Evaluating the Cost of Capital for Your Small Business Investment

Understanding the cost of capital is essential for small business investors. It signifies the opportunity costs associated with various forms of financing, which can significantly affect your business decisions. Investors must weigh the risks against potential returns on investment (ROI). Additionally, this evaluation allows entrepreneurs to discern whether a project is worth pursuing based on the required rate of return. When evaluating your cost of capital, consider both debt and equity financing options. Debt typically costs less due to tax deductibility, but high levels of debt can increase financial risk. Meanwhile, equity financing may involve giving away ownership but often brings invaluable resources and expertise. Each business is unique, so it’s crucial to analyze individual financial situations and market conditions to determine the most favorable financing mix. The overall goal is to minimize the weighted average cost of capital (WACC) to maximize your business’s valuation. Small business owners should strive for an optimal balance of these financing sources to ensure a successful investment journey. Effective use of resources is key to sustaining operations and driving growth in an increasingly competitive marketplace.

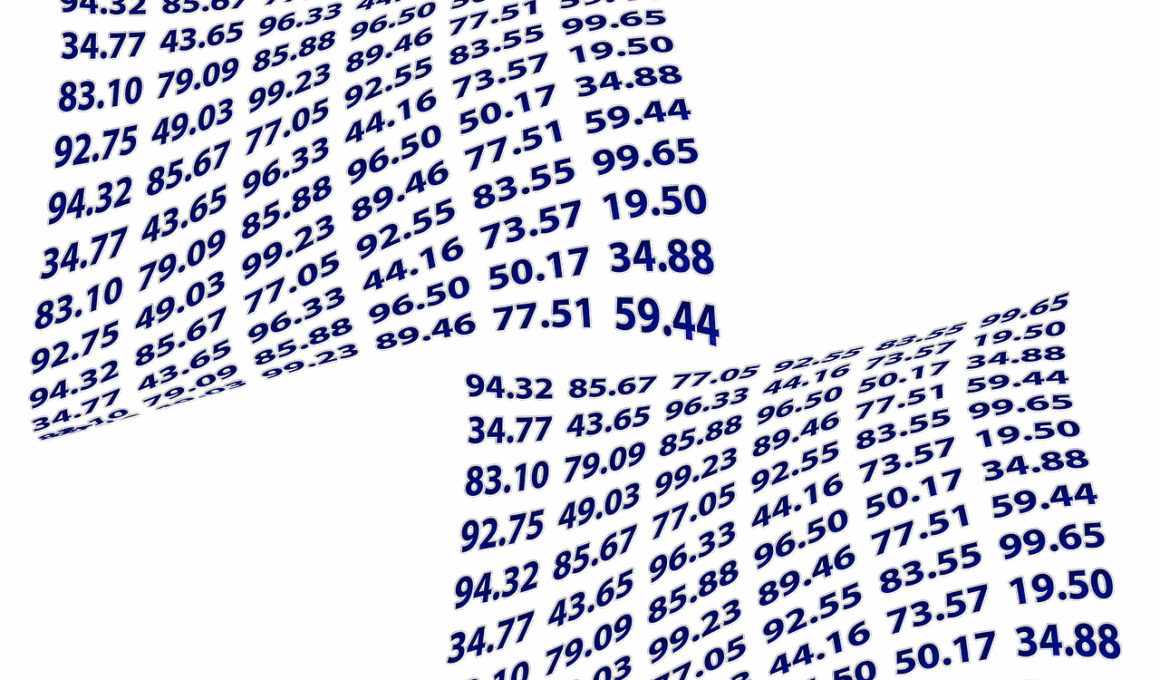

To get a clearer understanding of your cost of capital, it’s essential to look at how WACC is calculated. This metric combines the cost of equity and the after-tax cost of debt, creating a comprehensive measure of financial risk associated with your business capital structure. The formula typically looks like this: WACC = (E/V * Re) + (D/V * Rd * (1-T)), where E is equity, D is debt, V is the total firm value, Re is the cost of equity, Rd is the cost of debt, and T is the tax rate. To calculate the cost of equity, one can use models like the Capital Asset Pricing Model (CAPM), which accounts for the risk-free rate, market risk premium, and company-specific risk (beta). Alternatively, dividend discount models can be applied, depending on the business context. Debt costs can be easier to discern, especially if you have existing loans. Simply assess effective interest rates on borrowed funds and consider any fees. Ultimately, understanding these components of your cost of capital allows for informed investment choices that align with business strategy.

Importance of Assessing Risks

When evaluating your cost of capital, assessing various risks is a fundamental step. Identifying market risks, credit risks, and operational risks allows you to understand the factors that may influence your investment returns. Market risks encompass external economic conditions, interest rate fluctuations, and changes in consumer preferences that could impact your profitability. By forecasting these risks, you better prepare for potential challenges that may arise. Credit risk reflects the possibility of default on debt obligations, which can directly affect cash flow and overall financial health. To mitigate this risk, it’s wise to maintain a good credit score and make timely payments. Operational risks involve internal factors such as supply chain issues, employee performance, and management inefficiencies, which can also impede effective capital utilization. A comprehensive risk management strategy incorporates preventive measures to reduce exposure and enhance resilience against unforeseen events. This proactive approach ultimately fosters a more robust investment environment and contributes to long-term success in managing small business finances, allowing for better opportunities to navigate uncertainties that may come your way.

Moreover, understanding your business’s unique financial situation plays a critical role in evaluating the cost of capital. Different industries have varying benchmarks and standards of performance; thus, knowing how your business compares to these can yield insights into your capital structure decisions. Start by analyzing your competitors’ financial data, assessing their cost of capital, and identifying strategies that drive their growth. Utilize various financial ratios, such as the debt-to-equity ratio, current ratio, and return on equity, to gauge your organization’s financial health. This comparative analysis will shed light on areas for improvement, particularly regarding cost efficiency. It may uncover potential financing options that align better with your business goals and risk tolerance. Furthermore, consider your growth stage, as startups may prioritize equity financing over debt to reduce financial burden while scaling their operations. Overall, tailoring your analysis to specific market conditions and understanding industry characteristics facilitates informed choices that optimize financing strategies and ultimately boost your chances of economic sustainability and growth.

Evaluating Cost of Capital Alternatives

To further facilitate informed investment decisions, exploring various sources of funding is crucial. Small businesses can access numerous traditional and alternative financing options, including bank loans, lines of credit, angel investors, and crowdfunding. Each comes with distinct advantages and costs that entrepreneurs should assess based on their growth requirements and financial circumstances. Bank loans typically offer lower interest rates but demand rigorous documentation and a strong credit profile. Alternatively, lines of credit provide flexible borrowing and may assist cash flow management during peak periods. In contrast, angel investors and venture capitalists often bring valuable expertise alongside capital but may request equity stakes, impacting business control. Crowdfunding presents an innovative option, leveraging social media and online platforms to gather small amounts from numerous investors. It can also serve as a marketing tool, generating buzz around your product. Ultimately, weighing these options will guide you toward the ideal funding strategy for your business goals and financial context, empowering you to limit capital costs while maximizing growth potential and profitability.

Another vital consideration in evaluating your cost of capital is the economic environment in which you operate. Economic conditions, including inflation rates, interest rates, and overall market stability, can significantly impact your financial strategies. For instance, during periods of high inflation, your purchasing power and profit margins may shrink, necessitating adjustments to your investment projections. Interest rates tend to rise in inflationary environments, increasing borrowing costs; thus, it may be prudent to secure financing sooner rather than later. Additionally, a stable economic outlook contributes to more favorable investment conditions, influencing your decisions and strategies accordingly. Keeping abreast of macroeconomic trends can provide valuable forecasts for financial planning, which can feed into your overall cost of capital assessment. During economic downturns, investor sentiment may waver, impacting equity valuations and funding access. Thus, maintaining robust financial forecasting processes will equip you with insights to navigate fluctuating conditions and make well-informed choices tailored to your operational landscape, enhancing your capability to thrive in uncertain times.

Conclusion and Future Strategies

Ultimately, evaluating the cost of capital for your small business investment is a continuous process. The landscape of financing options is ever-evolving, and staying informed on market trends will equip you to optimize your cost of capital effectively. This proactive mindset also prepares you to pivot when necessary and seize opportunities for growth that align with your financial objectives. Regular revisits to your capital structure enable adjustments that reflect both external economic conditions and internal business shifts. Engaging with financial advisors can provide useful insights tailored to your unique circumstances, allowing for a more comprehensive analysis of financing decisions. Additionally, fostering healthy relationships with lenders and investors can result in preferential terms and more accessible future fundraising efforts. Ultimately, a well-rounded approach that encompasses sound risk assessments, industry benchmarks, and economic trends will poise your business for sustained growth and success. Investing in knowledge and strategic planning today will pay dividends in your ability to understand and manage capital costs while driving the vision that fuels your small business ambitions forward.

In conclusion, evaluating the cost of capital for your small business requires a detailed approach. Understanding the relationship between risk and return leads to better investment decisions. Continually assessing your capital structure will help identify areas for improvement. Moreover, regularly accessing funding opportunities ensures you remain agile in a dynamic market. The wide array of options, such as securing favorable loans or attracting investors, enables growth while mitigating risks. Educating yourself on economic conditions empowers you to navigate interests suitably. Maintaining strong lender relationships fosters a positive credit profile and ensures better financing terms. Engage with financial advisors for insights unique to your context. Ultimately, strategic management of capital costs is vital for long-term success in small business ventures. It crystallizes your financial ambitions, helping balance competing interests effectively. In practice, a continuous reassessment will catalyze progress, enabling you to proactively seize opportunities and overcome hurdles. The lesson for small business investors is clear: lasting success is built on well-founded financial acumen and strategic foresight that accommodates both internal capabilities and external challenges.