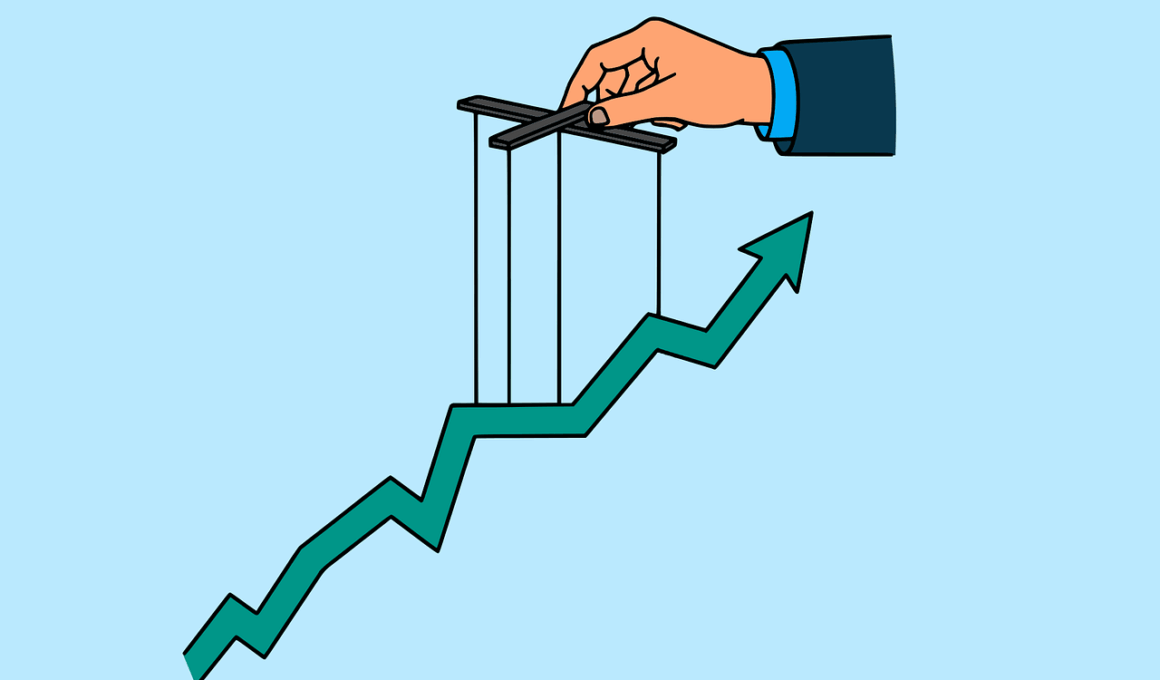

Understanding Market Manipulation and Its Legal Prohibitions

Market manipulation refers to various illegal activities aimed at distorting the true price of securities in the financial markets. In essence, it involves creating a deceptive appearance of market demand, typically to profit from artificially inflated or depressed stock prices. This can manifest in various forms, such as insider trading, pump-and-dump schemes, and misinformation dissemination. Regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States, continuously monitor trading practices for red flags that indicate manipulation. Penalties for engaging in these practices may include hefty fines, revocation of licenses, and even imprisonment. Investors can protect themselves by being cautious of unexplained price spikes or trends that do not align with fundamental business indicators. Understanding market manipulation laws is vital for anyone participating in trading activities. The repercussions of illegal manipulation not only affect individual traders but can also undermine confidence in the entire financial system. Thus, vigilance is essential for ensuring the integrity of the markets and discouraging fraudulent practices.

There are several tactics used in market manipulation that traders and investors should recognize to safeguard against potential losses. One common form is the “pump and dump” scheme, where fraudsters artificially inflate a stock’s price through misleading promotional campaigns. Once the price peaks, they sell off their shares at a profit, leaving other investors to suffer losses as the price plummets. Another tactic is insider trading, where individuals with non-public, material information about a company exploit this knowledge for personal gain. This behavior is illegal and undermines the principles of fair trading and transparency. Moreover, “wash trading” is a deceptive practice where a trader simultaneously buys and sells the same asset, creating an illusion of increased activity and interest in that security. Each of these methods erodes trust in the financial markets and contravenes securities laws. Investors must remain well-informed about the signs of manipulation and be cautious when approached with news or tips that appear too good to be true. Education remains the strongest defense against these unethical practices.

Legal Framework Governing Market Manipulation

The legal framework for addressing market manipulation is primarily encapsulated in securities regulations established to promote fairness and transparency. In the U.S., the Securities Exchange Act of 1934 provides the foundation for regulating trading practices and protecting investors. This Act empowers the SEC to investigate suspicious trading activities and impose penalties for violations. Enforcement actions taken against violators include civil penalties, administrative sanctions, and criminal charges where fraudulent intent is apparent. Additionally, various state laws complement the federal regulations, contributing to a comprehensive approach to combatting manipulation. Global markets have similar structures, allowing regulators to cooperate internationally to tackle cross-border manipulation. As trading technology advances rapidly, regulators are adapting their frameworks to new challenges presented by high-frequency trading and algorithmic market strategies. Consequently, staying updated with changes in the legal landscape is vital for all participants in financial markets. Understanding these legal obligations safeguards individual investors and upholds market integrity, preventing malpractices that could harm economic stability.

Litigation surrounding market manipulation often results from the aftermath of fraudulent activities, proving that enforcement plays a critical role. Those directly affected by manipulation may have grounds to file lawsuits, claiming losses incurred due to deceptive practices. Class-action lawsuits are common, consolidating the claims of multiple victims into a single action, which amplifies the challenges for the defendants. While proving market manipulation can be difficult due to the complex nature of trades and the market environment, courts have established precedents that help guide the legal process. Successful plaintiffs may recover damages, including the amount they lost plus interest, and defray litigation costs. Moreover, regulatory whistleblowers often play a crucial role in exposing manipulation, resulting in significant rewards for their information. Legal counsel specializing in securities law is essential for navigating these murky waters, enabling victims of manipulation to seek justice efficiently. Understanding the necessary legal pathways enhances the ability to address grievances arising from fraudulent market practices. Therefore, investors should be proactive in learning about legal recourse applicable to their experiences.

Impacts of Market Manipulation on Investors

Market manipulation impacts not only the integrity of markets but also the experiences of individual investors, leading to significant financial consequences. When manipulation occurs, it skews the true price discovery mechanism of securities, making it challenging for investors to ascertain a fair value. This can result in losses for unsuspecting investors who buy into artificially inflated stocks or sell at depressed prices. The emotional toll can be just as significant, causing anxiety and distrust in market mechanisms. Moreover, victims of manipulation may experience long-term repercussions, including loss of confidence in investing in the stock market entirely. This decline in investor confidence can stifle market growth as retail investors retreat, subsequently affecting overall market liquidity. The perception of fraud can deter new investors from entering the market, which is detrimental for economic vitality. Therefore, fostering an environment of transparency and honesty is critical, not only to protect individual investors but also to ensure the healthy functioning of financial markets. Those who manipulate must be held accountable to maintain investor trust and engagement.

Certain regulatory measures have been put into place to counteract and prevent manipulation in financial markets effectively. These include rigorous monitoring of trading activities through advanced technology and data analytics to detect anomalous patterns indicative of manipulation. Surveillance systems operated by exchanges and financial authorities allow for real-time analysis, making it easier to identify potential violations before they escalate. Furthermore, mandatory reporting requirements for significant trades and disclosures help hold traders accountable. Educational initiatives have also been created to inform investors about their rights and the various types of market manipulation. Additionally, regulators engage in outreach programs to create awareness among market participants about ethical trading practices. Transparency remains vital to restoring confidence and integrity in the markets. Collaborative efforts between regulatory agencies, exchanges, and market stakeholders enable a more robust defense against manipulative practices. By raising awareness and implementing preventive measures, markets can remain resilient against the adverse effects of manipulation. A proactive approach ensures that investors are aware and can act responsibly while contributing to a fair market landscape.

Recommendations for Investors

Investors can adopt several strategies to protect themselves from the adverse effects of market manipulation. Firstly, conducting thorough research before making any investment decisions is imperative. Familiarizing oneself with the fundamentals of the companies involved and monitoring financial news can help distinguish genuine opportunities from potential manipulation schemes. Additionally, investors should remain skeptical of any rapid price movements without clear reasons or accompanying news about the company’s fundamentals. Accompanying caution, diversifying one’s portfolio can mitigate risks associated with sudden market downturns tied to manipulation. It is also beneficial to consult with financial advisors who can provide insights and recommendations tailored to individual circumstances. Engaging with educational resources and online forums allows investors to learn from others’ experiences and stay up-to-date with market trends. Ultimately, establishing a strong financial foundation through education and awareness can empower investors, enhancing their ability to navigate complex market landscapes successfully. By taking an active role in understanding market dynamics, investors can equip themselves against the realities of market manipulation and protect their investments.

As we conclude, it is important to recognize that understanding market manipulation and its legal prohibitions is essential for anyone participating in financial markets. Knowledge of laws governing such practices not only protects investors but also contributes to the overall health of the markets. Regulatory bodies play a critical role in enforcing these laws and ensuring that transparent trading practices thrive. By being vigilant and informed, investors can combat manipulation effectively and make sound financial decisions. Market safety and integrity are paramount in preserving investor trust and promoting long-term economic growth. Continuous education and awareness are necessary to remain ahead of potential challenges posed by manipulative practices. Ultimately, a united front involving investors, regulatory agencies, and financial institutions is needed to discourage manipulation and uphold the principles of fair trading. Maintaining the integrity of financial markets benefits everyone involved by fostering a reputable environment for investment. Therefore, as participants in a complex financial landscape, a collective commitment to ethical practices will pave the way for sustainable market growth.