Benchmarking Corporate Financial Performance Using Analytics

In today’s corporate finance landscape, utilizing analytical insights becomes essential for assessing financial performance benchmarks. Companies continually seek methods to enhance efficiency and profitability, aligning analytical strategies with financial performance metrics. By analyzing historical data, organizations can establish performance benchmarks and identify areas for improvement. The use of advanced analytics tools enables finance professionals to generate actionable insights from vast datasets. Furthermore, these insights empower organizations to make informed financial decisions based on real-time data. Additionally, organizations can utilize comparative analyses to position themselves against industry competitors. Through effective benchmarking, corporations can establish a baseline for evaluating operational efficiency. Financial analytics play a crucial role in identifying cost-saving opportunities and enhancing revenue generation strategies. It is essential for finance teams to adopt a data-driven culture to thrive in evolving markets. By integrating predictive analytics, organizations can forecast future performance improving strategic planning and resource allocation. Financial metrics should evolve with market trends to remain relevant. Embracing financial analytics allows businesses to utilize data as a tool for strategic advantage while also fostering transparency and accountability within the organization.

This approach aids in uncovering critical patterns in corporate performance. By emphasizing variance analysis, firms can gain valuable insights regarding deviations from expected financial performance. This becomes crucial for decision-making, enabling organizations to proactively address potential challenges. The implementation of analytics allows finance teams to focus on data-driven insights rather than subjective assessments. As a result, it reinforces the significance of evidence-based practices in corporate finance. Through the lens of financial analytics, companies can develop key performance indicators (KPIs), which serve as vital metrics for success. These KPIs facilitate performance assessments, guiding strategic objectives. Furthermore, the influence of insights garnered from analytics extends beyond financial outcomes, optimizing operational processes, resource management, and stakeholder communication. Collaborative efforts amongst various departments can additionally benefit from these analytics. Data transparency fosters enhanced communication among teams while also promoting alignment on financial objectives. Companies can integrate analytics with cloud-based tools to afford real-time monitoring capabilities. Overall, the synergy between analytics and corporate finance enables a robust framework for achieving sustainable financial health.

Role of Predictive Analytics

Predictive analytics is a transformative force within corporate finance, allowing organizations to forecast future financial outcomes based on historical data trends. It empowers finance professionals to anticipate market changes, enhancing agility and resilience. By employing statistical algorithms and machine learning, companies can identify patterns that help predict revenue streams and assess risk factors. This forward-thinking approach enables proactive strategic planning. For instance, organizations can adjust budgets according to forecasted sales trends or evaluate the impact of market variables on their financial standing. Moreover, employing predictive models allows firms to refine cash flow management processes. Understanding potential future scenarios leads to informed decision-making, minimizing potential financial pitfalls. Additionally, predictive analytics aids in customer segmentation, optimizing pricing strategies by understanding consumer behavior. As a result, finance teams can tailor their offerings to meet market demands effectively. Implementing such analytics can pose challenges, including data integrity and resource allocation. However, appropriate investments in training and technology can yield substantial long-term benefits. In summary, predictive analytics not only informs better financial decisions but also enhances overall organizational performance through data-driven insights and forecasting techniques.

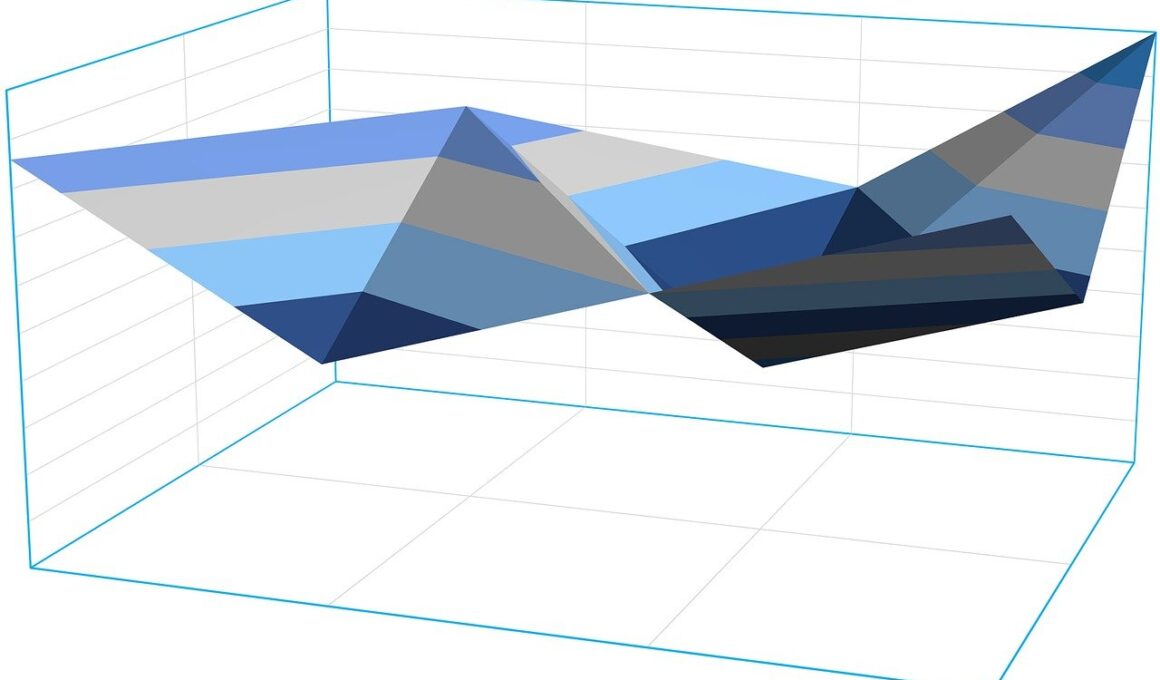

Another significant advantage of financial analytics is the ability to conduct scenario analysis. Scenario analysis assesses multiple potential future situations based on different variables, allowing companies to prepare responses to various market conditions. By undertaking scenario analyses, organizations can mitigate risks associated with financial uncertainties. This process is particularly beneficial in highly volatile economic environments. Finance teams can explore best-case, worst-case, and most likely scenarios, equipping leadership teams with insights necessary for contingency planning. An effectively executed scenario analysis leverages historical data to project outcomes while considering external factors such as market competition and regulatory changes. Enthusiastic adoption of scenario-based planning cultivates a proactive culture within an organization, ultimately enhancing agility in operations. Furthermore, these analytics foster collaboration across departments, ensuring all teams understand and contribute to strategic objectives. As organizations embrace advanced forecasting techniques, they can better align resources with strategic financial goals. This alignment leads to optimized financial operations and improved decision-making processes throughout the organization. Consequently, scenario analysis integrates seamlessly into a comprehensive benchmarking strategy, ultimately driving sustainable growth and profitability.

Benchmarking and Performance Metrics

Benchmarking remains central to cross-company financial performance comparisons, allowing businesses to assess their standing against industry peers. Through rigorous analysis of competitors’ financial metrics, organizations can identify best practices applicable to their operations. This practice provides valuable insights into industry standards regarding efficiency and profitability. With the right data analytics tools, organizations can segment their financial data effectively, measuring performance across distinct areas such as assets, liabilities, and shareholder equity. Additionally, adopting industry-specific metrics ensures simulations align closely with relevant benchmarks, leading to clarity in financial performance assessments. Companies that conduct benchmarking are better positioned to respond strategically to performance gaps. By identifying best practices observed amongst top performers, organizations can implement targeted strategies for improvement. Moreover, benchmarking encourages a continuous improvement mindset within corporate finance teams. It fosters a culture of accountability, driving teams to strive for enhancement of financial outcomes continually. Regular benchmarking exercises ensure that organizations stay attuned to industry trends. By leveraging insights gained from benchmarking efforts, businesses can fortify their market positions and drive sustainable growth. In doing so, they not only enhance their competitiveness but also bolster long-term financial stability.

Integrating advanced technology within financial analytics processes enhances overall efficiency and accuracy. The adoption of technologies such as artificial intelligence (AI) and cloud computing can revolutionize corporate finance practices. AI applications enable deep data analysis, discovering complex patterns that traditional methods might miss. As finance professionals leverage AI algorithms, they increase productivity while minimizing errors associated with manual data handling. Cloud computing enhances the accessibility of financial data, allowing stakeholders to collaborate effectively regardless of geographical constraints. Organizations can harness real-time analytics to track performance, enabling rapid adjustments to financial strategies based on evolving market conditions. Additionally, automation of repetitive tasks frees up valuable resources, allowing finance teams to focus on strategic analysis rather than time-consuming data entry or validation. Choosing the right technology partners becomes paramount for successful integration of these advanced capabilities. An organization’s commitment to continuous innovation in financial analytics positions it to remain competitive. As financial landscapes evolve swiftly, companies that prioritize technology adoption can gain a robust advantage in resource allocation and strategic planning. Ultimately, technology integration yields not only efficiency but also empowers teams to achieve more insightful and impactful financial analytics.

Conclusion and Future Outlook

The future of corporate finance will undoubtedly see enhanced reliance on analytics driven by the data revolution. As organizations increasingly adopt data-centric approaches, analytics will become integral to financial planning and performance evaluation. Furthermore, the convergence of financial analytics with advanced technologies such as machine learning and big data analytics will redefine corporate finance processes. Organizations must prioritize investment in analytical minds, equipping staff with the necessary skills to interpret complex data effectively. A strong foundation in analytics will not only drive better financial outcomes but also ensure agility in navigating shifts within the market landscape. Moreover, fostering a culture that embraces analytics will be crucial for organizations seeking to maintain competitiveness. Encouraging collaboration among teams will amplify the effectiveness of financial analytics in achieving unified goals. Companies must remain proactive in adapting to technological advancements in the analytics sphere. Embracing innovations will lead to new approaches in benchmarking, predictive modeling, and performance assessments, driving long-term growth. Thus, organizations that view financial analytics as an essential strategy will position themselves to thrive amidst future challenges, seize opportunities, and enhance overall corporate success.

In conclusion, the effective use of financial analytics offers a pathway towards heightened corporate performance and resilience. Through benchmarking and data-driven decision-making, organizations can precisely measure their financial health, identify areas for improvement, and enhance their competitive edge. Moreover, the integration of predictive analytics and technology will play a significant role in shaping the future of corporate finance. The continued focus on analytics ensures businesses can navigate complexities within ecosystems and remain relevant in a rapidly changing environment. With the right tools and strategies, organizations can cultivate an adaptive culture that prioritizes informed decision-making and strategic growth. Companies aspiring to leverage financial analytics must commit to ongoing education, continuously evaluating their methodologies, processes, and tools against industry benchmarks. Fostering a collaborative environment is paramount to achieving greater insights from financial data. Moving forward, it becomes essential for finance professionals to embrace innovation, ensuring robust frameworks are in place for data collection and analysis. This will enhance their ability to respond to emerging trends and market dynamics swiftly. Ultimately, the strategic application of financial analytics will be pivotal in determining organizational success, driving long-term viability and profitable growth.