Bookkeeping Best Practices for Startups

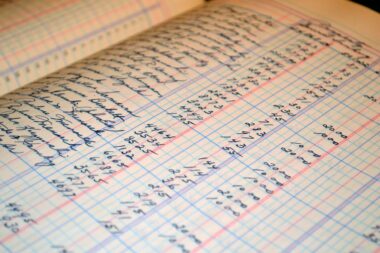

Starting a new business is both exciting and daunting, especially in terms of financial management. Bookkeeping is crucial for the success of any startup. It helps track income, expenses, and is vital for making informed business decisions. First, entrepreneurs should consider using accounting software that fits their needs. Software options can automate many bookkeeping tasks, such as invoice generation and expense tracking. Additionally, it’s essential to keep personal and business finances separate. This practice can simplify tax preparation and budgeting, minimizing confusion or errors. Furthermore, startups should set a regular bookkeeping schedule. Whether it’s weekly or monthly, consistent reviews allow business owners to stay on top of their financial health. Budgeting plays a pivotal role in managing a startup’s finances. Entrepreneurs should create monthly budgets that anticipate expenses and revenue. Tracking cash flow is just as important; maintaining sufficient cash reserves could prevent potential hiccups in operations. Networking with accounting professionals may also provide valuable insights during the startup phase and beyond, ensuring that the business is on solid financial ground as it grows.

Due diligence is another bookkeeping best practice every startup should follow. This process involves regularly reconciling bank statements with internal records. By ensuring that transactions match accurately, entrepreneurs can detect mistakes or fraudulent activities early, safeguarding their business’s financial integrity. Implementing internal controls also enhances accuracy and reduces the risk of errors. Startups should develop robust protocols for record-keeping, including how receipts are stored or who has access to financial documents. Training employees on these standards can foster a culture of accountability and meticulous attention to detail throughout the company. Moreover, a clear understanding of financial reporting is vital for startups. Business owners should familiarize themselves with essential financial statements, such as the balance sheet, income statement, and cash flow statement. These documents provide insights into profitability, financial position, and cash management, guiding strategic decision-making. If startups plan to seek funding or investment, having accurate and timely financial reports is essential. Investors often scrutinize financial records before deciding to support a business. Thus, consistent bookkeeping establishes credibility and professionalism when engaging with potential stakeholders in the business landscape.

The Importance of Accurate Record Keeping

Accurate record-keeping is fundamental for startups, especially as businesses grow and evolve. Financial records serve as a historical account of transactions, illustrating growth trends or areas needing improvement. Thorough record-keeping supports compliance with tax regulations, as it allows for accurate reporting of income and expenses. Failing to maintain proper records can lead to costly penalties or audits, which may jeopardize a company’s viability. Startups should maintain an organized filing system, whether digital or physical, to quickly reference and retrieve documents when needed. Consistent documentation practices also aid in evaluating the company’s financial performance over time. Regular reviews enable business owners to identify patterns, streamline operations, and make informed financial decisions. In the digital age, utilizing cloud storage solutions can enhance security and accessibility. These systems allow for convenient data retrieval, enabling teams to collaborate effectively without compromising security. Implementing robust backup measures ensures that critical financial data is secure, further protecting the company’s interests. Overall, the discipline of maintaining accurate records lays a foundation for long-term business success, providing insights necessary for strategic planning and operational adjustments.

When it comes to bookkeeping, cultivating a consistent routine is essential for any startup. Entrepreneurs should dedicate specific times each week to review financial transactions and update records. Relying on a scheduled routine minimizes the risk of backlog and errors, vastly improving overall accuracy. Utilizing technology simplifies this process; online accounting software allows startup owners to automate many repetitive tasks. For instance, software can generate invoices automatically, send reminders for overdue payments, and even categorize expenses with minimal manual input. This automated approach not only saves time but also minimizes human error, leading to more reliable financial data. Furthermore, startups should engage with financial advisors or accountants on a regular basis. An external perspective can highlight areas for potential improvement or suggest strategies for cost savings. They can also provide insights into tax deductions or credits that startups may overlook. Consulting with a professional fosters a better understanding of financial principles that can benefit business growth. Overall, establishing routines and leveraging technology ensures that bookkeeping remains a manageable, efficient, and productive undertaking for startup businesses over time.

Incorporating Financial Forecasting

Financial forecasting is an essential aspect of effective bookkeeping for startups. By projecting future income, expenses, and cash flow, business owners can make better decisions and prepare for potential challenges. Forecasting enables startups to set realistic goals based on expected performance and align their resources accordingly, ensuring that they can respond proactively to market changes. Utilizing historical financial data allows for more accurate predictions; understanding past trends can inform future strategies. Startups should consider using iterative forecast models. These models can adapt as new data becomes available, providing ongoing insight into financial health. Additionally, startups exploring funding must present credible forecasts to attract investors. Lenders and investors seek to understand the potential return on their investment, which requires well-prepared financial projections. Their confidence hinges on the company’s ability to explain how funds will be utilized effectively. Maintaining transparency in forecasting also prepares startups for stakeholder communications. Preparing for both favorable and unfavorable scenarios enables teams to craft strategic responses, ensuring resilience amidst uncertainties. Thus, effective forecasting not only guides internal decisions but also builds trust externally with stakeholders who are essential for business growth.

From cash flow management to funding acquisition, tracking financial metrics is paramount for every startup. Founders should identify key performance indicators (KPIs) relevant to their business context. These KPIs should align with overall business goals, enhancing the opportunity for targeted growth. Revenue growth rate, gross margin, and customer acquisition cost are common metrics that can provide insights into operational efficiency and profitability. Additionally, monitoring expense ratios helps identify areas where cost reductions can enhance margins and improve cash flow. By regularly reviewing these metrics, entrepreneurs can pivot or adjust strategies as necessary, ensuring continuous alignment with objectives. Implementing dashboards can enhance this process, providing real-time views into the startup’s financial health. These visualizations enable teams to quickly grasp important information and surface any red flags that require prompt attention. Financial literacy is equally important; empowering team members with a solid understanding of these metrics fosters a collaborative culture aimed at achieving the business’s financial goals. Overall, establishing a framework for performance measurement ensures that startups remain agile, competitive, and prepared for future growth challenges within their respective markets.

Conclusion

In conclusion, establishing effective bookkeeping practices is crucial for the success of startups. From accurate record-keeping to financial forecasting, each element contributes to a strong financial foundation. By investing time and resources into these practices, entrepreneurs can make informed decisions, paving the way for sustained growth and stability. Utilizing modern accounting technology can streamline processes while maintaining accuracy, thereby freeing up valuable time for startup owners to focus on their core business functions. Furthermore, engaging with financial professionals provides insights that can enhance strategic planning, ultimately reducing financial risk. As startups navigate their journey, the importance of strong bookkeeping cannot be underestimated. It serves as the compass that helps guide businesses through turbulent waters and towards their broader goals. By incorporating these best practices, startups increase their chances of longevity and success in a competitive landscape. Building a culture of financial awareness among team members ensures alignment towards collective goals, reinforcing accountability and shared responsibility. In the fast-paced world of startups, staying proactive in financial management can distinguish thriving businesses from those that struggle. Adopting these best practices is an investment in the future and should be prioritized by every emerging business as they grow.

The journey of every startup is unique, filled with challenges and opportunities. In this dynamic environment, the significance of sound bookkeeping practices cannot be overstated. As entrepreneurs strive to innovate and grow, having a solid financial management framework enables them to navigate uncertainties and seize opportunities effectively. By remaining vigilant, adaptive, and informed, startups can build not only a successful business model but also a lasting legacy that impacts their respective industries positively. Investing thoughtfully in establishing robust bookkeeping processes today will undoubtedly pay dividends in various forms as businesses mature and expand.