How to Use Key Performance Indicators (KPIs) to Monitor Financial Health

Understanding the financial health of a small business is crucial for sustainability. One effective method to achieve this is by utilizing Key Performance Indicators (KPIs). KPIs are measurable values that demonstrate how effectively a company is achieving its key business objectives. They provide invaluable insights into areas needing improvement and guide informed decision-making. When selecting KPIs, small businesses should focus on those that align closely with their financial goals. Common KPIs include net profit margin, current ratio, and return on equity. Each KPI highlights a different aspect of financial health and performance, allowing for a comprehensive financial analysis. For instance, tracking the net profit margin helps understand overall profitability, while the current ratio reveals short-term liquidity. Effective KPI monitoring involves regular performance tracking and adjustments to strategies as needed. Daily, weekly, or monthly reviews can be beneficial dependent on business needs. By integrating KPI evaluations into monthly financial reviews, small businesses can adapt quickly in a fast-paced economic environment. Ultimately, KPI usage empowers small businesses to maintain a clear view of their financial health and drive growth.

After identifying which KPIs to monitor, establishing a system for collecting and analyzing data is essential. Implementing software solutions, such as cloud-based accounting tools, can simplify this process. These tools automate data collection, offering real-time insights into the financial aspects of the business. Furthermore, consistent communication among team members regarding KPIs is crucial in ensuring everyone is aligned with the business objectives. Setting targets for each KPI allows businesses to measure progress effectively. Regular team meetings to discuss KPI outcomes can foster a culture of accountability and transparency. This collaborative approach allows team members to identify trends and address challenges proactively. Importantly, KPIs should not be static; they need to evolve with the business as it grows and changes. Business conditions, industry standards, and market demands shift, necessitating adjustments in KPIs. Reviewing and revising KPIs regularly ensures they remain relevant. Aligning KPIs with broader business goals creates a cohesive strategy that supports long-term success. In this way, businesses can navigate challenges while also seizing new opportunities in the marketplace.

Benefits of Using KPIs for Financial Health

Utilizing KPIs to monitor financial health offers numerous benefits to small businesses. First and foremost, KPIs serve as a performance dashboard, providing a snapshot of financial well-being. Small businesses can quickly ascertain which areas meet expectations and which need attention. Moreover, consistent KPI usage enhances strategic planning. With clear financial indicators, businesses make better-informed decisions to foster growth. For example, if a KPI indicates decreasing sales, management can investigate the root causes and implement necessary adjustments. Furthermore, KPIs promote accountability among different departments. Each team understands its role in achieving the organization’s financial goals. This fosters a collaborative effort to drive performance improvement. By sharing KPI data across teams and departments, businesses create a culture of transparency. Also, KPIs assist in risk management by identifying potential financial issues early. For instance, a sudden decline in cash flow is an indication to take corrective actions immediately. Overall, KPIs are an empowering tool that helps small businesses remain financially stable and navigate challenges effectively.

However, it is also important to recognize the potential pitfalls when implementing KPI monitoring. Small business owners must ensure they do not focus solely on the numbers without understanding the context behind them. Overemphasis on KPIs could lead to neglecting qualitative factors that influence business performance. For example, customer satisfaction, employee engagement, and market conditions should not be overlooked. Balancing quantitative and qualitative assessments provides a clearer picture of business health. Additionally, excessive KPI tracking can lead to confusion and overwhelm. Small business owners should prioritize a select few KPIs that align best with their strategic objectives rather than monitoring an overwhelming number. The risk is that spreading attention too thin can detract from meaningful, actionable outcomes. Furthermore, it is crucial to educate the team about the chosen KPIs and their significance. When employees understand the purpose and value of KPIs, they are more likely to buy into the process and contribute positively. Ensuring alignment and understanding fosters engagement and collective ambition towards achieving financial goals.

Setting Up Effective KPIs

Setting up effective KPIs requires careful consideration of several factors. Begin by clearly defining the strategic objectives of the business. All KPIs must align with these objectives to have a meaningful impact. Engage different team members in the KPI-setting process to gather diverse insights. This inclusive approach promotes buy-in and a shared vision among staff. Each KPI needs to be specific, measurable, attainable, relevant, and time-bound (SMART). Avoid vague measurements that can lead to confusion regarding performance expectations. After establishing relevant KPIs, determine data sources to track progress. Utilizing robust accounting software could help facilitate data collection, generating accurate insights. Team members should be trained on how to interpret the KPIs and relate them to their roles. Regularly reviewing the KPIs assists in pinpointing trends and identifying challenges. It’s useful to involve employees in analyzing KPI outcomes to gain their perspectives. The insights gathered from these discussions can inform strategies and tactics moving forward. Emphasizing the importance of KPIs within the organization cultivates a culture driven by performance and accountability.

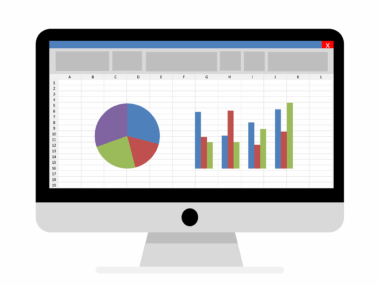

Furthermore, utilizing visual aids can enhance KPI tracking effectiveness. Dashboards, charts, and graphs visually represent data trends and assist in simplifying complex information. This visual representation allows teams to quickly identify patterns and insights that may require action. Digital dashboard tools are particularly beneficial, offering real-time KPI updates that keep staff informed. Additionally, celebrate achievements tied to KPI milestones to motivate and engage employees. Recognizing when departments achieve KPI targets reinforces positive performance and encourages ongoing efforts. Moreover, communication about KPI results is vital. Sharing performance data, both successes and areas for improvement, creates a unified front within the organization. Regular updates and discussions help maintain focus on strategic goals. Encourage feedback from staff regarding the KPI process as well. Insights collected from team members can lead to improvement and adjustment of KPI targets. Maintaining engagement from all employees is crucial for effective performance management. The emphasis on collaboration ensures everyone understands their contributions towards the overall financial health of the business.

Conclusion: The Road Ahead

In conclusion, Key Performance Indicators (KPIs) are invaluable tools for monitoring the financial health of small businesses. By carefully selecting and tracking relevant KPIs, business owners can gain insights into their financial performance. This proactive approach allows businesses to address challenges before they escalate and seize opportunities for growth. Moreover, fostering a culture of accountability and transparency across teams enhances overall performance. Effective KPI implementation involves regular reviews, team engagement, and strategic alignment with business goals. It’s essential to have the right tools and processes in place to support KPI tracking. Emphasizing both quantitative and qualitative aspects ensures a balanced view of company performance. Finally, small businesses must remain adaptable; reviewing and refining KPIs as the business evolves is crucial. In this ever-changing economic landscape, leveraging KPIs for financial health will empower small businesses to thrive and succeed. By staying informed and engaged through KPI monitoring, owners can make strategic decisions that lead to sustainable growth and long-term success.

KPIs not only improve business performance but also play a significant role in building customer loyalty and trust. When businesses communicate their performance transparently, customers feel their interests are prioritized. This transparency enhances relationships and fosters a loyal customer base. Regularly reviewing KPIs also leads to improved responses to market changes, as businesses can pivot strategies quickly. Lastly, integrating KPIs into the company culture promotes ongoing learning and development among employees. The continuous emphasis on performance understanding encourages a growth mindset. This mindset contributes to innovative ideas and solutions. In this fast-paced business environment, those who adapt quickly will thrive. Overall, the implementation of KPIs serves as a cornerstone in the framework of successful small business financial management.