Corporate Finance Strategy for Startups: Best Practices

Launching a startup can be both an exhilarating and challenging venture, and having a solid corporate finance strategy is critical for sustainability and growth. One of the initial steps is developing a comprehensive business plan that outlines financial forecasts, including projected cash flows, revenues, and expenses. By understanding expected performance, startups can make informed decisions, securing the necessary funding. This leads to another essential aspect: choosing the right funding sources. Startups often require capital to fuel their growth, so evaluating options such as angel investors, venture capitalists, or bank loans is vital. Additionally, startups should establish a rigorous budgeting process to maintain control over finances and ensure they stay on track. Building a financial model helps gauge the impact of various scenarios, enabling better strategic planning. Ultimately, focusing on clear financial objectives and creating a roadmap can steer startups toward achieving their goals while navigating potential challenges in the competitive landscape.

Understanding your target market is another critical step, as it allows startups to align their financial strategies effectively. Conducting thorough market research will help identify customer needs and behaviors. This knowledge enables startups to make calculated pricing decisions that maximize profit margins while remaining competitive. Furthermore, startups must prioritize their financial metrics, such as return on investment (ROI), customer acquisition cost (CAC), and lifetime value (LTV). Keeping an eye on these indicators helps startups fine-tune their services or products and adjust strategies as needed. Moreover, employing sophisticated financial tools can significantly assist in the analysis and reporting of financial data. Software platforms provide valuable insights that drive decisions based on real-time data instead of assumptions and guesses, which can lead to costly mistakes. Regularly reviewing these metrics will also help startups in forecasting their financial health, thereby enabling proactive adjustments to their strategies. All these factors contribute to building a sustainable financial foundation, which is paramount for long-term success.

Establishing a Financial Governance Framework

Having strong financial governance is crucial for startups looking to implement effective corporate finance strategies. This involves defining clear roles and responsibilities within the financial team, including setting up necessary checks and balances for transparency. Startups often start small, and assigning designated financial roles helps maintain financial discipline. Regular audits, either internal or external, assure stakeholders of the company’s integrity. Incorporating technology in managing finances plays an instrumental role in enhancing accuracy and efficiency, minimizing the risk of errors. Furthermore, startups should consider implementing an appropriate risk management strategy to safeguard against financial uncertainties. This could involve analyzing potential risks associated with cash flow disruptions or unexpected market changes. Identifying these risks early allows startups to devise contingency plans that are both practical and resource-effective. Such adaptation not only fosters resilience but also instills confidence among investors and stakeholders. Ultimately, a well-governed financial structure forms the backbone of a startup’s economic decision-making process, enhancing its reputation in the industry.

Networking is another critical aspect of corporate finance strategy development for startups. Building relationships with financial advisory firms, investors, and potential partners can uncover valuable opportunities and insights. Engaging with experts through mentorship programs provides guidance and expands one’s understanding of financial landscapes. Attending industry conferences and events strengthens professional relationships, facilitating connections that may lead to investment opportunities or beneficial partnerships. Beyond networking, always communicating your financial strategy transparently helps cultivate trust and credibility within the market. Clearly explaining how the company intends to generate revenue can assure investors or stakeholders of its viability and potential

for growth. Periodic reporting of the company’s performance in relation to its strategy keeps all parties engaged and informed. Open dialogues across various functions of the enterprise enhance collaboration and lead to innovative financial solutions. Ultimately, an emphasis on strong networking, combined with transparent communication, is a critical element of a successful corporate finance strategy for startups.

Leveraging Technology for Financial Strategy

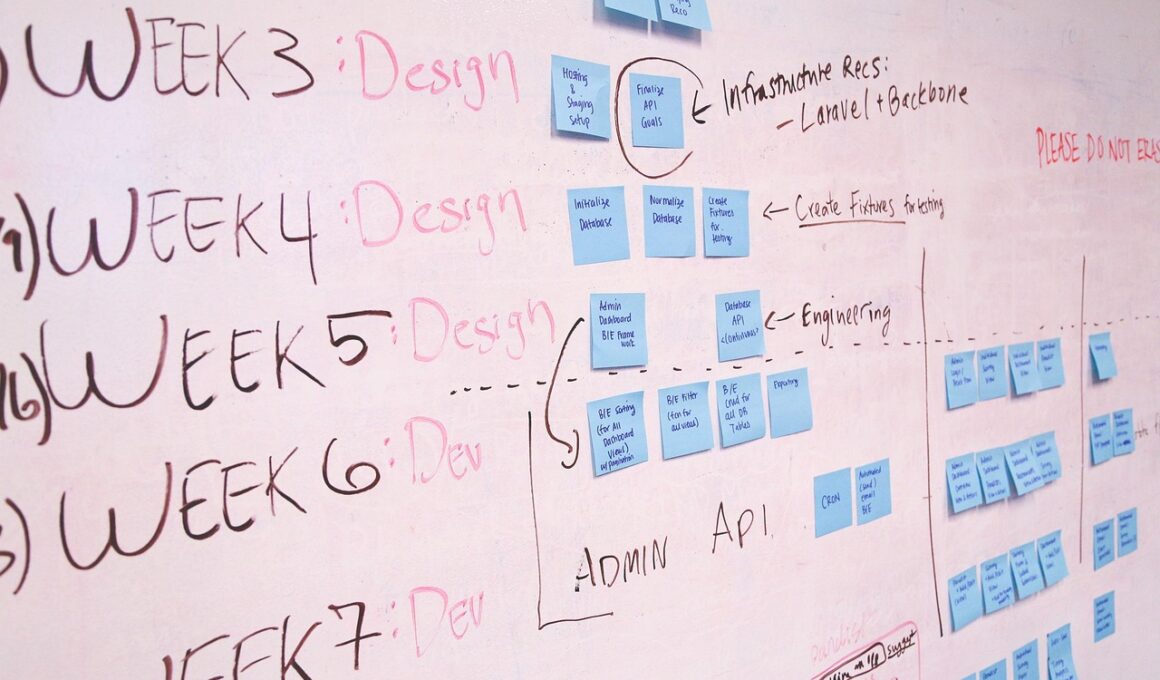

In the digital age, startups can leverage technology to enhance their corporate finance strategies. Cloud-based accounting tools, budgeting software, and data analytics platforms enable efficient financial management and reporting. Utilizing these resources allows startups to automate time-consuming tasks, freeing up valuable time for strategic planning and analysis. With access to real-time financial data, founders can make informed decisions quickly. Additionally, technology aids in creating sophisticated financial models that can simulate different scenarios, allowing startups to evaluate the potential outcomes of their financial strategies better. Implementing Artificial Intelligence (AI) tools can further enhance forecasting accuracy, enabling startups to anticipate market changes and plan accordingly. Understanding emerging fin-tech trends within the industry will also provide innovative solutions to traditional finance problems. Startups should be eager to adapt and integrate technology tools that add value to their operations and processes. Ultimately, combining tech advances with sound financial strategies creates a dynamic approach to managing finances, positioning startups favorably within competitive markets.

Moreover, emphasis on compliance is vital in developing robust corporate finance strategies for startups. Understanding the regulatory environment for financial reporting helps ensure adherence to relevant laws and stipulations. Establishing best practices around compliance from the start will mitigate risks and avoid potential fines or legal complications. This may involve training employees on regulations applicable to the industry and creating clear internal controls that promote compliant practices. Establishing a proactive stance rather than a reactive one regarding compliance ultimately supports operational integrity and investor confidence. Organizations that consistently practice transparency are more likely to have conducive relationships with investors and partners, which can support their long-term growth aspirations. Startups should also invest time in regular financial training to keep teams updated on compliance trends affecting finance operations, ensuring everyone understands their role in upholding these standards. Moreover, compliance effectively safeguards the startup’s reputation in the market, thereby supporting its overall success. Regularly scheduled reviews of compliance regulations resonate with the startup’s commitment to ethical conduct and sound financial governance.

Preparing for Future Investments

As startups mature, preparing for future investments becomes increasingly essential for ongoing growth. Establishing a corporate finance strategy that effectively attracts investors involves showcasing the company’s potential through detailed business modeling and growth forecasts. Transparency in financial performance showcases a history of revenue generation, enabling startups to present themselves as viable investment opportunities. A well-developed pitch deck that highlights key financial metrics, projected growth, and market positioning can significantly elevate the chances of securing investment funding. Engaging with investors early on to establish rapport allows startups to refine their pitches based on investor feedback and preferences. Furthermore, maintaining open communication with current investors ensures they remain informed about the startup’s journey. Regular updates not only confirm trustworthiness but may also secure additional funds from them in the future. Forming relationships with investment groups and venture capitalists may unlock further financing opportunities. Lastly, startups must remain adaptable to market changes, enabling them to pivot their finance strategies when necessary, allowing sustained investor interest.

In conclusion, corporate finance strategy development is crucial for startups aiming for sustained growth and viability. Each aspect of financial governance, budgeting, risk management, and compliance forms a cohesive framework that supports strategic objectives. From leveraging modern technology to establishing networked relationships, the pathway to financial success is multifaceted. By remaining proactive about market demands and transparent in communication, startups can enhance their reputation and attract the right kind of investor interest. As businesses navigate through different growth stages, continuously revisiting and refining financial strategies will empower them to adapt to changing landscapes. Emphasizing best practices in corporate finance not only ensures a solid financial foundation but fosters innovation and resilience in the complex digital economy as well. Cultivating a financial philosophy rooted in best practices enhances the chance of achieving long-term success. The journey may be challenging, but with a firm strategic approach, startups can turn their visions into reality and make a significant impact in the marketplace. Ultimately, the strength of any startup lies in its financial planning and ability to embrace opportunities, steering toward sustainable growth.