The Connection Between Property Tax and Commercial Leasing Agreements

Understanding the intricate relationship between property taxes and commercial leasing agreements is crucial for business owners. Property taxes significantly impact the total costs associated with leasing a commercial space. When tenants enter a leasing agreement, they often overlook the importance of property taxes that landlords must pay, as these taxes can affect rental rates. Property owners typically pass on property tax expenses to their tenants through various means, resulting in increased operating costs. Consequently, it’s essential for prospective tenants to be aware of any property tax implications before signing a lease. By examining these factors, businesses can negotiate better lease terms. Tenants should inquire about how property taxes are calculated and whether they will be influenced by potential tax increases over the lease’s duration. Additionally, understanding local regulations that influence property taxes can inform better decisions regarding leasing. Moreover, commercial properties in areas with high property taxes might carry higher monthly rents, affecting profitability. It’s advantageous for businesses to factor property taxes into their decision-making process during lease negotiations.

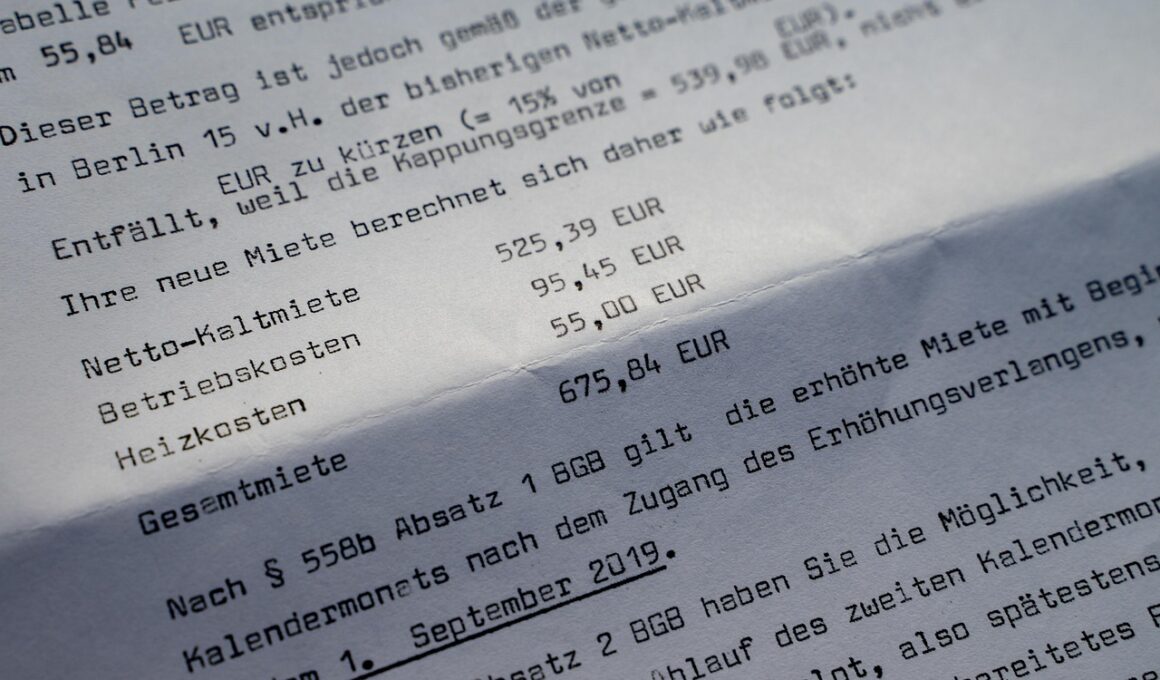

Moreover, an effective lease agreement should explicitly state the responsibilities concerning property taxes to avoid disputes. Clear delineation ensures that tenants know what costs they might incur during their lease term. This includes understanding whether the lease is gross or net; net leases often require tenants to cover property taxes and other expenses, while gross leases typically have these costs absorbed by landlords. Therefore, clarity in lease language is pivotal. Business owners must engage in thorough discussions with landlords to clarify these conditions, as ambiguous terms can lead to unexpected financial liabilities. Furthermore, potential tax increases can be substantial in certain regions. Knowing how property tax hikes influence rent may affect a tenant’s budget and profitability plans. During negotiations, businesses can also explore purchasing clauses that favor tax escalations. For instance, some leases may offer tenants protection against surging tax rates. Hence, proactive discussions and negotiations are essential in creating a transparent leasing process that safeguards both parties’ interests.

Another significant aspect is the evaluation of how property taxes impact the overall value of commercial real estate. Real estate valuation is heavily influenced by property tax assessments, as higher taxes can decrease property values. Conversely, properties in areas with lower tax rates often possess higher appeal to landlords and tenants alike, as they provide a more ample margin for profit. When engaging with commercial lenders, landlords should provide clarity on the tax status of their properties. Lower property taxes can contribute to a sound investment profile, making the property more attractive for financing. Thus, property taxes play a dual role, influencing both leasing agreements and the valuation of commercial assets. It is beneficial for leasing businesses to perform due diligence on the property taxes of potential lease locations. This evaluation includes researching historical tax assessments to predict future tax trends. A comprehensive analysis will ultimately prepare prospective tenants and landlords to make informed choices about their leasing agreements.

Risk Management Through Property Tax Awareness

Risk management strategies should integrate property tax considerations right from the outset of any commercial leasing agreement. Awareness around property tax obligations can prevent financial surprises for tenants. These obligations can arise from assessments that increase property values, thus elevating property taxes accordingly. This potential for sudden increases emphasizes the necessity for businesses to negotiate leases that include caps on property tax increases or provisions that address significant spikes. In some jurisdictions, tenants may seek to include language that allows them to contest property tax assessments. If property taxes significantly rise without justification, tenants should be able to argue their case to city or county tax assessors. Such provisions should guard against excessive taxation, protecting business operational viability. Additionally, companies should establish relationships with property tax consultants to navigate these complexities effectively. By monitoring property tax trends and implications over time, businesses can ensure they are well-prepared to address challenges related to leasing commercial spaces.

Tenants should also stay informed about local government policies that may impact property tax rates. Changes in legislation can directly affect taxing authority decisions, leading to increases in property taxes which trickle down to tenants. For instance, if a local government introduces new taxes or surcharges, businesses must be prepared for these financial obligations. Engaging with community stakeholders who monitor tax regulations can offer valuable insights. Businesses that proactively communicate with local property tax departments may also gain updated information on upcoming assessments or proposed rate changes. This dialogue can assist in timely responses to potential increases that can impact rent. Additionally, conducting periodic reviews of property tax assessments can help identify anomalies, paving the way for effective negotiation with landlords. Keeping abreast of these developments fosters an understanding of how property tax dynamics can evolve throughout a lease term. In doing so, businesses enhance their ability to navigate lease agreements effectively, minimizing financial exposure.

Template for Lease Negotiations

Creating a template for lease negotiations that explicitly addresses property tax responsibilities is an essential practice. Tenants should prepare a checklist that includes all property tax-related points such as escalating costs, assessment review, and payment obligations. Landlords may appreciate such proactive engagement, leading to more favorable negotiations. Furthermore, having a formalized approach can highlight the importance of these discussions during the initial stages of lease dialogue. When landlords see tenants coming prepared, it conveys seriousness and intention to clearly understand all facets of leasing. Additionally, both parties should detail how future tax increases may be addressed in the lease. In some cases, rent adjustment clauses can enable equitable changes in rental obligations reflecting property tax shifts. Therefore, establishing such templates gives tenants a structured framework to advocate effectively during negotiations. This clarity potentially leads to less dispute and a more harmonious tenant-landlord relationship over time.

Finally, businesses should consider the implications of property taxes in their long-term strategic planning. Understanding the broader market conditions impacting property taxes can help tenants assess their positioning in the commercial real estate marketplace. For example, areas with rising property taxes might lead to evaluating whether remaining in the same location is prudent for future business viability. Companies may even explore relocation options to jurisdictions with better tax climates. It is essential to factor in potential shifts surrounding property tax laws when evaluating lease renewals. By doing so, businesses can mitigate risk and strategically position themselves for consistent growth and sustainability. When considering the future, evaluating property taxes as part of a broader financial strategy allows for informed decisions that facilitate long-term planning. Given all these considerations, property taxes undeniably hold significant influence over commercial leasing agreements, and organizations must approach them with diligence. An active engagement in understanding these duties ultimately leads to more successful commercial leasing outcomes.

In conclusion, property taxes are a vital issue that businesses cannot afford to overlook while negotiating commercial leases. From understanding how taxes affect overall cost structures to addressing potential increases, tenants must approach these aspects with caution. Establishing transparent communication with landlords, implementing strategic negotiation templates, and maintaining awareness of local tax regulations are critical for successful leasing outcomes. Leveraging insights into property tax implications not only secures better lease agreements but also enhances the overall business strategy. As businesses navigate the complexities of commercial leasing, they can achieve stability and growth by recognizing the significance of property taxes. In doing so, they cultivate a more advantageous and sustainable operational framework, no matter what market challenges arise. By prioritizing discussions around property tax responsibilities, entities can advocate for favorable terms. Companies must ensure that property tax obligations are clear and reasonable within any leasing contracts. Therefore, diligent planning and communication regarding taxation will play a decisive role in achieving commercial leasing success.