Earnings Reports Explained: What Investors Need to Know

Earnings reports are crucial documents that publicly traded companies release each quarter. These reports provide insights into a company’s financial performance and overall health, playing a significant role in shaping investor perceptions. Investors use earnings reports to assess a company’s profitability, revenue growth, and expenses. Typically, companies report key figures such as earnings per share (EPS), revenue, and net income. Understanding these metrics allows investors to determine if a company’s stock is a worthwhile investment. Furthermore, earnings reports often include forward-looking statements and management’s analysis of potential risks and opportunities. Investors must pay attention to the context of the numbers and commentary provided for a comprehensive understanding. Accurate interpretation of these figures is key to making informed investment decisions. Analysts scrutinize these reports and compare them against market expectations. A company’s earnings can significantly impact stock prices, making it vital for investors to stay updated and perform thorough analyses. Therefore, having prior knowledge about earnings reports is essential for anyone looking to invest wisely in financial markets. A proactive approach will help to navigate investment choices more effectively.

Typically, earnings reports include a wealth of information that goes beyond raw numbers. Companies often present a breakdown of their revenue streams, highlighting which products or services performed best during the reporting period. This level of detail can help investors identify potentially lucrative market segments. Additionally, companies may provide year-over-year comparisons to illustrate their growth trajectory. This trend data allows investors to gauge long-term performance rather than focusing solely on quarterly results. Moreover, management addresses challenges faced during the reporting period, which may influence future performance. Understanding these challenges gives investors a clearer picture of operational efficiency and risk factors. Management’s commentary often sheds light on strategic decisions made in response to market conditions. Such insights can be crucial for making long-term commitments to a company’s stock. Investors should also consider earnings call transcripts, where executives answer analyst questions in detail. These discussions can offer invaluable perspectives on company direction and adaptability to changing industries. Therefore, diving deep into earnings reports and supporting materials is important for informed investment.

Another critical aspect of earnings reports is guidance. Companies frequently provide forecasts and estimates regarding future performance based on current market conditions. This guidance is vital for investors, as it can indicate whether a stock is likely to appreciate or depreciate in value. While management insights can be encouraging, these predictions can also carry risks if unforeseen events impact their accuracy. Consequently, investors should exercise caution and consider multiple scenarios when interpreting guidance. It is also advisable for investors to monitor industry trends when evaluating a company’s guidance. Shifts in market dynamics can significantly influence a company’s ability to meet these projections. Comparing guidance from one company to others in the same sector can aid understanding of overall market sentiment. Furthermore, contradictory guidance may signal potential issues within a company or sector. Therefore, diligent investors must analyze earnings guidance carefully to understand what the future may hold. Recognizing that guidance is not always guaranteed is crucial to developing a balanced investment strategy focused on risk management.

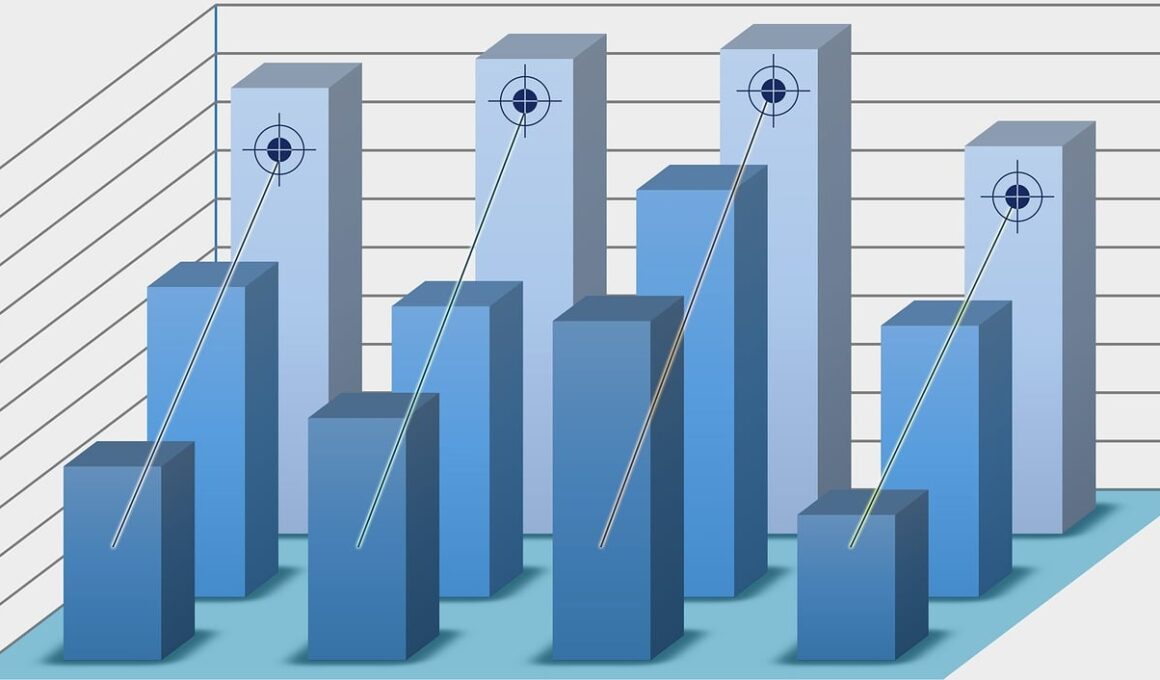

The Importance of Consensus Estimates

Consensus estimates are another critical component of earnings reports that investors must consider. These estimates provide an average forecast compiled from various analysts who research a company’s expected earnings. Understanding how a company’s actual earnings compare to consensus estimates can offer insights into market expectations. If a company’s results surpass these estimates, it often triggers positive reactions in the stock price. Conversely, falling short of consensus can lead to negative market sentiment and declines in share value. This discrepancy is known as an earnings surprise, which can create volatility in the stock price. Therefore, monitoring consensus estimates before and after earnings reports is crucial for navigating the market effectively. Investors may also consider the number of analysts covering a stock, as this can provide context for the reliability of consensus estimates. A larger pool of analysts often indicates greater confidence in the forecasts. Additionally, some investors specialize in trading around earnings surprises to capitalize on price fluctuations. Utilizing consensus estimates can enhance investment decisions and facilitate trading strategies tailored to quarterly earnings efforts.

Evaluating the impact of macroeconomic factors on earnings is essential for understanding a company’s full financial picture. Broader economic conditions, such as inflation rates, interest rates, and market demand, can influence earnings significantly. When reporting earnings, management often addresses external factors that may have played a role in their performance. For instance, a company may experience higher costs due to inflation, which could impact net income. Consequently, analyzing the economic environment allows investors to contextualize financial results in a broader framework. Economic indicators can provide guidance on market conditions, helping investors make educated assumptions about future earnings potential. It’s also important for investors to stay abreast of significant policy changes that may affect specific industries. For example, regulatory shifts can create opportunities or challenges that directly impact financial results. Analyzing the interplay between a company’s earnings and macroeconomic conditions provides a more complete view of operational performance. This analytical approach is crucial for developing sound long-term investment strategies centered on market realities.

In the world of investments, sentiment following an earnings report can drive stock price movements significantly. Market reactions to earnings results can often be disproportionate to the fundamental changes presented. Even minor adjustments in guidance or unexpected earnings can provoke substantial volatility. This phenomenon occurs due to investor psychology where perceptions rather than just facts influence decisions. Understanding the impact of sentiment on stock prices is valuable for investors looking to make tactical decisions in the short term. While strong performance generally leads to positive sentiments, unfavorable results can foster uncertainty and panic. Consequently, some investors may prefer a values-based approach to safeguard against emotional decision-making. Focusing on fundamental analysis and long-term growth potential may provide a more stable investment strategy. Moreover, understanding investor sentiment trends can offer additional insights into future price movements. For example, confidence in a company may suggest that stock prices have room to grow despite potential obstacles. Therefore, insightful investors should monitor sentiment alongside earnings reports for enhanced decision-making.

Conclusion: Navigating Earnings Reports

In conclusion, earnings reports are vital tools for investors seeking to understand a company’s financial health. Familiarity with the various components of earnings reports—including key financial metrics, guidance, consensus estimates, and macroeconomic factors—enables informed investment decisions. These reports reveal not only past performance but also future potential, guiding investors in their asset allocation strategies. Additionally, considering market sentiment in relation to earnings can enhance insights into price movements. By incorporating a comprehensive approach to analyzing earnings reports, investors can better position themselves to capitalize on opportunities and minimize risks. Continuous learning and monitoring of financial trends are essential for success in today’s dynamic markets. With the right strategies, investors can use earnings reports to strategize effectively and maximize returns. Ultimately, an informed investor is likely to achieve better long-term results by leveraging earnings reports. Therefore, taking the time to delve into these financial statements is an invaluable exercise for anyone looking to prosper in the financial markets. The pursuit of knowledge in this area will serve investors well over time.

As a final note, mindset matters when it comes to interpreting earnings reports. It’s essential to approach each quarterly result with a balanced perspective, recognizing both the positives and negatives. The financial landscape is complex, with many influencing factors. Hence, maintaining a level head is crucial for understanding the full implications of each report. Additionally, investors should be ready to adapt their strategies based on new data as markets evolve. Knowledge coupled with adaptability equips investors to face challenges confidently. By staying informed, investors can enhance their ability to react swiftly to market changes. Each earnings report is not merely a spreadsheet; it tells a story about a company’s journey through time. Understanding the narrative woven with numbers is key to evaluating its future viability. Do not underestimate the importance of ongoing education in attaining investment acumen. Aspiring investors should engage with resources, attend earnings calls, and connect with professionals in finance. The rewards of prudent investing are significant, and armed with the right knowledge, anyone can navigate this exciting, albeit complex, world of financial markets.