The Importance of Sensitivity Analysis in Financial Forecasting

Sensitivity analysis is a crucial aspect of financial forecasting, providing insights into how differing variables impact anticipated outcomes. By altering assumptions related to critical input factors, analysts can determine the extent to which these changes affect financial projections. This process allows businesses to identify potential risks and adjust their strategies accordingly. For instance, understanding the sensitivity of projected revenues to fluctuations in sales price or volume can help firms make informed decisions. Sensitivity analysis not only aids in decision-making but also enhances transparency in reporting to stakeholders. This is achieved by demonstrating how assumptions play a role in financial results and forecasts. For business leaders, conducting a rigorous sensitivity analysis can unravel hidden exposure to market dynamics. It also assists in evaluating investment opportunities by quantifying potential returns under varying conditions. Overall, this analytical method serves to bolster confidence among investors, ensuring they have a clearer picture of risks associated with projected investments. In an ever-changing market landscape, employing sensitivity analysis is essential for effective financial management and strategic planning.

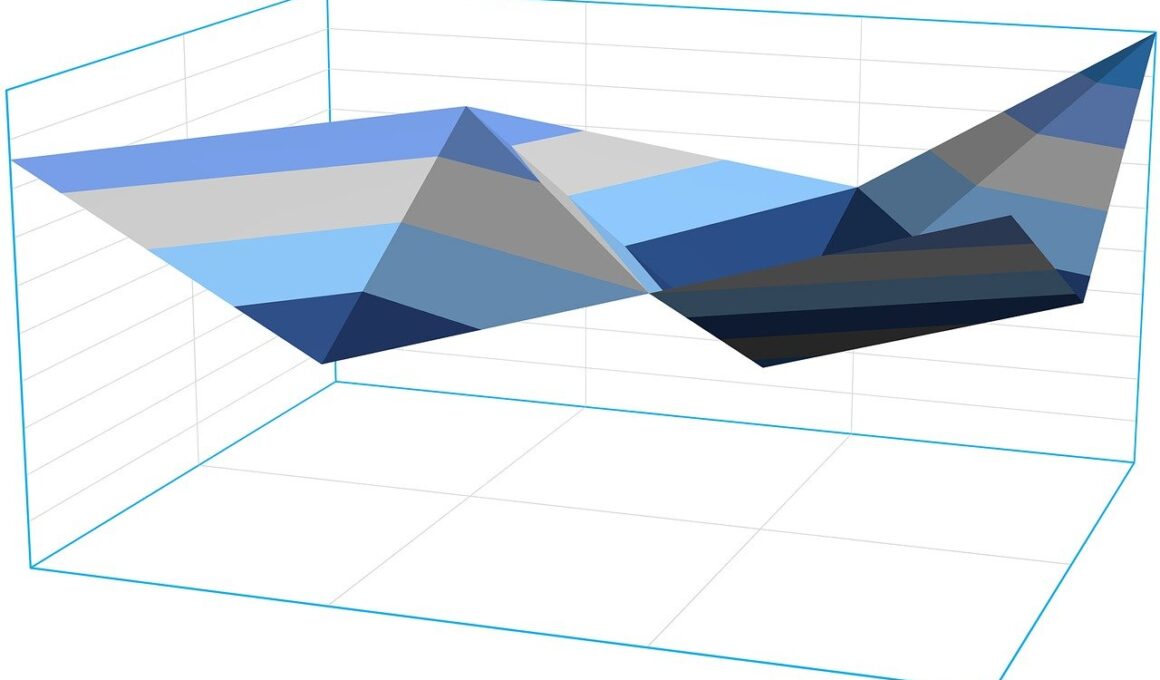

Moreover, sensitivity analysis supports better communication among stakeholders by articulating potential scenarios. Through various modeling techniques, organizations can visualize how shifts in key components, such as cost of goods sold or operating expenses, influence profitability. This visualization can take many forms, including graphical representations like tornado diagrams or spider charts, which simplify complex data for diverse audiences. Engaging stakeholders with these visual tools enhances their understanding of the implications of financial forecasts. It allows for proactive discussions regarding contingency plans in response to potential adverse shifts in the business environment. Furthermore, sensitivity analysis can improve budgeting and forecasting accuracy. By systematically evaluating the effects of different variable adjustments, organizations can generate more reliable financial projections. This reliability builds trust among investors, employees, and other stakeholders. To remain competitive, firms need to utilize these analytical techniques effectively. By highlighting areas vulnerable to changes, businesses forfeit less unknown risk, which often leads to more strategic alignment in their operations overall. Thus, integrating sensitivity analysis within the financial forecasting process emphasizes its multifaceted relevance in today’s volatile market.

Key Benefits of Sensitivity Analysis

One of the main benefits of sensitivity analysis in financial forecasting is enhanced decision-making. Businesses can prioritize initiatives based on the anticipated response to varying external factors. Identifying which variables possess the most significant impact enables management to allocate resources effectively. For instance, if a forecast reveals that a small change in labor rates dramatically affects profitability, companies can focus on negotiating better rates or improving operational efficiency. This focus leads to better resource management, directly impacting the bottom line. Additionally, sensitivity analysis aids in stress testing financial models. Companies can understand how financial forecasts hold up under adverse scenarios, such as economic downturns or unexpected expenses. This testing ensures that firms are prepared for potential adverse conditions, allowing quick adaptations to changes. Being proactive reduces the likelihood of severe financial disruptions. Moreover, sensitivity analysis promotes adaptability within the organization. Understanding which financial elements are more volatile allows for quicker adjustments. This adaptability is crucial in sectors where market conditions change rapidly. Firms that integrate these analyses into their forecasting models build resilience against uncertainties and secure a competitive advantage.

When implementing sensitivity analysis, companies often utilize software tools that facilitate the modeling process. Many advanced financial modeling programs incorporate sensitivity analysis features, allowing for ease in setting variable scenarios. As businesses collect data, they can create models that simulate different financial outcomes based on variable adjustments. This automation not only saves time but enhances accuracy in forecasts, providing more precise insights. Working with such tools enables finance teams to execute comprehensive analyses effortlessly. Furthermore, the increasing complexity of financial markets necessitates structured methodologies, such as sensitivity analysis. Stakeholders require precise forecasting to make informed decisions. By leveraging technology in these analyses, firms can adapt to the sophisticated demands of the market. In essence, utilizing advanced modeling tools streamlines information processing, allowing for real-time adjustments to financial strategies. As financial conditions evolve rapidly, a robust toolkit becomes invaluable. Businesses equipped with these sophisticated tools are better positioned to react promptly and strategically to changing market trends. Ultimately, using technology in sensitivity analysis fosters an environment of continuous improvement, encouraging firms to refine their forecasting approaches consistently.

Challenges in Sensitivity Analysis

Nonetheless, firms must recognize challenges associated with conducting sensitivity analysis effectively. One common issue is accessing high-quality data. Accurate forecasting relies on reliable data sources, and any inaccuracies can skew results. Inaccurate data entry or outdated information can lead to misleading conclusions about financial stability and performance potential. Additionally, determining the right variables to test can be complex. Analysts must carefully select which variables significantly impact forecasts while ensuring that the analysis remains manageable. In this regard, setting boundaries within the analysis helps avoid unnecessary complication, which could confuse stakeholders. Also, sensitivity analysis typically focuses on isolated variables, but real-world influences often occur simultaneously. Thus, failing to account for interdependencies can limit insights gained from the analyses. Moreover, over-reliance on sensitivity analysis may occur, causing firms to neglect qualitative aspects influencing financial performance. These factors may include customer behavior or market trends, which are harder to quantify yet equally impactful. Thus, it is critical for businesses to balance quantitative analysis with qualitative assessments for comprehensive decision-making.

To overcome these challenges, organizations can promote a culture of collaboration between departments. Effective financial forecasting requires input from multiple functions, such as marketing, sales, and operations. By facilitating cross-departmental efforts, businesses can ensure that their sensitivity analysis is well-informed and accurate. Regular meetings can be instituted focusing on aligning insights gathered from different teams to enhance overall analysis quality. Alongside this effort, investing in data management infrastructure becomes vital for accuracy. Organizations can implement strategies to improve data collection practices utilizing tools like customer relationship management (CRM) software and enterprise resource planning (ERP) systems. Integrating these systems streamlines data flow, helping create consistent and reliable datasets for analysis. Moreover, validating assumptions used during sensitivity analysis enhances reliability. Periodically reviewing assumptions with real-world outcomes allow analysts to refine future forecasts. Nonetheless, adopting a holistic approach enables businesses to remain agile in financial forecasting. This agility keeps organizations ahead in the competitive landscape and empowers them to respond effectively to shifting market conditions. Ultimately, embracing these strategies strengthens the overall effectiveness of sensitivity analysis in financial forecasting.

Conclusion

In conclusion, the importance of sensitivity analysis in financial forecasting is manifold, serving as an essential tool for modern businesses. By accurately assessing the impact of variable changes, companies can make informed decisions, effectively manage risks, and enhance financial transparency. It fosters better communication among stakeholders, promoting understanding and trust. Additionally, sensitivity analysis aids organizations in budgeting accurately and adapting their strategies to meet market demands. Despite challenges such as data accessibility and selection of pertinent variables, proactive measures can mitigate these issues. Cultivating a collaborative culture and investing in data management technologies help ensure that sensitivity analysis remains impactful. Moreover, regularly refining assumptions based on real outcomes enhances forecasting accuracy, encouraging organizations to remain agile amid uncertainties. Consequently, businesses that embrace sensitivity analysis position themselves for long-term success in an unpredictable economic environment. As they navigate their forecasting processes, leveraging sensitivity analysis can empower companies by broadening their strategic horizons. Continuous improvement through insightful analysis ultimately drives profitability and ensures sustainability. Emphasizing the importance of this analytical method cements its role as a fundamental component of effective financial forecasting.