The Growing Importance of Equity Crowdfunding in the Future Economy

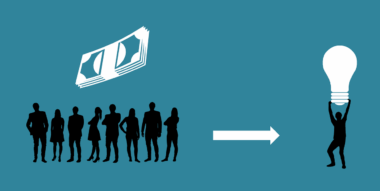

Equity crowdfunding is rapidly becoming a vital avenue for startups and small businesses seeking to raise capital. Unlike traditional methods, equity crowdfunding allows multiple investors to contribute smaller amounts, making investment more accessible than ever. This democratization of finance opens doors for innovative ideas that may not warrant the attention of larger venture capital firms. Furthermore, this approach fosters community engagement, as local investors often feel a personal connection to companies they help fund. The growing importance of equity crowdfunding coincides with a shift toward valuing transparency and social responsibility in business practices. Investors today are more interested in supporting projects that align with their values. Therefore, successful campaigns can not only secure funding but also build a loyal customer base interested in the company’s journey. More platforms are emerging, catering specifically to various sectors, enabling creators and entrepreneurs to find their niches. With advancements in technology streamlining these transactions and increasing the network of participants, the future of equity crowdfunding looks promising and robust. This financial evolution will certainly drive innovative projects into new areas, reshaping how businesses are financed in the years to come.

As we look toward the future, the role of technology in equity crowdfunding cannot be overstated. Online platforms facilitate seamless interactions between entrepreneurs and potential investors. These platforms often provide detailed insights into companies, including financial projections and business plans. Investors can conduct due diligence from the comfort of their homes, making informed decisions based on comprehensive data. Moreover, with the integration of blockchain technology, transactions can be made more secure, transparent, and efficient. The increased use of social media for promoting crowdfunding offers additional channels for creators to reach wider audiences. Additionally, tools for digital marketing can enhance visibility, enabling campaigns to attract interest from diverse demographic groups. As social media continues to play a pivotal role in shaping opinions and trends, entrepreneurs who harness its power effectively will likely see considerable success in their funding campaigns. Moreover, these platforms can support equity crowdfunding on a global scale, helping investors discover opportunities beyond geographic limitations. Ultimately, technology will remain at the forefront, fostering a vibrant ecosystem that enables innovative ideas to thrive and leave a lasting economic impact.

Despite its many advantages, equity crowdfunding is not without challenges. Regulatory frameworks differ across jurisdictions, which can complicate fundraising efforts for startups. Many platforms must navigate a complex web of rules that dictate how and when they can raise funds. Compliance with applicable laws is essential, as violations can lead to severe penalties. Furthermore, the saturation of crowdfunding platforms creates competition for attention, requiring entrepreneurs to differentiate their campaigns. Crafting a compelling narrative is paramount in attracting backers among numerous offerings competing for investments. The lack of established reputation can also deter potential investors who may prefer investing in well-known companies. This hesitance can affect the overall growth of equity crowdfunding if new ventures struggle to secure the amount of capital needed. However, as more success stories emerge, they may inspire confidence in the model. Investors will gradually become more informed about the eco-system and the types of ventures that frequently succeed. The ability for startups to innovate and connect with backers directly is fundamental to overcoming these hurdles. With persistence, the model can gain traction, enhancing the volume of investments into fledgling companies and disruptive ideas.

Equity Crowdfunding and Financial Inclusion

Equity crowdfunding stands as a beacon for financial inclusion, enabling individuals from diverse backgrounds to participate as investors. This inclusivity is vital in a world where traditional investment opportunities often favor the wealthy. By lowering the barrier to entry, equity crowdfunding allows individuals to invest in startups they believe in and potentially benefit from their success. This accessibility empowers everyday people to take part in the entrepreneurial process, fostering innovation and economic development. Furthermore, many platforms focus on niche markets and social causes, giving investors options aligned with their values. The rise of equity crowdfunding can be viewed as a key element in redistributing wealth and providing opportunities for personal financial growth. When individuals feel connected to their investments, they are more likely to stay engaged and support these businesses through word-of-mouth and advocacy. Consequently, successful campaigns often translate into wider community benefits as the funded businesses create jobs and stimulate local economies. Over time, equity crowdfunding can significantly impact financial literacy, motivating individuals to learn about investing and entrepreneurship, further solidifying its importance in achieving equitable economic advancement.

One of the exciting prospects of equity crowdfunding in the future economy is its ability to foster innovation across various sectors. By granting access to funding, it encourages entrepreneurs to explore uncharted territories and bring forth unique solutions to prevalent problems. Industries such as technology, renewable energy, and healthcare are already witnessing a surge in innovative projects funded through equity crowdfunding. Entrepreneurs can introduce novel ideas without being stifled by traditional financing routes that may differ in their vision. Furthermore, investors who are passionate about specific sectors are more inclined to support groundbreaking projects that resonate with their interests, creating a win-win scenario. This ecosystem nurtures a culture of creativity where new concepts can flourish and evolve. As a result, diverse products and services can enter the market, spurring further competition and advancements in their respective fields. The future of equity crowdfunding might see collaborations among investors and startups becoming commonplace, providing not just funding but also valuable mentoring networks. This mutual support within the entrepreneurial landscape will only amplify innovation and growth, ultimately leading to a more resilient economy.

The Global Impact of Equity Crowdfunding

As equity crowdfunding gains momentum, its global impact is becoming increasingly evident. Countries around the world are observing the success of crowdfunding platforms, prompting them to update their regulations to facilitate this funding model. This growing acceptance signifies a shift toward more flexible financial solutions that can adapt to the changing economic landscape. Some regions have already adopted favorable laws, allowing a broader range of investments in startups while ensuring investor protection. Consequently, international entrepreneurs can access diverse funding sources, enabling them to turn innovative ideas into reality. The global interconnectedness of markets further enhances these possibilities, as investors may seek to fund international projects that align with emerging trends. Such cross-border collaborations foster an exchange of knowledge, inspiration, and resources that can benefit startups while contributing to global economic growth. As equity crowdfunding continues to expand, localized platforms may eventually evolve, catering specifically to cultural and economic nuances. This trend signifies a promising future where innovative startups can find support and investors can discover new opportunities, thus driving economic development across international borders.

In conclusion, equity crowdfunding represents a transformative development in the future economy. It democratizes investment opportunities, allowing individuals to participate in funding creative projects that resonate with them. The supportive ecosystem surrounding equity crowdfunding enables collaboration and innovation, fostering ideas that may change industries and lift communities. Addressing the challenges associated with regulation and market saturation will require concerted efforts from industry players and stakeholders. Moreover, the responsible use of technology will be crucial in creating secure and transparent platforms. As awareness grows and more success stories emerge, investor confidence in equity crowdfunding will likely increase. This shift will help normalize alternative funding options for startups, leading to a broader acceptance of innovative ventures. As we embrace this financial evolution, the future of crowdfunding may redefine how businesses secure capital and interact with their communities. Ultimately, equity crowdfunding has the potential not only to transform individual lives through investment opportunities but also to catalyze economic growth, innovation, and progress on a larger scale. Its impact will be seen in various sectors as businesses flourish, supported by the collective investment of passionate individuals.

Equity crowdfunding is rapidly becoming a vital avenue for startups and small businesses seeking to raise capital. Unlike traditional methods, equity crowdfunding allows multiple investors to contribute smaller amounts, making investment more accessible than ever. This democratization of finance opens doors for innovative ideas that may not warrant the attention of larger venture capital firms. Furthermore, this approach fosters community engagement, as local investors often feel a personal connection to companies they help fund. The growing importance of equity crowdfunding coincides with a shift toward valuing transparency and social responsibility in business practices. Investors today are more interested in supporting projects that align with their values. Therefore, successful campaigns can not only secure funding but also build a loyal customer base interested in the company’s journey. More platforms are emerging, catering specifically to various sectors, enabling creators and entrepreneurs to find their niches. With advancements in technology streamlining these transactions and increasing the network of participants, the future of equity crowdfunding looks promising and robust. This financial evolution will certainly drive innovative projects into new areas, reshaping how businesses are financed in the years to come.