Best Practices for Transparent Consolidated Financial Reporting

In the realm of financial accounting, consolidation is a crucial process that enables companies to amalgamate financial data from various subsidiaries into a single set of statements. This comprehensive procedure is imperative for providing stakeholders with accurate and meaningful insights into the overall financial health of an organization. It is essential to ensure transparency during this process. To achieve this, companies should adopt best practices that enhance trust and credibility in their financial reporting. A well-established internal control framework is fundamental. This will create an environment where financial information is collected and verified for accuracy. Furthermore, it allows for the implementation of strict policies regarding data handling, ensuring compliance with laws and regulations. Regular audits conducted by external parties can further add a layer of reliability and assess the performance of the consolidation process. Such diligent practices not only promote transparency but also enhance the reliability of consolidated financial statements. Establishing a culture of transparency within the organization is paramount, as it fosters accountability and a sense of responsibility in all individuals involved in the financial reporting process.

The Importance of Consistent Accounting Policies

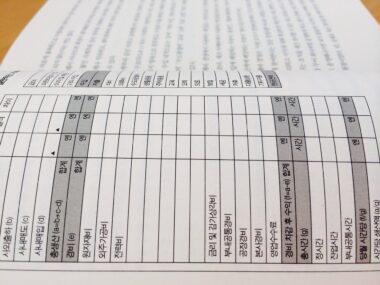

Consistency in accounting policies is pivotal in the consolidation of financial statements. Adopting uniform accounting policies across all subsidiaries streamlines the consolidation process and ensures comparability. Disparate accounting methods can lead to discrepancies during consolidation, making it challenging to provide a clear picture of the group’s financial status. Standardizing accounting policies helps to align the recognition of revenues, expenses, assets, and liabilities, thus ensuring accurate integration. This can be implemented by formulating a group-wide accounting policy manual that will guide all subsidiaries in adhering to the established methods. The manual should address critical areas such as revenue recognition, tax implications, and asset valuations. It is essential to provide training to finance personnel to familiarize them with these policies. Moreover, reviewing and updating these policies regularly is vital to adapt to changing regulations and accounting standards. Stakeholders gain confidence in the reported figures when they see transparency in how financial data is accumulated and reported. Thus, consistent accounting policies not only facilitate smooth consolidation but also contribute to greater trust in the financial documents presented to investors and regulatory bodies.

Another crucial aspect of transparent consolidated financial reporting is the significance of detailed disclosures. Companies must provide comprehensive explanations regarding their methodology for consolidation. Disclosures should clarify which subsidiaries are included in the consolidation and the reasons for excluding any entities. Important elements such as percentage of ownership, governance structures, and the nature of the relationship with subsidiaries should also be outlined. Stakeholders need insight into the consolidation approach being adopted, especially if the enterprise has acquired businesses that may result in goodwill or intangible asset considerations. Clear disclosures enable stakeholders to understand the nuances of the financial data presented, allowing them to make informed decisions. Moreover, sufficient detail surrounding segment reporting is recommended, particularly for organizations operating across multiple industries or geographical markets. This additional information ensures that stakeholders can assess the performance of various segments at a glance, gaining clarity on economic drivers. Thus, transparent disclosure practices serve to enhance the understandability and relevance of financial statements for all parties involved, ultimately leading to more informed assessments of an organization’s overall performance.

Utilizing advanced technologies can significantly improve the transparency of consolidated financial reporting. Many organizations are transitioning to cloud-based accounting systems that facilitate real-time data sharing among subsidiaries. These technologies can automate data collection, reporting, and consolidation processes, reducing the likelihood of manual errors. In addition, cloud-based solutions enhance collaboration among financial teams, allowing them to work together seamlessly, regardless of geographical barriers. Another advantage of leveraging technology is the ability to maintain an audit trail. This enables organizations to track changes in financial data over time, providing an additional layer of transparency and accountability. Integration of data analytics can further enhance reporting by allowing companies to analyze trends, forecasts, and variances in financial information effectively. Therefore, investing in modern financial systems is critical for organizations aiming to deliver transparent consolidated financial reports. As technology continues to evolve, organizations must remain agile and adopt innovative tools that enhance their financial reporting capabilities. Embracing technology ensures that financial reporting is not only accurate but also transparent and relevant in today’s fast-paced business environment.

Regular internal reviews and audits cannot be understated in the realm of transparency in consolidated financial reporting. These reviews serve to evaluate the effectiveness of the consolidation process and identify areas needing improvement. Organizations should conduct periodic evaluations of both financial reporting processes and supporting internal controls to ensure they align with the best practices and regulatory requirements. Engaging independent auditors to review consolidated financial statements can provide additional assurance to stakeholders about the integrity of the financial information presented. This external validation is crucial for maintaining credibility, especially for publicly traded companies that are accountable to shareholders. Internal audit teams can conduct random checks and thorough reviews of data collection processes to uncover potential discrepancies. This ongoing scrutiny creates a proactive culture that places a high value on accuracy and transparency. By establishing a feedback loop, companies can continually refine their reporting practices. This iterative process ensures that financial reporting remains reliable, and stakeholders can trust the presented financial information. Ultimately, regular audits foster confidence and security in corporate financial reporting.

Effective communication with stakeholders regarding consolidated financial statements is another essential practice that enhances transparency. Companies should proactively engage with investors, analysts, and regulatory bodies to clarify their reporting objectives, updating them on the key aspects of financial performance. Regular earnings calls and informative presentations help bridge the knowledge gap, allowing stakeholders to seek insight into the figures reported. Elaborating on the implications of financial data in the context of overall corporate strategy can also prove beneficial. Investors highly appreciate transparency regarding cash flows, management projections, and future outlooks, enabling them to make informed decisions based on the consolidated reports presented. Furthermore, engaging with stakeholders also means addressing their questions and concerns openly. This two-way communication reinforces trust and strengthens relationships between the organization and its stakeholders. Teams responsible for investor relations should develop comprehensive FAQ guides to assist shareholders in deciphering complex financial statements. Hence, effective communication not only makes financial reports easier to interpret but also cements the organization’s commitment to transparency and openness.

Lastly, successful consolidated financial reporting requires a commitment to ongoing education and training for all involved personnel. It is essential that teams responsible for financial reporting are well-versed in both accounting principles and relevant regulations. Regular training sessions can cultivate knowledge of best practices, factoring in updates to accounting standards and legislative changes. Educational programs should encompass specialized topics such as international financial reporting standards and regulatory compliance requirements. Additionally, encouraging professional development opportunities fosters a culture of continuous improvement among finance teams. This not only leads to higher quality financial reporting but also strengthens the team’s ability to identify and mitigate risks associated with the consolidation process. In turn, this commitment to staff education can enhance the accuracy, relevance, and transparency of financial information presented to stakeholders. Organizations that prioritize training tend to benefit from improved employee performance and retention in finance roles. This holistic approach creates a capable workforce proficient in financial consolidation and aligned with the organization’s values, ensuring the delivery of transparent and reliable consolidated financial statements.

In conclusion, achieving transparent consolidated financial reporting is both an art and a science, requiring a combination of best practices, technology, and stakeholder engagement. By embracing consistency in accounting policies, enhancing disclosures, and fostering effective communication within the organization and with external stakeholders, companies can significantly raise the quality of their financial reporting. Moreover, leveraging technology, conducting regular audits, and committing to ongoing training further bolster transparency. These practices not only secure stakeholder confidence but also establish a foundation for informed decision-making in a dynamic business environment. Companies should continuously assess and align their financial strategies with evolving industry standards and regulations to enhance their reporting mechanisms. In this manner, organizations can ensure the delivery of reliable consolidated financial statements reflecting their operational realities accurately. Transparent reporting also reinforces accountability, strengthens corporate governance, and promotes trust among stakeholders. Ultimately, as consolidated financial reporting becomes increasingly complex, companies that prioritize these best practices set themselves up for long-term success. They will be well-positioned to adapt and thrive in a landscape that demands clarity, precision, and transparency in financial reporting processes.