Understanding Economic Uncertainty

Economic uncertainty is a phenomenon that can significantly affect corporate finance strategies, especially during unpredicted downturns. Businesses must understand the definition of economic uncertainty, which refers to situations where economic conditions fluctuate without clear trends, leading to unpredictability in financial performance. Companies must spend time analyzing various indicators, such as GDP growth rates, inflation rates, and employment figures. By monitoring these indicators, businesses can forecast future performance and adapt their financial strategies accordingly. Investing in market research and using data analytics plays a crucial role in this process. Additionally, organizations can improve resilience by diversifying revenue streams and capitalizing on emerging markets, which may provide opportunities even during economic downturns. Identifying potential areas of expansion or investment requires comprehensive market analysis and strategic planning. Strengthening relationships with stakeholders, such as customers, suppliers, and investors, can also mitigate the impacts of uncertainty. Building strong communication channels fosters transparency and trust, which can help organizations navigate financial challenges more effectively. The ability to adapt to changing environments is vital for maintaining financial stability and achieving long-term growth.

Importance of Strategic Financial Planning

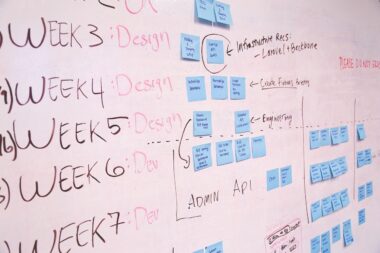

Strategic financial planning plays an essential role in navigating economic uncertainty effectively. It allows organizations to allocate resources wisely, ensuring sustainability during challenging times. Employing a comprehensive approach enables businesses to evaluate their current financial position critically, analyzing their strengths, weaknesses, opportunities, and threats. By assessing their internal resources and external market conditions, organizations can develop a robust plan that outlines achievable financial goals within a realistic timeframe. Having a well-defined strategy not only helps in risk management but also sets the groundwork for successful execution of operations. Businesses can optimize cash flow management, ensuring they have the necessary liquidity to cover operational expenses. Moreover, effective financial planning empowers organizations to identify potential investments, prioritize projects, and allocate budgets accordingly. This foresight is crucial in fostering innovation and can differentiate a company from its competitors. Engaging stakeholders during the planning process enhances collaboration, increasing the likelihood of success. By aligning financial objectives with broader business goals, organizations can build resilience and maintain a competitive edge in their industry. Ultimately, strategic financial planning is the cornerstone of navigating challenges posed by economic uncertainty.

Risk Management Strategies

Implementing risk management strategies is crucial for organizations during times of economic uncertainty. These strategies help businesses identify, assess, and mitigate potential risks that may adversely impact financial stability. A comprehensive risk management framework should include the development of risk assessment matrices that categorize risks according to their likelihood and potential impact on operations. By conducting thorough risk evaluations, companies can pinpoint vulnerabilities while evaluating their ability to withstand market fluctuations. Additionally, scenario planning enables organizations to prepare for various potential outcomes based on different economic conditions. Such foresight allows decision-makers to develop contingency plans that can be activated if adverse situations arise. Techniques such as hedging, diversification, and obtaining insurance provide further protection against unforeseen shocks. Furthermore, fostering a risk-aware culture within the organization ensures that employees at all levels are engaged in the risk management process. Regular training sessions and awareness campaigns can help reinforce this mindset. Ultimately, a proactive approach to risk management equips organizations with the necessary tools to make informed financial decisions, minimizing the impacts of economic uncertainty on their operations.

Another significant aspect of strategic financial planning during economic uncertainty involves cash flow management. Companies must ensure they maintain sufficient liquidity to cover operational expenses and unexpected costs. Effective cash flow forecasting allows organizations to project their liquidity needs accurately, helping them make informed decisions about capital allocation and resource management. By analyzing cash inflows and outflows, businesses can identify trends and patterns, enabling them to adjust their spending and investment strategies accordingly. Additionally, optimizing working capital by streamlining inventory management and receivables processes can contribute significantly to improving cash flow. Companies should negotiate favorable payment terms with suppliers to extend payables and reduce cash strain. Maintaining open communication with stakeholders regarding payment schedules will foster collaboration and ensure organizational survival. Moreover, establishing cash reserves can provide a safety net during uncertain times, enabling organizations to navigate financial challenges more effectively. Creating a buffer helps companies respond to sudden shifts in market demand or unexpected expenses, such as operational disruptions or regulatory changes. Robust cash flow management empowers organizations to adapt while focusing on long-term growth strategies amidst volatility.

The integration of technology and financial analytics is vital for refining corporate finance strategies during economic uncertainty. Leveraging financial technology can enhance data analysis, improve decision-making, and streamline financial processes. Emerging technologies such as cloud computing, artificial intelligence, and machine learning facilitate a data-driven approach to financial planning. Companies can access real-time financial data, enabling them to analyze trends and performance indicators more effectively. Predictive analytics tools allow for accurate forecasting, giving organizations the insights they need to adapt their financial strategies proactively. Moreover, technology can automate repetitive tasks, freeing up finance teams to focus on strategic planning and problem-solving. Implementing robust financial software systems ensures better reporting and compliance with financial regulations. Increasing transparency through technology enhances stakeholder trust and improves communications regarding financial performance. Furthermore, businesses can experiment with scenario analysis using advanced modeling techniques, simulating various economic conditions’ impacts on their performance. Overall, embracing technology is essential for shaping agile financial strategies that respond to the challenges of economic uncertainty and enable organizations to thrive in a competitive landscape.

Stakeholder engagement is another essential aspect of corporate finance strategy development in uncertain times. Engaging employees, customers, investors, and suppliers fosters transparency, enhances collaboration, and builds trust. Open communication channels can provide valuable insights into market trends, consumer behavior, and emerging opportunities. Regularly updating stakeholders about financial performance and strategic objectives can help alleviate concerns during periods of uncertainty, reinforcing commitment to organizational goals. Furthermore, seeking feedback from these groups can drive innovation, enabling businesses to refine their financial strategies in response to evolving market conditions. Conducting stakeholder surveys or holding focus group discussions can yield useful information that helps companies better align their strategies with stakeholder needs. During economic downturns, investing in customer relationships ensures continued loyalty, while maintaining strong supplier partnerships helps manage supply chain risks. Additionally, transparent communication with investors about financial challenges and recovery strategies can help retain their support and confidence. In conclusion, engaging stakeholders is a critical component of strategic financial planning, providing companies with the support needed to navigate uncertainty successfully.

Finally, establishing key performance indicators (KPIs) is fundamental to measuring success in corporate finance strategy development during times of economic uncertainty. KPIs provide valuable metrics that track organizational performance and inform financial decision-making. Businesses should develop measurable and relevant KPIs that align with their strategic objectives, allowing them to monitor progress effectively. Key metrics might include profitability ratios, cash flow metrics, and return on investment indicators. Monitoring these KPIs helps organizations identify deviations from established targets and take corrective actions promptly. Regularly reviewing performance against KPI benchmarks allows for timely adjustments to financial plans, ensuring alignment with changing economic conditions. Establishing a performance review process fosters accountability and enables organizations to make data-driven decisions. Furthermore, utilizing dashboards or financial reporting tools can enhance visibility into performance outcomes, simplifying the analysis process for decision-makers. Sharing KPI results with stakeholders promotes transparency, reinforcing the commitment to achieving financial goals despite uncertainty. Ultimately, KPIs serve as essential tools for guiding organizations toward successful navigating economic challenges while ensuring long-term sustainability.

The final paragraph wraps up the article, highlighting the necessity for strategic financial planning in a dynamic economic landscape. Organizations that effectively employ financial strategies can withstand uncertainties and emerge stronger. Adaptability and forward-thinking must become core tenets of the corporate finance mindset. This proactive approach not only guarantees financial stability but positions companies to seize opportunities that arise during transitions. Achieving long-term success necessitates continuous monitoring of the economic environment, as fluctuations can occur rapidly and unexpectedly. Maintaining an agile framework allows organizations to pivot swiftly in response to internal and external pressures. Financial resilience becomes integral to corporate culture, empowering teams at every level to remain focused on growth and innovation. Therefore, successful companies prioritize strategic financial planning and understand the importance of collaboration in achieving excellence. Engaging stakeholders and utilizing technology, alongside robust risk management practices, are critical to navigating economic uncertainty. Companies should embrace change as a potential for improvement, positively impacting their financial performance and overall sustainability. With the right financial strategies, organizations can thrive even in the face of adversity.