling interests properly. Non-controlling interests need to be reported accurately to reflect the actual financial position of the group. If omitted, it could paint an incomplete picture of the total equity. Companies should ensure comprehensive ownership analysis is performed regularly to avoid such issues. Additionally, errors often arise during the currency translation process, particularly when dealing with foreign subsidiaries. The exchange rates used for financial statements require precise documentation and clarification to prevent confusion. Changes in these rates can impact the consolidated figures massively, resulting in volatility in reported profits or losses. Another area of concern is the misspecification of the financial year-ends for the entities involved. All entities must conclude their financial years at the same time to provide a fair representation during consolidation. If they do not, the final figures may mislead analysts and investors when examining performance. Lastly, disregarding the auditor’s recommendations during the consolidation process can lead to adding errors and further complications in the financial statements.

Improper Classification of Items

Improperly classifying items within financial statements is a major concern that can lead to various issues. Items should be categorized correctly as assets, liabilities, equity, revenues, or expenses to enhance clarity in financial reporting. Misclassifying these figures can lead to confusing interpretations by stakeholders, including investors and analysts. Inaccurate representation of assets can result in faulty valuation and investment decisions. This emphasizes the need for accurate classification and reporting practices. Recognition of revenue can also be problematic during consolidation and should abide by the generally accepted accounting principles (GAAP). If revenue is recognized prematurely or inappropriately, it can create discrepancies within the financial statements. Such errors will not only impact the current reporting period but can also mislead future assumptions and projections. Furthermore, it becomes crucial to manage the account balances related to income taxes correctly. Errors in tax balances can trigger significant discrepancies in net income and affect the group’s overall financial position. Businesses should invest time in refining their accounting procedures to eliminate such classification errors, especially if they are operating multi-entity organizations.

Another common issue is forgetting to include all subsidiaries in the consolidation process. Legal structures might lead management or accountants to inadvertently exclude certain subsidiaries from consolidation. This could distort the financial results, presenting a misleading picture of the company’s economic situation. A thorough review of ownership stakes is essential to ensure that all appropriate entities are included and accounted for accurately. Additionally, errors related to timing differences during the consolidation process may arise, especially for companies operating in multiple jurisdictions. Understanding the timing for revenue recognition and expense reporting can be complex, requiring awareness of local accounting practices. Another often-overlooked area is the treatment of goodwill and other intangibles. If these items are not evaluated carefully or impairment tests not performed correctly, financial statements can show inflated values. The treatment of financial instruments, such as derivatives, also needs precise documentation to avoid misstatements. Companies should engage with financial experts to adopt best practices suitable for their specific industries to minimize these common pitfalls during the consolidation of financial statements.

Neglecting Internal Controls

Neglecting strong internal controls can also lead to significant mistakes during the consolidation process. Robust internal controls help ensure key financial data and reports are accurate and comply with relevant regulations. Companies should implement comprehensive checks and balances on all data inputs and calculations in the consolidation process. A lack of internal controls might cause errors in financial reporting to go unnoticed until external auditors raise potential issues. Engaging in ongoing training and assessments of staff can reinforce the importance of maintaining strict adherence to internal controls. Regular reviews and audits of the consolidation process can reveal weaknesses in internal controls that need addressing. In addition, management should remain vigilant in monitoring compliance with the internal control policies established. Implementing technology solutions can also streamline the consolidation process, reducing human errors while improving accuracy. Furthermore, organizations should encourage open communication around financial reporting issues. Aligning the finance and accounting teams ensures everyone is aware of standards that must be upheld during consolidation. Transparency aids in fostering a culture of accountability, ultimately reducing common errors inherent in financial consolidations.

In summary, avoiding these common errors during the consolidation of financial statements is critical for accurate financial reporting and analysis. To achieve this, organizations must invest in training, develop comprehensive documentation, and implement rigorous internal controls. Proper communication between different entities and departments is essential for a clear understanding of the complexities involved in consolidation. Engaging financial experts to validate processes can provide additional assurance and accuracy. Moreover, utilizing the latest technology to streamline reporting and ensure prompt data consolidation helps mitigate concerns. Regular reviews of the consolidation protocol should also be scheduled annually to identify potential resource gaps or areas for improvement. Organizations should adopt a proactive approach to continually evolve financial reporting practices and address any challenges promptly. By focusing on these strategies, organizations can mitigate the risks of errors occurring. Ultimately, accurate financial statements are essential in fostering trust with shareholders and other stakeholders in the organization. Prioritizing this accuracy leads to a more stable foundation for future growth and financial success.

Conclusion

Consolidating financial statements effectively is a multifaceted process that demands diligence and precaution. Errors from neglecting proper analyses or controls can have cascading effects on an organization’s financial health and stakeholder trust. It’s vital for organizations to stay updated with evolving accounting standards and practices, as these can impact the consolidation process significantly. Furthermore, involving external auditors can help provide an added layer of assurance that the consolidation adheres to financial regulations. Management should ensure that all involved parties are educated on the implications of the consolidation process, enhancing clarity and teamwork. Building a strong framework for financial consolidation based on the lessons learned from past errors will set the groundwork for sustainable accuracy. Continuous improvement in this domain is not just advisable but necessary for long-term viability and success. In essence, as companies navigate the complexities of financial consolidations, adherence to sound practices and comprehensive internal reviews will be the cornerstone of reliable reporting and effective decision-making.