Preparing an Unadjusted Trial Balance: What You Need to Know

In the accounting cycle, preparing an unadjusted trial balance is a crucial step. This is typically done after all transactions have been recorded in the general ledger. The purpose is to ensure that the total debits equal total credits, thus confirming the accuracy of the accounting records. To prepare the unadjusted trial balance, an accountant must first compile a listing of all accounts from the ledger. Each account’s balance should be clearly stated alongside whether it is a debit or credit. This process mirrors maintaining systematic records which foster accountability within a business. With the unadjusted trial balance completed, accountants can detect any discrepancies that may arise during the recording process. If the totals are not equal, it indicates that errors were made. Balancing is essential not only for operational integrity but also for compliance with accounting standards. Common errors include misposts, omissions, and transpositions. Once an unadjusted trial balance is prepared successfully, it becomes a foundation for subsequent financial statements.

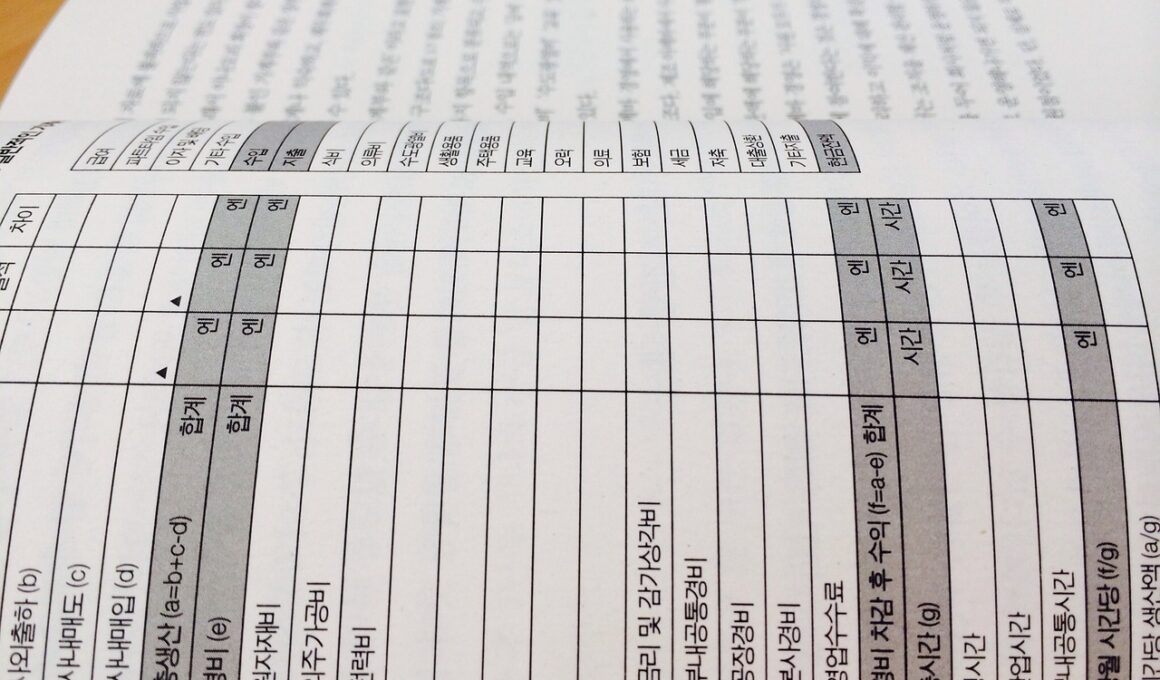

To enhance accuracy in preparing an unadjusted trial balance, various steps are involved. First, there should be careful review and reconciliation of all account transactions that occurred during the accounting period. It is vital to ensure that every transaction recorded reflects correctly in the general ledger entries. Any discrepancies identified during this review should be rectified immediately to maintain the integrity of financial reporting. After reconciliation, the next step in preparation is to format the account balances into a structured trial balance report. A typical report includes columns for account title, debit balance, and credit balance. For clarity, each account category should be grouped, which assists in identifying errors quickly. It is prudent to double-check calculations for accuracy, as mistakes can lead to significant problems in financial reporting. Remember, the unadjusted trial balance serves as a key internal document and provides the basis for the adjusting entries that follow. Adjustments may include accruals, deferrals, and estimates that will impact final financial statements. Thoroughness in this step is essential for clarity and transparency.

Understanding the Importance of an Unadjusted Trial Balance

The unadjusted trial balance is a critical tool in the accounting cycle. Its main purpose is to confirm that the sum of all debits equals the sum of all credits. This balance serves as a checkpoint before preparing final financial statements. A successful trial balance reflects that the bookkeeping process is complete and accurate so far. If this balance is not achieved, accountants must investigate the records for possible errors. This proactive approach helps maintain trust in the accuracy of financial reporting, which is beneficial for stakeholders, including investors, auditors, and regulators. Furthermore, a well-prepared unadjusted trial balance can highlight potential issues with certain accounts that may warrant a closer look. For analysts, this balance can signal the need for adjustments in either revenue recognition or expense classification. Ultimately, ensuring that the unadjusted trial balance is accurate forms the backbone for future financial analyses and decision making. Management can utilize this document as a foundation for understanding company performance and making informed future projections. Hence, it plays a vital role in strategic planning and financial management.

There are several key components of an unadjusted trial balance that should never be overlooked. As previously mentioned, every trial balance will include account titles, debit totals, and credit totals. These components have specific formats and standards laid out in generally accepted accounting principles (GAAP). The primary structural elements include a clear identification of account categories, such as asset, liability, equity, revenue, and expense accounts. Specific details regarding each account must also be consistently presented to ensure clarity and transparency, which fosters a better understanding by anyone reviewing the document. Organizations might use software to automate this process, thus minimizing the risk of human errors. It’s also critical for accountants to adjust and ensure their software settings comply with accounting standards. After compiling the trial balance, companies can also compare their results against prior periods and industry benchmarks. This exercise can provide insights into performance trends or flag potential concerns before they escalate. Regular reviews of these reports can bolster proactive management strategies aimed at fiscal responsibility and growth.

Common Errors Encountered When Preparing the Trial Balance

When preparing an unadjusted trial balance, various common errors can occur. Misclassifying accounts is one such error; for instance, categorizing an expense account as an asset can lead to significant distortions. Another frequent mistake is omitting account balances entirely from the trial balance report. Such omissions can arise from simple oversight or from inadequate tracking of all transactions. While transposition errors, where digits are swapped (e.g., 24 instead of 42), can also lead to inaccuracies, ensuring a meticulous approach can help prevent these. Numerically incorrect balances owing to addition mistakes can also disrupt the balance, making it essential to double-check calculations. Additionally, another potential pitfall is the failure to use consistent accounting period assumptions, possibly skewing overall results. These errors, despite being common, can have serious downstream effects on financial reporting and decision-making. Hence, taking a systematic and methodical approach to preparation is advisable, particularly for businesses undergoing rapid growth scenarios or those experiencing restructuring. Implementing robust checks and balances can significantly mitigate risks associated with unadjusted trial balance preparations.

Following the preparation of the unadjusted trial balance, the next essential steps in the accounting cycle must be considered. Adjusting entries will need to be made based on the discrepancies found during the preparation process. This involves reviewing all income and expenses to recognize accrued or deferred items accurately. These adjustments are significant as they ensure that the financial statements present a true reflection of the company’s performance and financial position. After making necessary adjustments, the next step is to prepare the adjusted trial balance. This revised document will validate that adjustments accurately balance out the accounts. Following this, the adjusted trial balance can be used to create financial statements, such as the income statement, balance sheet, and cash flow statement. Accuracy in this step is critical; any remaining discrepancies will directly affect the company’s financial reporting. Regularly reviewing these steps helps streamline the overall accounting process for efficiency. Knowledge of managing the trial balance properly can save time and reduce error rates. Moreover, proper documentation of the entire process is necessary for accountability and transparency.

Conclusion: Mastering the Trial Balance Process

To master the trial balance process effectively, it’s important to follow established best practices. Being consistent in routine checks and maintaining accuracy in the accounting cycle is key. Alongside, leveraging accounting software can reduce manual errors and facilitate efficient preparation. Accountant training should emphasize the critical importance of the unadjusted trial balance in maintaining credible records. Regular updates and continuing education in the latest accounting standards will assist accountants in staying proficient and compliant. Each accounting level should understand that this phase is as crucial as any other step in financial reporting. A solid grasp of the unadjusted trial balance prepares accountants for a seamless transition into creating adjusted entries and final financial statements. By cultivating an environment of accuracy and consistency, organizations can better safeguard their financial integrity. Through diligent practices and adherence to standards, companies not only enhance their internal financial reporting, but they also bolster the reliability of their overall fiscal management. This can positively influence investor confidence, leading to long-term success and stability.

Final Thoughts on Financial Accounting

Financial accounting in its entirety is built upon foundational elements like preparing the unadjusted trial balance. A solid understanding of this process enhances overall data accuracy and business performance. Therefore, continuous improvement and attention to detail in the preparation stage are crucial. Stakeholders and businesses alike benefit from clear financial insights derived from well-prepared trial balances. This foundational step creates a reliable conduit for subsequent financial activities. Thus, it should not be regarded as merely a procedural task, but rather a strategic initiative that feeds into larger business goals. Identifying errors early through this practice not only saves time but also simplifies future accounting activities. Opting for transparent, thorough accounting practices reflects well on businesses, positioning them for success. Engaging with professional development will further sharpen accountants’ skills to master the nuanced intricacies within financial reporting. Thus, learning and applying the right concepts can facilitate proficient preparation of financial documents. Ultimately, the ability to prepare an unadjusted trial balance presents a crucial capability that underpins organizational effectiveness and fiscal robustness.