Liabilities Explained: What You Need to Know

Liabilities play a crucial role in the financial health of any business. These obligations arise from past transactions or events and involve the future transfer of economic benefits. In accounting, liabilities are categorized under two main types: current and non-current liabilities. Current liabilities are due within a year, while non-current liabilities are payable after one year. Examples of current liabilities include accounts payable and short-term loans, whereas long-term debts, mortgages, and bonds are considered non-current liabilities. Each of these obligations must be reported on the balance sheet, showcasing the company’s financial commitments. Understanding both types of liabilities enables stakeholders to assess the company’s liquidity and financial stability. Moreover, analyzing these liabilities helps in making informed investment decisions. Investors, creditors, and management need to keep a close eye on these obligations. Proper management of liabilities can lead to improved cash flow and financial muscle for the organization. Thus, knowing how to account for and report liabilities effectively is essential for business sustainability and growth. This comprehensive exploration of liabilities will guide readers through various aspects necessary for understanding financial statements.

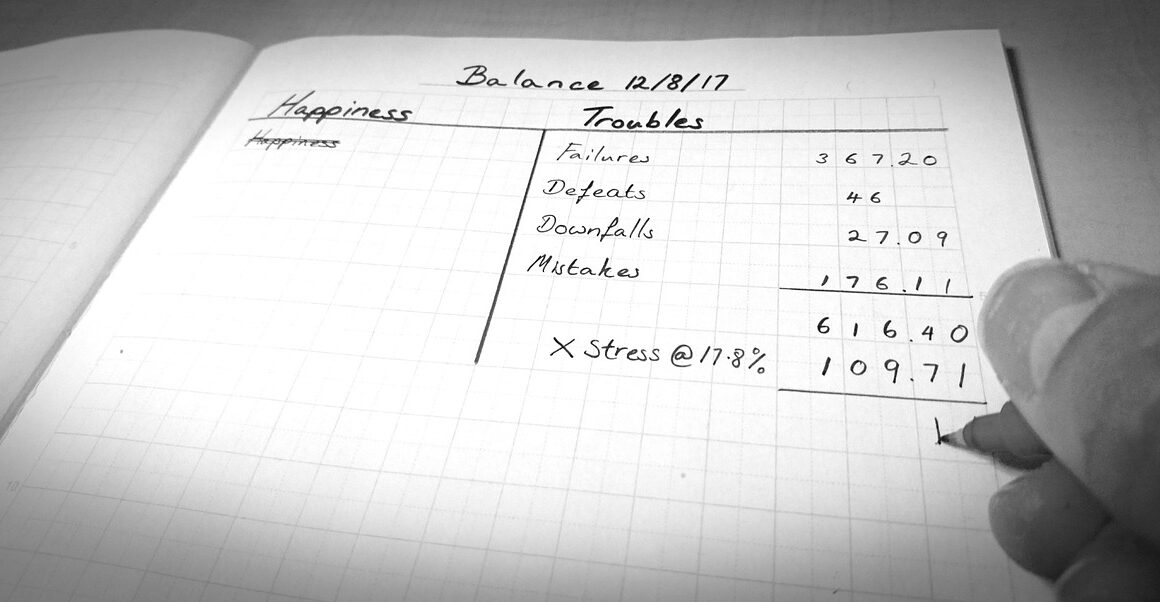

The balance sheet is an essential financial statement that depicts a company’s financial position at a specific point in time. It consists of three primary sections: assets, liabilities, and equity. Assets represent resources owned by the company, while liabilities show what the company owes, and equity reflects the owners’ residual interest in assets after deducting liabilities. In a typical balance sheet, liabilities are listed after assets but before equity. This order emphasizes the financial obligations a company must meet. Investors often analyze liabilities’ composition to evaluate risk. A heavy reliance on debt can indicate potential solvency issues, which is why it’s imperative to analyze both current and non-current liabilities. The relationship between total liabilities and total assets is known as the debt ratio, a significant measure for assessing financial leverage. A high debt ratio may suggest increased risk as the company might face difficulties in meeting its obligations. Conversely, lower liability levels indicate financial stability and strength, allowing Businesses to capitalize on opportunities without over-leveraging their finances.

Importance of Current Liabilities

Current liabilities are vital for assessing a company’s short-term financial health. They must be settled within a year using current assets or operational cash flow. Managing current liabilities effectively ensures operational continuity and prevents liquidity crises. Common examples include accounts payable, where the company owes money to suppliers for goods or services received. Other common current liabilities include accrued expenses, short-term loans, and other financial obligations. These elements not only impact daily operations but also play a critical role in maintaining good supplier relationships. When companies consistently pay their current liabilities on time, they build trust and credibility within their industry. This credibility is crucial for negotiating favorable purchase terms with suppliers. Another vital aspect is the current ratio, which compares current assets to current liabilities. A ratio below one indicates potential liquidity issues. Conversely, a high current ratio indicates strong liquidity, giving confidence to creditors and investors alike. Understanding current liabilities’ dynamics can empower businesses to manage debts effectively, leading to positive cash flow and overall financial health.

The categorization of non-current liabilities is essential for a complete understanding of a company’s debt obligations and long-term sustainability. Non-current liabilities often include items such as long-term loans, deferred tax liabilities, and bonds payable. These debts usually have maturity dates extending beyond a year, providing businesses a longer timeframe to meet their obligations. Investors closely analyze non-current liabilities to forecast future cash flows and overall financial strategy. An organization with a substantial amount of non-current liabilities might signal to investors a reliance on long-term debt for funding operations or expansion. Furthermore, managing these liabilities effectively can facilitate long-term investments and projects that generate revenue over time. Understanding the interest obligations associated with these debts is critical; it has implications for cash flow management and profitability. Additionally, it’s essential to assess the terms of these liabilities, as some may have restrictive covenants limiting operational flexibility. For businesses aiming for growth, maintaining a balanced ratio of non-current liabilities to equity is vital to ensure long-term financial stability and lower investment risk.

Debt-to-Equity Ratio Analysis

The debt-to-equity ratio is a financial metric that compares a company’s total liabilities to its shareholder equity, revealing the relative proportion of debt used to finance the company’s assets. A higher debt-to-equity ratio may indicate higher financial risk, as it shows a larger reliance on borrowed funds. Conversely, a lower ratio suggests a more conservative approach, with greater reliance on equity financing. Stakeholders often analyze this ratio to assess the risk associated with a company’s capital structure. Companies in capital-intensive industries may typically have higher ratios due to heavy reliance on debt for growth. For example, energy or utilities firms often showcase elevated debt levels as they require significant upfront financing for their projects. Monitoring the debt-to-equity ratio over time can provide insights into a company’s financial health and risk trends. Companies should aim for a balanced ratio that reflects their operational strategy while also attracting potential investors. Over-leverage can impede financial flexibility, while a prudent approach can promote sustainable growth and risk mitigation. Thus, this metric is paramount in the financial decision-making process.

Understanding how liabilities impact overall financial performance is essential for stakeholders. Financial reporting standards require companies to disclose liabilities clearly, allowing investors to analyze their implications. Operating in compliance with these standards provides transparency and instills investor confidence. One of the major advantages of well-managed liabilities is the ability to leverage financing options for growth. In many instances, companies can use favorable debt terms to fuel expansion or new projects. However, firms must also implement robust risk management strategies related to their liabilities. Failure to do so can lead to cash flow issues, hampering operational effectiveness and overall business sustainability. Every organization should perform regular reviews of their liabilities and ensure that they correspond with cash flow projections. This comprehensive understanding will prepare businesses for potential market shifts or unforeseen economic downturns. Debt that isn’t well-monitored can quickly spiral out of control. Therefore, ensuring regular assessments and financial health checks of liabilities can guide timely decision-making processes. Ultimately, this assessment will help companies to cultivate not just financial clarity but sustained growth.

Conclusion and Best Practices

In conclusion, understanding liabilities is paramount for maintaining a healthy financial footing within any organization. Businesses must understand the nuances between current and non-current liabilities, including their implications on cash flow and risk management. Adopting best practices in managing these debts, such as timely payments and regular financial assessments, plays a crucial role in overall financial success. Organizations should establish clear financial guidelines to monitor liability ratios and ensure compliance with reporting standards. Engaging in proactive risk management strategies regarding liabilities not only enhances trust among stakeholders but also improves operational efficiency. Furthermore, continually educating finance teams about liabilities’ implications can promote sound financial decision-making. Investors should prioritize companies demonstrating effective asset-liability management. This understanding can influence investment choices and help drive stakeholders toward responsible financial practices. Ultimately, liability management should be viewed as a vital component of comprehensive financial strategy. By implementing sound financial policies and practices regarding liabilities, companies can create a solid foundation for future growth while ensuring long-term business sustainability.

In addition, creating an environment of financial literacy within the organization can empower employees to make informed decisions regarding liabilities. Training programs focused on financial management should be encouraged at every level. Additionally, companies could consider using financial software that helps effectively track and manage liabilities, ensuring accuracy and real-time data availability. Regular company-wide meetings regarding financial status can foster open communication and lay the groundwork for better financial planning. Overall, an informed workforce enhances accountability and stewardship over the organization’s financial obligations. By investing in education and technology, organizations can build a culture of financial responsibility amongst employees. This, in turn, benefits not only the organization but also its stakeholders. Financial transparency and diligent liabilities management can ultimately lead to improved performance and enhance company value in the long run. Individuals and teams who are well-informed about liabilities can better identify potential issues and proactively work towards solutions. This collective awareness reinforces the importance of healthy financial practices. Thus, a comprehensive approach to financial literacy and liability management benefits everyone within the organization, ensuring overall long-term success.