Exit Strategy Due Diligence: Planning Ahead for Investment Returns

Due diligence is a critical component of the investment process, particularly when planning for an exit strategy. Investors need to ensure that they fully understand potential exit avenues before any capital is committed. An effective exit strategy not only maximizes returns but also mitigates risks associated with unforeseen market fluctuations. Given the complexity of investment landscapes, having a checklist for due diligence tailored specifically for assessing exit strategies can dramatically improve decision-making. A well-prepared checklist should encompass multiple areas: market analysis, operational performance, competitive positioning, financial health, and legal reviews. By examining these aspects, investors can gain valuable insights into the viability of an exit option. Furthermore, identifying potential acquirers early on can provide an advantageous position. Understanding the motivations of potential buyers ensures that investments align with their strategic interests. This foresight allows for more effective negotiations and smoother transitions. A thorough understanding of the market will also assist in anticipating challenges that may arise during the exit process, ensuring investors are prepared for potential hurdles.

The Importance of Financial Metrics

When assessing an investment’s exit strategy, financial metrics play a pivotal role. Investors must scrutinize various financial statements, including balance sheets, income statements, and cash flow statements, to understand the company’s fiscal health. Key ratios such as the return on investment, profit margins, and debt-to-equity ratios can provide invaluable insights into profitability and operational efficiency. These metrics help investors gauge how well the company is performing and predict potential growth trends. Evaluating these figures in the context of industry benchmarks is equally essential; doing so enables investors to discern positive or negative performance relative to competitors. Moreover, consistency in achieving financial goals contributes to establishing credibility among potential buyers. A sound understanding of financial health assists in creating realistic exit expectations. Investors should also consider how external economic factors could impact these metrics during the exit. Effective due diligence necessitates awareness of market volatility, regulatory changes, and technological advancements that could influence the timing and terms of an exit strategy. Overall, priority should be given to financial metrics throughout the due diligence process.

Next, we explore the role of market dynamics in shaping exit strategies. Analyzing market trends when planning an exit is crucial. Understanding the current market landscape, including consumer behavior and competitor movements, provides insights into the optimal exit timing and method. Trends affecting supply and demand can heavily influence how investors should position their exit. For example, if similar companies are experiencing high acquisition activity, it may signal a ripe moment for divestment. Conducting thorough market research is essential, involving the collection of both quantitative and qualitative data. This includes assessing macroeconomic indicators, potential market growth rates, and any emerging sector challenges. Additionally, having access to up-to-date industry reports and forecasts can clarify potential future scenarios. Investors should remain agile to adjust their exit strategies as market conditions evolve. Positioning adaptability as a key factor in exit planning allows for rapid responses to new opportunities and threats. Keeping abreast of industry news will facilitate an informed decision-making process throughout the investment lifecycle. Ultimately, staying informed leads to maximizing return potential during the exit.

Assessing Operational Performance

Operational performance should not be overlooked when conducting a due diligence check for exit strategies. Efficient operations often translate to improved financial outcomes, making them a crucial metric to evaluate. Assessing the organization’s operational strengths and weaknesses enables investors to identify improvement opportunities. This includes examining productivity levels, employee engagement, and supply chain efficiency. Understanding the intricacies of operations can uncover hidden costs that may reduce profitability at the point of exit. Investors should also evaluate any unique competitive advantages that may enhance operational performance, such as proprietary technology or specialized talent. In addition, recognizing management capabilities and business scalability is vital. High-performing teams positioned well for growth often increase the attractiveness of a business to prospective buyers. Moreover, a strong culture and clear operational processes can make the transition smoother, convincing buyers of the investment’s continued success post-exit. Investors should give careful thought to how these operational elements can be highlighted in marketing the business to potential acquirers. Ultimately, operational efficiency is fundamental, influencing the valuation of an investment at its exit.

Legal compliance and potential liabilities can significantly impact exit strategies and must be scrutinized during due diligence. Identifying any existing legal issues related to the business is essential, as they may affect the company’s valuation or attractiveness to buyers. Reviewing contracts, licenses, and permits ensures that the business operates within legal frameworks. Potential legal entanglements could also lead to unforeseen expenses and complications during the exit process. Investors should initiate thorough legal audits to uncover any hidden liabilities that could arise post-exit. Additionally, gaining clarity on intellectual property rights and patent ownership is vital, especially if technology or innovation plays a key role in the business. Having a clean legal slate builds credibility with prospective buyers and instills confidence in the company’s future. Investors must also be aware of any regulatory requirements they need to meet in their industry. This ensures compliance, avoiding fines or disruptions that could deter potential buyers. By understanding the legal landscape, investors can make informed decisions and develop a robust exit strategy that minimizes risk factors.

Building a Target Buyer Profile

Creating a detailed target buyer profile is invaluable when planning for exit strategies. Identifying potential acquirers beforehand allows investors to tailor their value proposition accordingly. This involves understanding what characteristics make a buyer most suitable, including their geographical preferences, financial capabilities, and strategic objectives. Conducting audience research through various channels, such as industry networks, conferences, and market surveys, can yield insightful customer data. Analytical tools enable investors to gain insights into previous acquisition behavior within the sector as well. Familiarity with what attracts potential buyers increases the likelihood of successful engagements. Furthermore, tailoring the business presentation to resonate with the specific needs of each target buyer can significantly enhance negotiation outcomes. Identifying synergies between the current business and prospective acquirers highlights mutual benefits. This, in turn, can lead to more favorable deal structures and pricing strategies, optimizing overall exit profitability. Investors should also monitor potential acquirer developments and shifting interests closely. Keeping the lines of communication open helps adjust exit strategies in response to changing buyer landscapes. Building relationships with likely buyers over time can greatly enhance the chances of a successful exit.

As the exit strategy progresses, adapting to changing circumstances is paramount. Investors should remain flexible throughout the due diligence process, prepared to modify their plans in response to new information or market shifts. Regularly evaluating and assessing both internal and external factors will keep decision-making aligned with overarching goals. Communication among stakeholders should be prioritized, as it fosters transparency and collaboration when navigating complexities during an exit. Keeping all parties informed allows for collective perspectives, improving problem-solving efficiency. Moreover, preparing for contingency scenarios is essential; this guarantees that exit plans can be revised as required without jeopardizing overall objectives. Utilizing an ongoing review process to track progress with due diligence metrics ensures that any red flags are promptly addressed. Being proactive in assessing performance against established benchmarks enhances long-term viability. By taking this approach, investors can transform challenges into opportunities as they prepare for their eventual exit. In addition, fostering strong relationships with legal and financial advisors is crucial while navigating investment transitions. Such support enhances strategic agility, empowering investors to achieve their desired exit outcomes while safeguarding their interests.

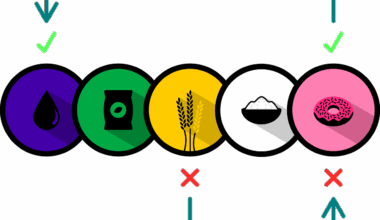

In conclusion, a comprehensive due diligence process is the cornerstone of effective exit strategy planning. This detailed approach allows investors to gain critical insights, mitigate risks, and maximize potential returns. Various components, including financial metrics, market dynamics, operational performance, legal compliance, and buyer profiling, must be intricately woven into an investor’s strategy. Continuous evaluation and adaptability ensure that exit plans remain relevant and achievable in the face of changing circumstances. Through thorough preparation and strategic foresight, investors can effectively navigate complex exit scenarios. Building strong relationships with stakeholders and remaining informed about industry trends contributes to making sound investment choices. Ultimately, the investment landscape is dynamic and ever-evolving, necessitating that investors stay vigilant and proactive. Successful exits are not merely a result of opportunity; they require diligent planning and insightful research, all grounded in solid due diligence practices. By focusing on these essential areas, investors position themselves to create favorable outcomes during exits, achieving their financial goals while minimizing risks. The journey to a successful exit is paved with careful planning, informed decisions, and clarity on objectives.