Aligning Financial Forecasting with Business Growth Objectives

In a rapidly evolving business landscape, financial forecasting stands as a critical tool. It enables organizations to predict future performance, facilitating informed decision-making and strategic alignment with growth objectives. Implementing effective financial forecasting helps businesses navigate uncertainties, allocate resources efficiently, and capitalize on emerging opportunities. By closely linking forecasting processes to growth strategies, companies can ensure they are not just reactive but proactive in their planning. This alignment helps drive sustained growth and profitability, while managing risks effectively. For optimal results, organizations should adopt dynamic forecasting models that adjust to market changes. Such adaptability enhances accuracy, reinforcing the confidence stakeholders place in management’s abilities. Companies are empowered to make adjustments swiftly based on real-time data analytics and market trends. Furthermore, leveraging advanced technologies for data collection can increase the forecasting process’s precision. Utilizing AI machine learning raises the quality of predictive insights. Establishing a cross-departmental approach ensures that all relevant perspectives inform the forecasting effects. Engaging teams from finance, sales, and operational departments fosters collaboration, enhancing the quality of insights obtained. This multifaceted approach solidifies the validity of forecasts and drives overall business success.

The importance of accuracy in financial forecasting cannot be underestimated. Key performance indicators (KPIs) serve as benchmarks that gauge how well a business aligns with its growth objectives. An accurate forecast provides clarity regarding revenue streams, expenditures, and cash flow, enabling informed operational decisions. Without precise forecasting, organizations risk inefficiencies that can lead to missed opportunities and diminished market competitiveness. Regular reviews and adjustments to forecasts based on performance data and market trends are essential. This iterative process allows for real-time adjustments, enhancing adaptability to unforeseen changes in the market landscape. It is also crucial to consult historical data when developing forecasts, as past performance maps a route toward anticipated outcomes. Embedding a robust forecasting culture within organizational practices also contributes to long-term sustainability. Stakeholders, such as investors and partners, often rely on financial forecasts for trusting future developments. Therefore, ensuring accuracy transforms forecasting into a strategic asset, fostering investor confidence. Channeling resources towards improving forecasting capabilities can yield significant returns in operational effectiveness. Adopting a discipline of consistent forecasting reviews can provide organizations with a competitive edge, as they skillfully navigate uncertainties and maximize growth potential.

Integrating Technology in Financial Forecasting

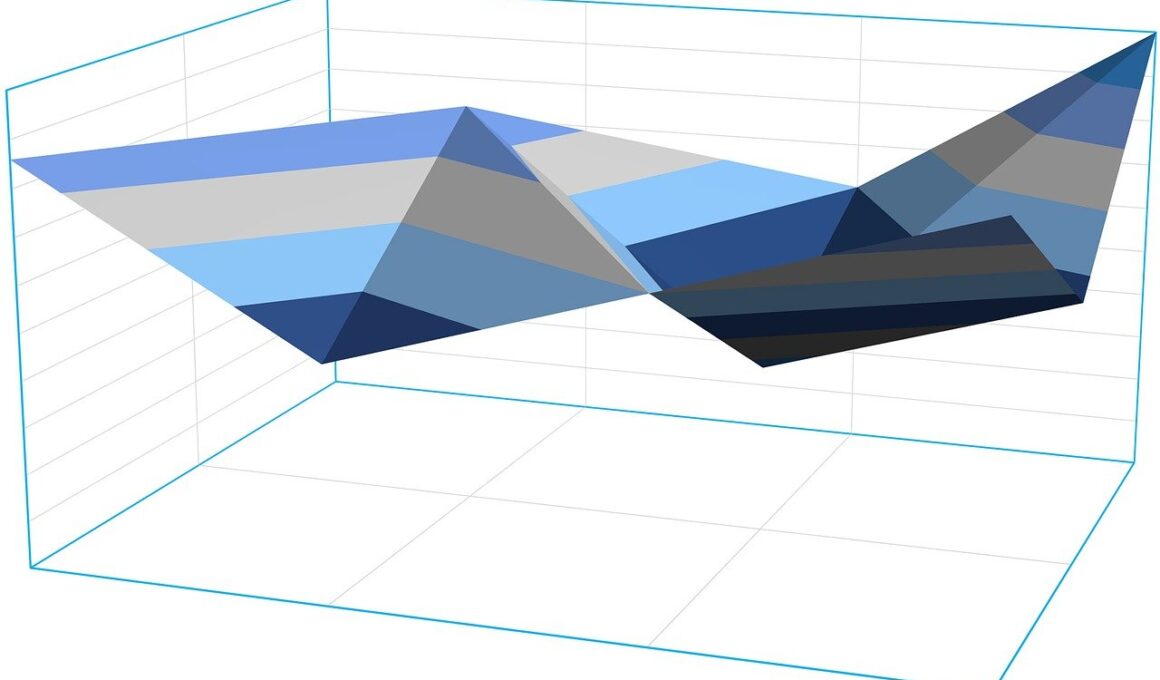

Integrating technology into financial forecasting has transformed traditional practices, significantly improving accuracy and efficiency. Advanced forecasting software powered by machine learning algorithms can analyze vast datasets, identifying patterns and trends that might escape manual analysis. This technological integration allows for rapid processing of information, facilitating timely insights that support strategic planning. Companies can create highly sophisticated models, adapting to fluctuations in the market and aligning with organizational objectives. Additionally, utilizing cloud-based platforms ensures data accessibility across various departments, fostering collaboration. With teams working in unison, organizations enhance the forecasting process’s quality and relevance. Incorporating visual analytics provides stakeholders with clear and actionable insights, often enhancing decision-making speed. Organizations must embrace data analytics to gain a competitive edge, leveraging platforms that provide real-time financial performance metrics. This results in improved forecasting capabilities, which directly influence growth objectives. Implementing these advanced tools may require initial investment; however, the long-term benefits significantly outweigh upfront costs. A tech-savvy financial approach ensures businesses remain agile and responsive, essential factors in today’s fast-paced economy. Establishing a foundation for ongoing system updates can sustain the forecasting process amid continuous technological advancements.

Moreover, organizational culture plays a pivotal role in aligning financial forecasting with business growth objectives. Fostering a culture where data-driven decision-making is prioritized encourages engagement from all departments. It is essential for financial services, marketing, and other teams to collaborate proactively throughout the forecasting process. Regular communication between teams ensures that all insights and feedback are considered, leveraging diverse perspectives on business performance. Encouraging open dialogues can lead to innovative strategies, extending beyond established practices. Incorporating cross-functional training enables staff to understand the interconnectedness of functions within the organization, enhancing their ability to contribute to forecasting discussions. This proactive culture establishes accountability among team members, emphasizing the importance of accuracy and timely updates. Recognizing that every team member’s input strengthens forecasting efforts creates a sense of shared ownership and commitment to achieving growth objectives. Further, leadership plays a critical role in instilling this culture by advocating for transparency, collaboration, and continuous improvement. Therefore, addressing cultural elements surrounding financial forecasting fosters an environment conducive to innovative thinking and superior results, ultimately driving business growth and resilience to market fluctuations.

Training and Development for Effective Forecasting

Effective financial forecasting relies on skilled personnel equipped with the necessary tools and knowledge. Investing in training programs designed for finance and operational teams enhances accuracy and insight quality. By prioritizing the continuous professional development of staff, organizations cultivate the capabilities required to leverage advanced tools and methodologies. Knowledgeable employees are better prepared to navigate complex forecasting scenarios, providing reliable insights. Regular workshops and training sessions should cover the latest trends in financial forecasting and analytical techniques. By staying current, finance teams can explore innovative forecasting practices that can be applied within their organization. Creating a feedback loop where employees can express their challenges with forecasting processes helps identify areas for improvement. This team approach not only strengthens skills but also deepens collaboration across departments. Furthermore, fostering a mentoring system allows seasoned team members to share their expertise, solidifying a shared understanding of best practices. Experienced mentors can also instill a sense of confidence among junior staff, encouraging their contributions. This dual approach of training and mentoring nurtures a workforce adept in financial forecasting, driving alignment with growth objectives and boosting overall business performance.

Performance metrics serve as a critical component in evaluating the effectiveness of financial forecasting processes. Establishing clear metrics enables organizations to monitor the accuracy of forecasts and identify areas for enhancement. Regular performance assessments reveal discrepancies between projected and actual outcomes, providing insights into improvements that can be made. Tracking the frequency and causes of forecasting errors helps to refine models and methodologies over time. By integrating these performance measures into the organizational workflow, businesses can create a sustained focus on improvement and innovation. Furthermore, utilizing performance data to communicate results to stakeholders enhances transparency and strengthens trust in the organization. Stakeholders appreciate insights into how forecasts align with actual performance, indicating thorough analysis and diligence. Addressing performance metrics proactively allows organizations to pivot quickly if forecasting models underperform. Moreover, these evaluations can inform strategic decision-making processes, guiding executives in resource allocations and potential adjustments. Thus, incorporating metrics is vital for enhancing forecasting reliability and achieving overarching business growth objectives. As the organization evolves, performance evaluation becomes a continuous process that reinforces commitment to forecasts, adaptation, and alignment.

Conclusion and Future Directions

In conclusion, aligning financial forecasting with business growth objectives is integral to organizational success in today’s dynamic environment. Companies can enhance decision-making, navigate uncertainties, and capitalize on growth opportunities through strategic forecasting practices. By integrating technology, fostering a collaborative culture, investing in training, and establishing performance metrics, organizations empower their financial forecasting capabilities. As advancements continue to emerge, companies must remain adaptable, embracing new technologies and methodologies. Future directions in forecasting processes will likely center around more sophisticated analytics and predictive modeling tailored to specific organizational needs. Additionally, integrating feedback mechanisms and maintaining open communication across teams will further enhance forecasting accuracy and relevance. The alignment between financial forecasting and business objectives will only become more vital as the competitive landscape evolves, and organizations that prioritize this connection will stand the test of time. Sustaining a commitment to continuous improvement will set organizations apart, fostering resilience, and agility in navigating market challenges and opportunities. As businesses make concerted efforts towards better forecasting practices, they position themselves to thrive amidst uncertainties and drive sustainable growth while achieving their long-term objectives.

The importance of transforming insights into actionable strategies cannot be overlooked. This final aspect of aligning financial forecasting with growth objectives establishes a comprehensive view. Organizations must recognize that overseeing and nurturing this process enables them to adapt dynamically. Emphasizing impact analysis around changing market conditions is crucial. Understanding how forecasts will influence business outcomes shapes strategic planning. Furthermore, maintaining flexibility ensures organizations can pivot when necessary, based on real-time insights. Therefore, embracing financial forecasting fosters an innovative approach, equipping the organization to tackle challenges effectively. The recognition that financial forecasting is not static, but an evolving practice contributes to sustained success. In summary, aligning financial forecasting with growth objectives involves many factors. Organizations must commit to integrating technology, fostering a collaborative culture, focusing on training, establishing performance metrics, and nurturing flexibility. As companies implement these strategies, they position themselves for growth resilience and adaptability. This comprehensive perspective ensures they meet the evolving demands of market uncertainties. The journey of alignment continues as organizations refine their practices and focus on actionable strategies. Financial forecasting emerges as an indispensable component of their long-term vision, creating pathways toward sustained business growth.